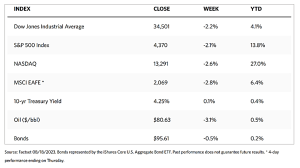

Stock Markets

Stocks fell over the week sending all the major indexes downward. The Dow Jones Industrial Average (DJIA) slumped by 2.21%, not far from the DJ Total Stock Market’s 2.24% drop. The broad-based S&P 500 Index declined by 2.11% while the technology-heavy Nasdaq Stock Market Composite fell even further by 2.59%. The NYSE Composite Index descended by 2.44%. Not surprisingly, the risk indicator CBOE Volatility Index rose by 16.58%. Part of the decline may be accounted for as part of a healthy pullback strategy, although there is no doubt that sentiment was affected by developments in the geopolitical environment and a recalibration in investors’ realistic economic expectations due to the recent optimistic economic news losing steam.

This is the third consecutive week that stocks ended lower. Investor sentiment was apparently dampened by a sharp increase in longer-term bond yields and concerns that China is facing a sharp economic slowdown. The S&P 500 Index has closed the week down by 5.15% from its intraday peak on July 26. Although growth shares should weaken the most in theory in reaction to rising rates placing a greater discount on future earnings, they are instead holding up moderately better than value stocks, as shown by the Russell 1000 Growth Index. Small-cap stocks underperformed the rest of the market. According to traders, the market’s swing appeared to have been accentuated by program trading, technical factors, and thin summer trading. Nevertheless, shifting expectations for the economy will likely continue to drive market movements for the second semester of 2023.

U.S. Economy

The sharp rise in inflation rates the economy has experienced since 2022 appears to be tapering off, which means that it is unlikely that the Federal Reserve will resume its policy of increasing interest rates to keep inflation under control. The focus of economic and monetary policymakers has shifted from increasing inflation to slowing growth. In the year thus far, longer-term interest rates climbed significantly, causing the 10-year Treasury yield to hit a new high for the year in the past week. It appears that there is a resiliency in economic growth prompting the market to accept that the Fed may continue to raise interest rates in the future, which resulted in the record high reached by the 10-year Treasury yield last week.

While household spending may slow as the year heads towards its end, this does not spell a significant retreat in consumer spending from the market altogether. The likelihood of a rolling recession is still intact, which means different areas of the economy will alternate in their slowdown which will result in a mild deceleration in the overall GDP. Spending remained strong in July, according to the recent retail sales report, although the underlying trends showed that sending habits are shifting. Sales of household furnishings, including furniture and appliances, vehicles, electronics, and other large-ticket items, declined. If the economy can sidestep a hard recession, which is the likely outcome due to healthy employment conditions and strong consumer finances, then there appears no reason that the financial markets will return the steady gains it has made since the bear market bottomed out last year.

Metals and Mining

The metals market this week responded to the movements in other financial and commodities markets. On the last day of trading, gold prices hit another five-month low overnight as rising U.S. treasury yields and a rally in the U.S. dollar index created headwinds causing sellers to dominate in the gold and silver markets. Foreign markets also caused ripples as the Chinese economy continued to soften, prompting the country’s central bank to promise further stimulus measures and support the depreciating yuan. Meantime, minutes of the last FOMC meeting released on Wednesday afternoon sent signals that the Fed remains committed to reining in the U.S. inflation. The market read the minutes as leaning hawkish, causing the rise in U.S. treasury yields. However, gold closed slightly higher for the last trading day, ending nine consecutive daily declines and lower lows.

The spot prices of precious metals ended lower this week. Gold closed at $1,889.31 per troy ounce this week, down by 1.28% from its closing price of $1,913.76 the week before. Silver ended trading almost unchanged, from last week’s price of $22.69 to this week’s price of $22.75 per troy ounce, marginally up by 0.26%. Platinum dipped by 0.16% from last week’s closing price of $916.07 to this week’s closing price of $914.58 per troy ounce. Palladium, previously at $1,299.07, ended this week at $1,257.57 per troy ounce for a decline of 3.19%.

The three-month LME prices of industrial metals have also lost some ground for the week. Copper came from $8,386.00 the week before to $8,235.50 per metric ton this past week for a decline of 1.79%. Zinc, previously at $2,457.00, closed this week at $2,298.00 per metric ton, a descent of 6.47%. Aluminum closed this week at $2,145.50 per metric ton, lower by 2.65% from the earlier week’s closing price of $2,204.00. Tin, formerly at $26,885.00, descended by 5.88% to close the week at $25,305.00 per metric ton.

Energy and Oil

The upside for crude oil prices is no longer as clear as it was two weeks ago even though backwardation in oil markets reached the widest level since April and inventories are declining globally. Backwardation refers to the condition when the current price, or spot price, of crude is higher than prices trading in the futures market. The recent minutes of the FOMC meeting showed that the Fed members were divided over the need for further rate hikes, thereby cautioning against market hopes of a soft recession. Furthermore, Chinese economic woes were again resurrected, causing Brent to move lower week-on-week to end at $84 per barrel.

Natural Gas

For the report week from Wednesday, August 9, to Wednesday, August 16, 2023, the Henry Hub spot price fell by $0.36 from $2.91 per million British thermal units (MMBtu) – its highest price since January 2023 – to $2.55/MMBtu, aligning with the decline in the Henry Hub futures price. The price of the September 2023 NYMEX contract decreased by $0.367 from $2.959/MMBtu to $2.529. The price of the 12-month strip averaging September 2023 through August 2024 futures contracts declined by $0.133 to $3.340/MMBtu. Regarding regional spot prices, natural gas spot prices fell at most locations during this report week, except in Southern California. Price changes this week ranged from an increase of $2.85/MMBtu at SoCal Citygate to a decrease of $0.42/MMBtu at Sumas on the Canada-Washington border.

International natural gas futures prices increased this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.78 to a weekly average of $11.76/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $1.40 to a weekly average of $11.75/MMBtu. During the week last year corresponding to this report week (the week from August 10 to August 17, 2022), the prices were $49.94/MMBtu and $65.07/MMBtu in East Asia and at the TTF, respectively.

World Markets

Stocks fell in Europe due to growing fear of growing uncertainty surrounding China’s economic outlook as well as the likelihood of a prolonged elevated interest rate regime in Europe. The pan-European STOXX Europe 600 Index plunged by 2.34%, while major stock indexes likewise softened. Germany’s DAX declined by 1.62%, Italy’s FTSE MIB lost 1.81%, and France’s CAC 40 Index gave up by 2.40% for the week. The UK’s FTSE Index plummeted by 3.48%. UK’s markets reacted to the report of wage growth accelerating, thus bolstering the perception that inflation rates will again increase. This exerted further pressure on the Bank of England (BoE) to further raise interest rates.to put the arrest a possibly heating economy. Average weekly earnings (excluding bonuses) in the UK climbed by 7.8% in the three months through June from 7.4% in the three months through May. Services prices, which are seen by the BoE as the best predictor of underlying domestic inflation, speeded up to its highest level since March 1992 at 7.4%.

Japan’s stock markets declined over the week amid concerns regarding the broader impact of China’s macroeconomic weakness and its troubled property sector. The Nikkei 225 Index receded by 3.2% and the broader TOPIX Index fell by 2.9%. Tourism-related stocks led the shares whose prices declined most notably. The yield on the 10-year Japanese government bond (JGB) increased to 0.64% from 0.58%, its yield level at the end of the previous week. This was the result of the Bank of Japan’s (BoJ’s) monetary policy adjustment in July, the purpose of which was to allow JGB yields to more freely rise by turning its 0.5% yield ceiling from a rigid limit to a reference point. The yen softened to around HPY 145.5 versus the U.S. dollar, from its previous exchange rate of about JPY 144.9 the week earlier. Japanese authorities were prompted to intervene in the foreign exchange market in September 2022 to stem the currency’s decline when it traded at its lowest level in nine months. Meanwhile, Japan’s GDP grew by 6.0% quarter-on-quarter in the three months to the end of June 2023, driven largely by strong exports, and exceeding the 2.9% forecast by economists.

China’s equities succumbed to growing pessimism about the country’s flagging economic recovery. The Shanghai Stock Exchange Index dropped by 1.80% and the blue-chip CSI 300 fell by 2.58%. Hong Kong’s benchmark Hang Seng Index plunged by 5.89%, its biggest weekly fall in five months. According to official data for July, China’s economic activity continued to soften overall. Retail sales and industrial output advanced at a slower-than-expected rate in July compared to their readings one year ago. Also falling short of forecast was the fixed asset investment growth for the first seven months of 2023. Urban unemployment worsened slightly, edging up from June’s 5.2% to July’s 5.3%. New home prices in 70 of China’s largest cities fell by 0.23% in July from June, when they declined for the first time this year. Recent developments suggest that the strength of the recovery of China’s property sector may be faltering, and it may not sustain the growing stabilization it showed earlier this year.

The Week Ahead

The important economic data to be released in the coming week include the Purchasing Managers’ Index for services and manufacturing and the Michigan consumer sentiment survey.

Key Topics to Watch

- Existing home sales

- S&P flash U.S services PMI

- S&P Flash U.S. manufacturing PMI

- New home sales

- Fed officials interviews from Jackson Hole summit

- Initial jobless claims

- Durable goods orders

- Durable goods minus transportation

- Powell gives opening speech at Jackson Hole summit

- University of Michigan consumer sentiment final

Markets Index Wrap Up