Insurance council was ordered to issue suspensions to reflect severity of conduct by licensees

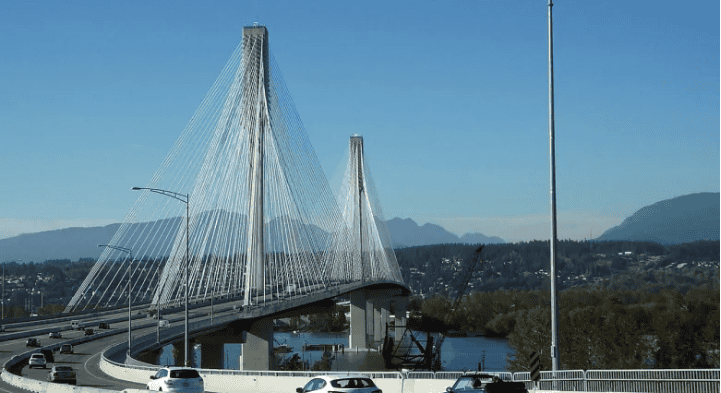

A Lower Mainland insurance broker has been handed an eight-month licence suspension for entering fake information in order to bypass outstanding debts for the tolls drivers once had to pay to cross the Golden Ears and Port Mann bridges.

Although the province stopped collecting tolls for the bridges in September 2017, the ramifications of an ICBC investigation into widespread dishonesty by more than 100 insurance brokers are still being felt within the industry.

The Insurance Council of B.C. suspended Jugjit Singh Sumra last month until mid-June 2020 after a hearing which included evidence from an officer with the special investigations unit that uncovered the scheme in 2015.

Sumra was accused of entering false receipts needed to override outstanding toll debts between 20 and 30 times. The officer also claimed that the licensee admitted to overriding his own toll debt on one occasion.

Failure to protect public interest

Sumra is one of eight brokers suspended in recent months after B.C.’s Financial Services Tribunal ordered the Insurance Council — which regulates the industry — to suspend licensees instead of fining them.

The other seven brokers were all initially given $5,000 penalties.

But the Financial Services Tribunal said that wasn’t tough enough to reflect activity that involved lying and spoke directly to the trustworthiness of brokers — finding the regulator “failed to reasonably protect the public interest.”

The scheme came to light in 2015 after ICBC became aware that some licensees had been entering false information relating to the bridge toll debts in order to help customers renew their insurance.

Prior to the elimination of the tolls, customers were billed for crossing the bridges by administrators charged with collecting the tolls.

Customers who owed more than $25 after missing set deadlines had a note placed on their file that made it impossible to pay for their insurance without settling.

Insurance brokers couldn’t help customers pay the tolls when they wanted to renew their insurance, but they could override the system by entering receipt numbers customers were given when they called the administrators to pay.

Those receipt numbers contained two letters and a series of numbers.

But ICBC investigators found that by entering any two letters followed by any five numbers, the brokers could override the system.

‘Inappropriate and unreasonable sanction’

The Insurance Council of B.C. went public with the story in July 2017, saying several brokers had been fined and as many as 100 could be affected by the end of the investigation.

But those fines were challenged by B.C.’s Financial Institutions Commission (FICOM), which took the case to the Financial Services Tribunal, a kind of appeal body for the regulation of B.C.’s financial industries.

“If a licensee is prepared to commit a dishonest act for 30 or 50 or 100 clients in the processing of insurance applications, that conduct deserves serious denunciation,” FICOM claimed.

“A fine is an inappropriate and unreasonable sanction for dishonest conduct, especially when the conduct is repeated and deliberate.”

The brokers themselves largely claimed they had been trying to help customers.

One said she had a brain injury and couldn’t defend herself. Another lashed out at ICBC for tying the bridge toll debts to insurance in the first place, saying not a single customer “had positive things to say about ICBC.”

“It is truly disappointing that a Crown Corporation cannot devise a foolproof, properly tested computer system for the efficient handling of bridge toll debts,” the broker wrote.

‘Ethics for Insurance Brokers’

Yet another broker said that she had not intentionally given ICBC any false information, relying instead on the code numbers that her clients had given her.

She said she may have been guilty of “wilful blindness and not intentional fraud.”

In the end, the Insurance Council issued the other seven brokers suspensions of between five and nine months.

Sumra’s case went to a hearing, which he failed to attend, notifying the Insurance Council by email three hours before it was set to begin.

He claimed he was trying to find evidence that he did not — in fact — bypass toll debt on his own insurance.

At the end of the day, though, Sumra said he would “take all the blame.”

The council agreed to suspend him for eight months and order him to take an “Ethics for Insurance Brokers” course before returning to work.

He won’t be the only one in the course.