When Apple (NASDAQ: AAPL) released its most recent financial results, the numbers were scrutinized by Wall Street. Even in light of its record-breaking performance, investors appeared to want even more. That may have been the result of some confusion about year-over-year unit sales comparisons, as one fewer week in the current-year quarter distorted the results compared to the prior year.

Apple generated $88 billion in revenue, up 13% year over year, and earnings per diluted share of $3.89, up 16% over the prior-year quarter. Both numbers exceeded analysts’ expectations, yet concerns regarding slowing sales of the flagship iPhone remain.

There are still plenty of reasons to like Apple over the longer term.

1. A growing ecosystem of products

In the most recent earnings conference call, Apple CEO Tim Cook revealed a seldom-reported metric for the company: Apple’s active installed base grew to an all-time high of 1.3 billion devices in January, up 30% in just two years. Each device provides a built-in market for Apple’s other products and services — funneling customers to the App Store and to subscription services like Apple Music.

2. How can I be of service?

Early last year, Apple CEO Tim Cook said that the company’s goal was to double the size of its services business in the following four years. At the time of that pronouncement, services had generated revenue of $25.5 million in the preceding four quarters. In order to hit Cook’s goal, the segment would have to produce nearly $51 million in annual revenue by the end of 2020. That may sound ambitious, but just 12 months later, services revenue has grown by nearly 19% year over year, to $31.3 million. If that growth rate continues, Apple will achieve Cook’s goal with room to spare.

3. It can still command higher premiums

Michael Walkley, an analyst for Canaccord Genuity, estimates that Apple’s flagship iPhone commanded 87% of the profits in the smartphone industry, despite selling only 18% of the total units in the fourth quarter of 2017. This stark reality is the result of Apple’s long-standing ability to command a premium for its products. That was on full display with the release of the iPhone X, which helped the company increase its average selling price (ASP) for the iPhone to $796, up from just $695 in the prior-year quarter. While future year-over-year ASP changes will likely be far less dramatic, it does illustrate the company’s ability to command higher premiums for its products.

4. A compelling valuation

Those looking to buy a stock at a bargain need look no further than Apple, which is trading at a significant discount to the broader market. Investors can pick up shares for just 18 times trailing earnings, and an even lower 15 times forward earnings estimates. By comparison, the S&P 500 has a trailing price-to-earnings ratio of 26 and a forward valuation of 18.

Those numbers don’t take into account Apple’s massive cash balance, either. As of its last financial release, the company had about $285 billion in cash on the balance sheet, with the vast majority of that held overseas. Apple recently announced that it would be repatriating those funds under U.S. tax reform, paying an estimated $38 billion in taxes in the process.

Backing out the net cash on its balance sheet, which is approximately $125 billion after subtracting the expected tax payment, Apple’s valuation becomes even more attractive, with trailing and forward P/E ratios of 15 and 13 respectively.

5. It’s shareholder-friendly

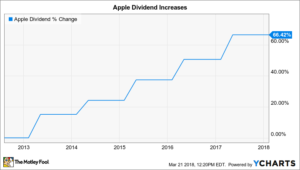

In the Steve Jobs era, Apple was content to stockpile cash for a rainy day. That cash pile continues to grow, but soon after Tim Cook became CEO, Apple instituted a massive capital return program. In early 2012, the company announced that it would begin paying a dividend for the first time since 1995. Apple has raised its payout every year since, increasing the total by 66%, and paying $64 million in dividends during that time.

Apple didn’t stop at dividends, either. Since instituting a share buyback plan in late 2012, the company has spent a massive $176 million repurchasing shares, and lowering its share count by more than 22% in the process.

All told, Apple has returned a whopping $248 million to shareholders, and many expect the company to announce its next dividend increase in May. That dividend currently yields 1.4%, with a payout ratio just over 25%, giving Apple ample room to continue to increase its payout for the foreseeable future.

One more thing

Apple investors have long been concerned that the iPhone is the company’s swan song. Every product the company has released since has been compared to its flagship device, always with the conclusion that “it’s no iPhone.” Now that it’s produced two category-killers — the now defunct iPod, and the iPhone — investors somehow believe that Apple will never have another device to rival its cash cow.

Remember, though, that many companies are extraordinarily successful without ever having produced a category-killer. Apple continues to innovate, introducing new products like the HomePod and AirPods; while those products may not be the “next iPhone,” they’ll help Apple continue to grow both its top and bottom lines. We may yet see another category-killer — but that isn’t necessary for the company to thrive.

I think Apple will continue to generate impressive results for shareholders for many years to come.