Chevron (NYSE: CVX) certainly deserves some credit for its most recent quarter. Higher production and higher prices led to a 39% increase in net income and gave management confidence to raise its dividend. But even though there was a lot of good news in this report, there is still something that doesn’t feel quite right when you compare Chevron’s future to its peers’.

Here’s a brief look at the company’s most recent earnings results and some of the milestones it hit this past quarter, as well as the oil giant’s plans for the future.

By the numbers

Metric Q1 2018 Q4 2017 Q1 2017

Revenue $37.8 billion $37.6 billion $33.4 billion

Net income $3.64 billion $3.12 billion $2.68 billion

EPS (diluted) $1.90 $1.64 $1.41

Operating cash flow $5.04 billion $6.23 billion $3.78 billion

Data source: Chevron warnings release. EPS = earnings per share.

Chevron turned in one of the better quarters among the big oil companies thus far, in large part because its business is so much more tied to upstream production than the rest. Higher production rates from its core production assets and much higher realized prices — the average realized crude oil price was $61 per barrel — were the driving force behind this past quarter’s results.

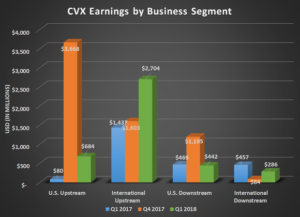

Breaking down these results into their respective business segments, you have to keep in mind that the company took a lot of one-time charges and benefits last quarter related to U.S. tax law, so take any U.S.-based business result with a grain of salt. The one that stands out here the most is the gain in international upstream, which was mostly attributed to its Gorgon and Wheatstone liquefied natural gas (LNG) facilities. Even though they export natural gas, the contracts in place are indexed to oil prices. That’s how its natural gas price realization — $5.85 per thousand cubic feet — was much higher than many of its peers’ in the quarter.

Even though earnings were impressive for the quarter, cash flow was surprisingly light. That’s because Chevron had a large working capital build in the quarter. Adjusted for working capital movements, operating cash flow would have been a much more robust $7.1 billion. It ended the quarter with a net debt-to-capital ratio of 18.1%.

The highlights

- First-quarter production came in at 2.85 million barrels of oil equivalent per day (BOE/D), an impressive 6% increase from this time last year. The two big drivers of this were Chevron’s shale operations in the Permian basin and the continued ramping up at its Gorgon and

- Wheatstone LNG facilities in Australia. These two projects helped to offset natural field decline and about 60,000 barrels per day of asset sales.

- Management was very adamant about noting that there was a large working capital build in the quarter that kept operating cash flow results down. Historically, the company has had large capital builds in the first quarter that draw down through the rest of the year.

- Its results in the Permian Basin continue to be the crown jewel of Chevron’s portfolio. First-quarter production in the basin was 252,000 BOE/D. Even after management increased its forecast, production rates continue to wildly outpace guidance.

- The board of directors approved a 4% increase to its dividend.

What management had to say

Here’s CEO Michael Wirth’s press release statement on the company’s most recent results:

Our cash flow continues to increase with the powerful combination of expanding upstream margins and volumes. Oil and gas production is increasing, most notably in our Gorgon and Wheatstone LNG Projects in Australia, and our shale developments in the Permian Basin where production grew 65 percent from a year ago. Upstream volumes are expected to continue to increase in future quarters.

The capital plan seems to be missing something

Over the past several months, most of Chevron’s peers have announced or started some form of capital return program involving buybacks and higher dividends. While management did just announce a dividend increase, it has been surprisingly quiet about any intention of share repurchases or something similar. The absence of a shareholder-friendly plan stands out even more when you look at its modest capital spending plans over the next few years. This capital plan is screaming for some form of capital return to shareholders, but management has said in analyst meetings and conference calls that it is pretty low on its lists of cash priorities right now.

According to CFO Pat Yarrington, it wants to get to a place where it has a more sustainable rate of excess cash flow such that it can make routine buybacks, and that the priority right now is paying its dividend with cash only and to grow that payout. The trouble is, Chevron has chosen to leverage itself to upstream production more than its peers, so sustainable rates of excess cash flow will be much harder to attain in the long run.

Something feels lacking in Chevron’s current capital plan, and its backlog of potential projects outside the Permian Basin is looking mighty small. I think management has something simmering on the back burner that will get announced soon because the current trajectory it has in place just doesn’t seem to add up to a value proposition as strong as its peers’.