Stock Markets

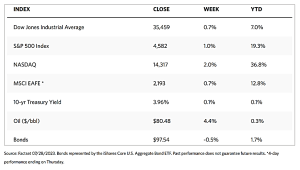

The major indexes were up this week as investors perceived that inflation was easing, the Federal Reserve may be ending its restrictive cycle, and economic growth remains resilient. The Dow Jones Industrial Average (DJIA) recorded its 13th consecutive daily gain on Wednesday, its longest winning streak since 1987, before closing on Friday with a 0.66% weekly gain. The total stock market inched up 0.97% for the week, while the S&P 500 Index gained 1.01%. Technology tracker Nasdaq Stock Market Composite outperformed with a rise of 2.02%. and the NYSE Composite climbed by 0.46%. The indicator of perceived risk, CBOE Volatility, dipped by 1.99%.

The Nasdaq’s relatively strong performance may be attributed to the continued market enthusiasm this year surrounding AI (artificial intelligence), the market’s stellar performance of late is due to a trifecta of better macro trends, namely: economic growth resilience, continued inflation moderation, and the forthcoming end to rate hikes by the Fed and other global central banks. Despite the investor optimism, trading this week was relatively muted as the summer vacation season diverted some of the attention from the Federal Reserve Policy meeting, some high-profile corporate earnings reports, and the release of economic data. Growth stocks easily outperformed their value counterparts.

U.S. Economy

The release of the second-quarter U.S. GDP report was the focus of this week’s economic news. The key growth indicator surprised on the upside. The annualized GDP growth was 2.4%, exceeding the estimate of 1.8%, and accelerated from the previous quarter’s 2% growth rate. Underlying this resilience was the strength in business investment and a rebuild of inventories among companies. Notably, personal consumption, a primary economic driver, was 1.6%. This figure exceeded expectations of 1.2%, although it indicated some economic cooling when viewed against the first quarter’s 4.2% annualized growth rate.

Despite some indication of slowing, the GDP data did not show signs of an imminent downturn or recession. More likely, the economy may undergo what analysts refer to as a “rolling recession” where parts of the economy (e.g. manufacturing) may be bottoming and recovering while other parts (e.g. services) may yet have to soften. Thus, although the economy may further descend towards the end of the year, the occurrence of a hard recession seems unlikely.

This quarter’s GDP report appears to paint the picture of progressively moderating inflation even as growth continues to accelerate. The headline GDP price index dipped to an annualized 2.2% against an expected 3% and well below the previous quarter’s 4.1% reading. The Fed’s preferred inflation indicator, core PCE inflation, also slowed in June to 4.1% year-over-year. This is below expectations of 4.2% and the previous month’s 4.6% reading. The slowdown in both inflation and core inflation is a welcome development for the Fed. It is a sign of easing price pressures even while growth remains solid.

Metals and Mining

A historic shift became evident from the results of a new investor survey from State Street Global Advisors that was recently released. A surprising trend in the gold market emerged showing Millennials as having the highest percentage of gold (17%) in their investment portfolio. Both Baby Boomers and Generation X hold approximately 10% of their portfolio in gold. The interest of Millennials in this asset class represents an unprecedented untapped potential. Gold was hitherto perceived as an outdated, archaic asset, viewed as an investment tool for the older generation, a dwindling customer base. The revelation that gold is attracting a larger, younger, and increasingly affluent investor pool may point to the prospect of the greatest generational transfer of wealth in history. A New York Times article published in May made an in-depth analysis of this trend and noted that an expected $84 trillion will be passed down from the older generations to the Millennials and Generation Xers through 2045. The affinity of these generations for gold may provide strong support for the growth of this asset class.

This past week, the precious metals spot market continued its consolidation. Gold closed at $1,959.49 per troy ounce, 0.12% lower than the previously weekly close at $1,961.94. Silver ended this week at $24.34 per troy ounce, down by 1.10% from the previous week’s close at $24.61. Platinum ended this week at $938.64 per troy ounce, a drop of 2.82% from the previous closing price of $965.84. Palladium closed the week at $1,249.86 per troy ounce, a loss of 3.51% from the closing price of $1,295.34 a week earlier. On the other hand, the three-month LME prices of base metals generally moved up. Copper, formerly at $8,485.50, closed this week at $8,662.50 per metric ton, up by 2.09%. Zinc, which ended the previous week at $2,383.50, closed this week at $2,497.50 per metric ton, higher by 4.78%. Aluminum, which closed last week at $2,201.00, ended this week at $2,222.00 per metric ton which is higher by 0.95%. Tin, which last week was priced at $28,715.00, rose by 0.09% to close this week at $28,740.00 per metric ton.

Energy and Oil

The GDP readings for the second quarter showed the U.S. economy’s resiliency and underlying strength and accounted for the recent rally in oil prices. Investors became optimistic about the possibility of a soft landing in the upcoming recession. The prospects of Chinese refiners suddenly buying significantly less than they do now due to China’s hoarding of crude is perceived as a negative factor in the upcoming months, however, analysts view this as exerting little downside impact on ICE Brent. The latter ended this week around $83 to $84 per barrel and posted another week-on-week gain. China oil stockpiles shot through the roof, boosted by all-time high imports of Russian crude and doubling of Iranian flows year-on-year. As a result of this hoarding, China has amassed almost 1 billion barrels in crude inventories, the highest level of stocks in almost three years, potentially drawing from them in the second half of this year.

Natural Gas

For this report week starting Wednesday, July 19, to Wednesday, July 26, 2023, the Henry Hub spot price rose by $0.10 from $2.51 per million British thermal units (MMBtu) at the beginning of the report week to $2.61/MMBtu at the end of the report week. The price of the August 2023 NYMEX contract increased by $0.062 from $2.603/MMBtu to $2.665/MMBtu throughout the report week. The price of the 12-month strip averaging August 2023 through July 2024 futures contracts ascended by $0.118 to $3.259/MMBtu.

International natural gas futures price movements ended mixed this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia declined by $0.10 to a weekly average of $11.13/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, rose by $1.00 to a weekly average of $9.67/MMBtu. In comparison, for the same week last year (that is, the week from July 20 to 27, 2022), corresponding prices were $39.96/MMBtu in East Asia and $53.64/MMBtu at the TTF.

World Markets

Despite the Federal Reserve and the European Central Bank (ECB) announcing interest rate hikes, the pan-European STOXX Europe 600 Index and the major indexes (Italy’s FTSE MIB, France’s CAC 40, Germany’s DAX, and the UK’s FTSE 100) all realized gains over the past trading week. Investor sentiment turned optimistic in light of the dovish tone adopted by the global monetary policymakers. Reports from China early in the week that authorities there are considering adopting additional measures to boost the world’s second-largest economy gave additional incentive for investors to take positions in the market. Eurozone bond yields rose on concerns that Japanese yields may rise and prompt an exodus of Japanese investors from that market, but as the week wore on, yields steadied. For instance, the yield on Germany’s 10-year sovereign bond rose above 2.56% before closing the week at about 2.49%. Similar volatility was experienced by Swiss and French bonds. UK government bond yields likewise ended higher. Annual inflation in the euro area was reported at 5.5% in June, down from 6.1% in May but still higher than the ECB’s target of 2%.

Japan’s stock markets advanced over the past week. The Nikkei 225 Index was up by 1.4% while the broader TOPIX Index gained 1.3%. Investors were pleasantly surprised when the Bank of Japan (BoJ) tweaked its monetary policy. The BoJ announced that it would increase its flexibility around its yield curve control (YCC) target. The central bank likewise revised its forecast for consumer price inflation upward in fiscal 2023, as was generally expected. The yield on the 10-year Japanese government bond (JGB) climbed to 0.55% – its highest level in around nine years – from 0.48% where it was at the end of the previous week. The move was on the back of the BoJ’s recent monetary policy tweak and in anticipation of further normalization. The yen strengthened to approximately JPY 139.8 versus the U.S. dollar, from JPY 141.8 the week before.

Chinese stocks rallied in response to Beijing’s indications that it will provide more stimulus to support the economy. The blue-chip CSI 300 surged by 4.47% while the Shanghai Stock Exchange Index gained by 3.42%. The Hong Kong benchmark, Hang Seng Index advanced by 4.41%. China’s top decision-making body, the Communist Party’s Politburo led by President Xi Jinping, pledged to boost domestic consumption with its new stimulus package in response to a flagging recovery from the pandemic lockdowns that ended in December. Officials also announced support for the ailing real estate sector after the Politburo’s most recent meeting during which it set policies addressing economic concerns for the rest of 2023. No specific policy measures were announced, however, other than signaling a pro-growth stance. As China continues to struggle with weak demand, economists lowered their growth forecasts for the country’s gross domestic product for the year. GDP is expected to expand by 5.2% in 2023, down from the previous estimate of 5.5%. Growth from 2024 is expected to be 4.8%. The revisions were made in response to China’s announcement that its economy grew at a slower-than-expected pace in the second quarter due to weakening domestic and external demand.

The Week Ahead

Among the important economic data that were scheduled for release this week are labor market, manufacturing, and services data.

Key Topics to Watch

- Chicago Business Barometer

- Fed senior loan survey

- S&P final U.S. manufacturing PMI

- Job openings

- ISM manufacturing

- Construction spending

- ADP employment

- Initial jobless claims

- U.S. productivity (prelim)

- S&P final U.S. Services PMI

- ISM services

- Factory orders

- U.S. nonfarm payrolls

- U.S. unemployment rate

- U.S. hourly wages

- Hourly wages year over year

Markets Index Wrap Up