What happened

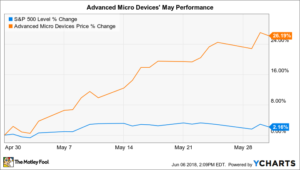

Advanced Micro Devices (NASDAQ: AMD) shareholders trounced the market last month. Their stock gained 26%, according to data provided by S&P; Global Market Intelligence, compared to a 2% increase in the S&P; 500.

The spike contributed to head-turning gains on the chipmaker’s volatile stock, whose shares are up nearly 600% in the past three years.

So what

May’s increase came as investors continued to digest AMD’s latest impressive operating trends. The company revealed in late April that sales surged higher by 40% in the first quarter even as operating profit margin jumped to 36% from 32% in the year-ago period. Like peer NVIDIA, AMD is benefiting from rising demand for high-performance chips in a wide range of fields, including gaming, data processing, and cryptocurrency mining.

Now what

With the outlook for these markets strengthening, AMD clearly has the wind at its back. CEO Lisa Su and her executive team are forecasting another sales growth acceleration next quarter, in fact, as revenue gains rise to 50% and profit margin ticks up to 37% of sales.

Investors have to temper their enthusiasm for attractive figures like that with the knowledge that this is a volatile industry, as evidenced by the fact that AMD has posted a net loss in two of the last three fiscal years.