Stock Markets

In the week just ended, all major indexes ended down on news that Fitch, one of the “Big Three” credit rating agencies, downgraded the U.S. debt rating from AAA to AA+. The Dow Jones Industrial Average (DJIA) is down by 1.11% while the DJ total stock market index fell by 2.19%. The broad-based S&P 500 declined by 2.27% and the technology-heavy Nasdaq Stock Market Composite plummeted by 2.85%, suffering the heaviest losses for the week. The NYSE Composite fared slightly better although it came down by 1.79%. CBOE Volatility, which tracks risk perception, rose by 28.28%. This week’s downgrade was only the second in the history of the U.S., the first being the decision by Standard & Poor’s in August 2011. The unexpected development was the first negative surprise in a long time and draws the market’s attention to the worsening fiscal outlook of the country. Fitch said that its decision “reflects governance and medium-term fiscal challenges.”

The week was busy with corporate earnings releases. Investors were particularly keen on news of performances by mega-caps Amazon and Apple which were announced after trading on Thursday. Amazon performed better than expected driven by the strength of its core retail business and causing it to rally by more than 9% on Friday’s opening bell. On the other hand, Apple disappointed on a mixed report that showed that its services business continued to excel but iPhone sales were lower than expected. The communications company traded down by 3%.

U.S. Economy

In the closely-watched monthly nonfarm payroll report issued by the Labor Department, hiring appears to have slowed from its faster pace at the start of the year. In July, employers added 187,000 jobs which is roughly the same as June’s downwardly revised 185,000 jobs and lower than expectations. While the labor market data still showed health over the past two months, there is an evident slowdown from the first five months of the year when an average of 287,000 jobs were added per month. Unemployment this week was reported at 3.5%, a slight improvement from the 3.6% reported for the prior month. Wage growth was unchanged from June which was 4.4% over the 12-months.

Results of the Job Openings and Labor Turnover Survey from the Bureau of Labor Statistics were released earlier in the week. They showed a modest drop in the number of job openings in June, although layoffs fell for a third straight month. Coming in better than expected was ADP’s private employment survey, although it did show that hiring slackened to 324,000 from 455,000 in June. In other developments, the Institute for Supply Management (ISM) manufacturing Purchasing Managers’ Index was reported at 46.4, slightly lower than the consensus expectation of 46.9. This is the ninth straight month that the manufacturing PMI came in under 50, the borderline indicator for contraction. Meanwhile, treasury yields jumped higher, with the yield on the benchmark 10-year U.S. Treasury note increasing from 3.95% at the end of the previous week to nearly 4.20% early on Friday. Following the release of the jobs report, yields decreased to about 4.05%.

Metals and Mining

The markets for precious and base metals hardly moved this week when the financial markets were surprised late Tuesday when Fitch downgraded the U.S. Long-Term Foreign-Currency Issuer Default rating. Fitch said in its announcement that it sees the U.S. general government deficit rising to 6.3% and 6.9% of GDP in 2024 and 2025, respectively. When U.S. sovereign debt was last downgraded by S&P in 2011, a rally drove gold prices above $1.900 an ounce, a record high at the time. This time, however, gold prices hardly moved from their support as they continued to move sideways within a steady range. This is because the fear in the marketplace is not as palpable as it was in 2011 when the global economy was still recovering from the 2008 financial crisis. This time growth has been robust so far as the world economy emerges from the coronavirus pandemic and the labor market remains strong.

The spot prices in precious metals moved sideways for the week. Gold came down slightly by 0.85%, from its previous week’s close at $1,959.49 to this week’s close at $1,942.91 per troy ounce. Silver slid slightly by 2.92%, from its closing price last week of $24.34 to its closing price this week of $23.63 per troy ounce. Platinum ended this week at $925.95 per troy ounce, down by 1.35% from last week’s closing price of $938.64. Palladium inched up this week to $1,260.35 per troy ounce, 0.84% higher than last week’s closing price of $1,249.86. The three-month LME prices for base metals hardly did any better. Copper ended the week at $8,611.00 per metric ton, down by 0.59% from last week’s close at $8,662.50. Zinc closed this week at $2,485.00 per metric ton, down slightly by 0.50% from the previous week’s $2,497.50 close. Aluminum ended this week at $2,230.00 per metric ton, higher by 0.36% from last week’s close at $2,222.00. Tin ended the week at $28,023.00 per metric ton, down by 2.49% from the earlier week’s close at $28,740.00.

Energy and Oil

For the sixth straight week, oil prices have been set by the coordinated supply-side management of Saudi Arabia and Russia, and this will continue to prevail as the two OPEC+ heavyweights extend their production and export cuts into September. Friday’s attack on Russia’s Black Sea oil terminals and swelling backwardation appears to set the scenario for further upside on the price of crude as Brent has moved above $85 per barrel, the highest level since March. In a press release published by Saudi Arabia’s news agency SPA, the KSA has pledged to extend its voluntary production cut of one million barrels per day until next month, suggesting that we may see further cuts should they prove necessary. Meanwhile, Russia pledge to reduce crude oil exports by 300,000 barrels per day in September, down from 500,000 barrels per day in August. The report was released less than one hour after Riyadh’s announcement of its production cut extension, suggesting close coordination between the two pronouncements.

Natural Gas

For this report week starting Wednesday, July 26, and ending Wednesday, August 2, 2023, the Henry Hub spot price fell by $0.18 from $2.61 per million British thermal units (MMBtu) to $2.43/MMBtu. The August 2023 NYMEX contract expired Thursday at $2.492/MMBtu, down by $0.17 from the start of the week. The September 2023 NYMEX contract price descended to $2.477/MMBtu, down by $0.22 for the week. The price of the 12-month strip averaging September 2023 through August 2024 futures contracts decreased by $0.16 to $3.164/MMBtu.

The international natural gas futures prices declined this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia declined by $0.21 to a weekly average of $10.91/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, descended by $0.75 to a weekly average of $8.92/MMBtu. In the week last year corresponding to this week (i.e., the week from July 27 to August 3, 2022), the prices were $43.97/MMBtu in East Asia and $59.54/MMBtu at the TTF.

World Markets

The pan-European STOXX Europe 600 Index closed 2.44% lower, mostly in response to higher U.S. bond yields and a host of disappointing European earnings reports that dampened investor appetite for riskier assets. Following suit and registering lower weekly performance were major country stock indexes. France’s CAC 40 Index declined by 2.16%, Italy’s FTSE MIB lost 3.10%, and Germany’s DAX slumped by 3.14%. The UK’s FTSE 100 Index dropped 1.69%. As resilient economic data suggested that a global recession may be avoided, European government bond yields broadly climbed. The yield on the 10-year German government bond climbed to its highest level since March. After the Bank of England (BoE) raised borrowing costs for a 14th consecutive time, the yield on the benchmark 10-year government bond in the UK stabilized below 4.5%. The BoE raised its key interest rate by 0.25% to 5.25%, the highest it has been in the last 15 years. The central bank warned that rates were likely to remain elevated for some time. It stated that “the MPC (Monetary Policy Committee) will ensure that the Bank Rate is sufficiently restrictive for sufficiently long to return inflation to the 2% target.” The BoE predicted that the inflation rate will fall at a faster rate than its May forecast, to 4.9% by the end of 2023. Economic growth will likely remain hardly changed at 0.5% for 2023 and 2024.

Japanese stocks softened in reaction to the U.S. sovereign credit rating downgrade by Fitch that adversely affected global investor risk appetite. The Nikkei 225 Index charted a 1.7% loss for the week while the broader TOPIX Index followed suit, ending lower by 0.7%. Japanese stock markets fell despite the support provided domestically by a strong corporate earnings season. Many companies saw output recover post-pandemic and benefitted from the weak yen and rising prices. The yield on the 10-year Japanese government bond (JGB) increased to a nine-year high of 0.65%, from 0.55% where it ended the previous week. This was in response to the July monetary adjustment by the Bank of Japan (BoJ) to effectively allow interest rates to rise more freely. The yen weakened to about JPY 142.6 against the U.S. dollar, from around JPY 141.1 the preceding week, given the BoJ’s continued commitment to its accommodative position and Japan’s wide interest rate differential with the U.S. Speculation was rife that Japan’s Ministry of Finance may likely intervene in the foreign exchange markets to prop up the value of the yen.

Chinese stocks advanced as Beijing’s supportive stance offset investor concerns regarding the latest batch of disappointing economic data. The blue-chip CSI 300 advanced by 0.7% while the Shanghai Stock Exchange Index rose by 0.37%. The State Council, China’s cabinet, announced new measures that aimed to revive consumption. The wide-ranging policies concentrated on easing restrictions on consumption in several sectors, among which are autos, real estate, and services. Local regions were likewise encouraged to provide subsidies for home appliance purchases and home renovation materials in rural areas. There was no mention, however, of any direct cash support for customers to bolster spending which is among the measures called for by some analysts. In the meantime, China’s official manufacturing Purchasing Managers’ Index (PMI) climbed to 49.3 in July in line with expectations. It remains below the 50-point threshold between expansion and contraction, which was consistent over four consecutive months. The non-manufacturing PMI weakened to 51.5 which was lower than expected, from 53.2 in June. New home sales by China’s top 100 developers dropped by 33.1% in July from one year earlier, extending declines for a second month in a row.

The Week Ahead

The consumer price index (CPI) and producer price index (PPI) inflation data and the trade balance are among the important economic data scheduled for release in the coming week.

Key Topics to Watch

- Consumer credit

- NFIB optimism index

- Philadelphia Fed President Harker speaks

- U.S. trade balance

- Richmond Fed President Barkin speaks

- U.S. wholesale inventories

- Initial jobless claims

- Consumer price index for July

- Core CPI for July

- CPI (year-over-year)

- Core CPI (year-over-year)

- Treasury budget

- Producer price index for July

- Core PPI for July

- PPI (year-over-year)

- Core PPI (year-over-year)

- Consumer sentiment (prelim)

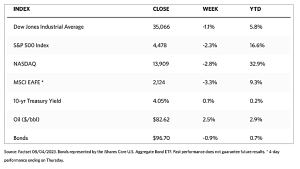

Markets Index Wrap Up