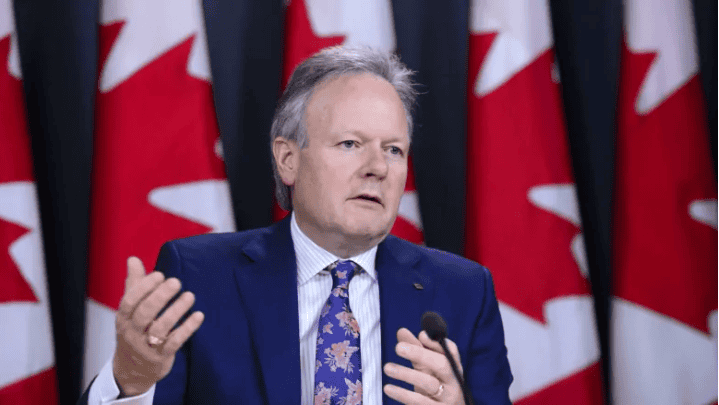

Bank of Canada governor raises possibility of mortgage-backed securities in speech to Winnipeg Board of Trade

Bank of Canada governor Stephen Poloz says it’s time for fresh ideas when it comes to Canadians’ mortgage options.

In a speech Monday in Winnipeg, Poloz said changes could include encouraging loan terms longer than five years, the creation of a market for private mortgage-based securities and the launch of shared-equity mortgages for first-time home buyers.

More innovation would help boost flexibility for borrowers, lenders and investors, while also lowering risks in the financial system, Poloz said.

“To be clear, the system is not broken — it has served Canadians and financial institutions well,” he said in prepared remarks during his speech to the Canadian Credit Union Association and Winnipeg Chamber of Commerce.

“But we should not stop looking for improvements and I invite all of you to join this effort.”

3 key housing-market stories

Poloz is making the recommendations as he monitors three key housing-market stories — the oil-slump-driven slowdown in Alberta and Saskatchewan, the steep drop in resale activity in Toronto and Vancouver, and steady growth in many other parts of Canada.

Looking ahead, he predicted the overall Canadian housing sector to start growing again later this year as the Vancouver and Toronto markets stabilize.

In a news conference following the speech, Poloz offered more details about his take on the two big housing markets.

Poloz said the fundamentals — like population growth and job creation — in those cities have been “really strong” and he expects they’ve “put a floor” under the adjustment process. The still-low interest rates remain quite attractive, he added.

He credited the tougher mortgage guidelines, which brought in interest-rate stress tests, for working as they were designed. They helped improve the quality of loans and stop the speculative increase in house prices in Vancouver and Toronto, he said.

Poloz predicts buyers affected by the stress tests will return to the market in search of less expensive homes, while some will wait until they’ve saved more for a down payment.

“All those conditions give you confidence that it’s a matter of adjustment and, after that, a return to normal growth,” he said.

On his request Monday for more brainstorming on the mortgage marketplace, Poloz said he’s wondered why so few changes have been introduced in his lifetime.

In its spring budget, the federal government announced it would create shared-equity mortgages as a way to provide interest-free loans from Canada Mortgage and Housing to help first-time home buyers. The plan, if implemented, would also encourage a lift in housing supply as new homes would qualify for more CMHC aid, Poloz said.

The government is expected to lay out more details on the proposal later this year.

Poloz said the plan would help make the financial system safer because mortgage risks would be shared between the borrower and the lender, though CMHC would have an equity stake in the home.

In another example, he suggested there should be more work to promote the merits of fixed-rate loans longer than five years. Only two per cent of all fixed-rate mortgages issued in 2018 had durations longer than five years, he added.

For borrowers, longer terms would mean they would have to deal with fewer renewals, reducing the risk that they will face higher interest rates. Policy-makers would also benefit from the increased stability related to fewer renewals.

He said there’s some momentum in Canada towards the creation of a private market for mortgage-backed securities. Poloz said it would provide a more-flexible source of longer-term funding for mortgages not insured by CMHC.

They would have to be designed carefully, he said, because mortgage-backed securities were central to the “sub-prime debacle” ahead of the financial crisis more than a decade ago.