Helmerich & Payne’s (NYSE: HP) earnings have been a bit peculiar over these past few quarters. Even though rig counts have risen considerably since their nadir back in May 2016 and its fleet utilization numbers have grown, the oil rig lessor is still posting net losses each quarter. Considering how much better other oil services companies are doing lately, especially those with a large concentration in U.S. shale, it seems odd that Helmerich & Payne’s results have been so slow to recover.

Let’s examine the company’s most recent quarterly report to see what is going on with this string of losses and what it will take for it to get back to turning a profit.

By the numbers

Metric Q2 2018 Q1 2018 Q2 2017

Revenue $577.5 million $564.1 million $405.3 million

Operating income ($1.2 million) $3.5 million ($65.6 million)

EPS (Diluted) ($0.12) $4.55 ($0.45)

Free cash flow $26.7 million ($58.5 million) $7.8 million

Data source: Helmerich & Payne earnings release. EPS = earnings per share.

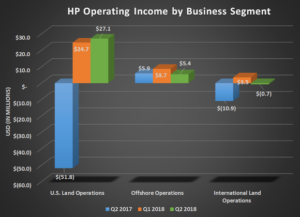

One thing that has been noticeable lately has been the slowdown in revenue growth we saw in the prior quarters. While producers are still adding rigs for their drilling programs, it is at a decidedly slower rate than what we saw a year ago. The side benefit to this is that expenses for rig reactivations have declined to the point that Helmerich & Payne’s U.S. land drilling segment is pulling in a steady profit. This is helping to offset weakness in its offshore and international land segment, which shouldn’t take much since its U.S. land segment is much larger than the other two business segments combined.

All in all, these numbers were fine, but what was more promising was the company’s improving outlook for the upcoming quarter. According to its press release, Helmerich & Payne expects revenue from all three of its segments to increase, as it has received interest for its idle equipment. Also, the company continues to upgrade its fleet at a high rate, so there should be ample rigs to take up any spare capacity in the market right now.

What management had to say

Over the past few quarters, Helmreich & Payne has been bragging about its ability to take market share from its competitors. In the press release, CEO John Lindsay touted how the company’s fleet is commanding a high market share and how it plans to gain even more over the next few quarters:

The demand for super-spec rigs continues to persist as the industry’s super-spec fleet remains nearly 100% utilized. H&P leads the way with more than 40% of the super-spec market share in U.S. Land. We also have approximately 50% of the industry’s idle rig capacity not already at super-spec capability that can be readily upgraded to those specifications in the current pricing environment. Our robust financial position and the composition of our fleet continues to drive our ability to respond to current and future FlexRig demand. Given the tightening market conditions for FlexRigs and the value proposition we provide for customers, we expect increases in average dayrates for our rigs in the U.S. Land spot market to accelerate during the next few months.

Market share now, payoff later

It’s a little curious to see Helmerich & Payne continue to upgrade its fleet at such a fast pace when the rate of rigs getting added to the field has slowed down considerably. One would think it would be an opportune time to slow the upgrade rate to lower costs and focus on improving margins and cash flow.

Instead, its high rate of upgrades and management’s comments about market share suggest that the company wants to ensure that any rig getting added to the field today will be a Helmerich & Payne rig. It doesn’t want to give any of its competitors any opportunity to add newbuild rigs to their fleets to meet incremental demand. After all, only 59% of Helmerich & Payne’s U.S. land fleet is utilized.

With oil prices rising steadily, it’s likely that we will see a few companies increase their capital budgets and put a few more rigs into the field relatively soon. If Helmerich & Payne can capture those additional rigs, then this high rate of spending will have been worth it.