Sign up for China Rising, a new weekly dispatch on where China stands now and where it’s going next.

Stocks across Asia kicked off the week with strong gains after soothing Federal Reserve comments and an easing of monetary policy in China stoked a renewed appetite for risk assets. The dollar fell to the lowest in more than two months against peers.

Shares in Japan led the charge, with advances also in Hong Kong, South Korea and Australia. U.S. futures climbed, signaling Friday’s rally in U.S. stocks could continue, and European futures also rose. Federal Reserve Chairman Jerome Powell said policy is flexible and officials are “listening carefully” to financial markets, while the People’s Bank of China cut the required reserves for banks.

Treasuries steadied after Friday’s slide that sent yields soaring back to 2.67 percent. Fresh talks between the U.S. and China on trade, and Powell’s remarks sapped demand for the dollar as the yen led gains in G-10 currencies.

“It’s probably an opportunity to buy the dips if you are underweight equity allocations,” Raymond Lee, managing director and portfolio manager at Kapstream Capital, said on Bloomberg TV. “I do think going forward you are probably not likely to see that type of move where equities sell off 20 percent in the space of six weeks, but generally volatility will be higher than what you saw in 2017 and the first half of 2018.”

Powell’s remarks are helping to lift sentiment that’s been hammered as global equities posted their biggest annual loss since the financial crisis, easing concerns the Fed is determined to raise rates even as global economic growth cools and markets tumble. Even after the slump in Treasuries at the end of last week, 10-year yields remain more than 50 basis points lower than where they peaked in November.

A further step by China’s central bank late Friday to secure liquidity to the slowing economy may also help assuage concerns. Apple Inc. last week cut its revenue outlook for the first time in almost two decades, citing weakness in China’s economy as one of the reasons. U.S. and Chinese officials will begin trade negotiations on Monday in the hope of reaching a deal during a 90-day truce between President Donald Trump and his counterpart Xi Jinping.

Elsewhere, the won and the Indonesian rupiah led gains in Asian emerging-market currencies. Oil extended its recent rebound to trade back above $48 a barrel.

For more on our markets coverage, you can go to the Markets Live blog.

Here are some events investors may focus on this week:

A U.S. delegation is in Beijing for trade talks with Chinese officials, the first face-to-face encounter since Trump and Xi agreed to a temporary truce on Dec. 1.Wednesday sees the release of minutes from the Fed’s Dec. 18-19 policy meeting. Powell will speak to the Economic Club of Washington D.C. on Thursday. U.K. Parliament resumes a debate on the Brexit withdrawal bill, with Prime Minister Theresa May seeking to avoid defeat in a vote set for the week of Jan. 14.

These are the main moves in markets:

Stocks

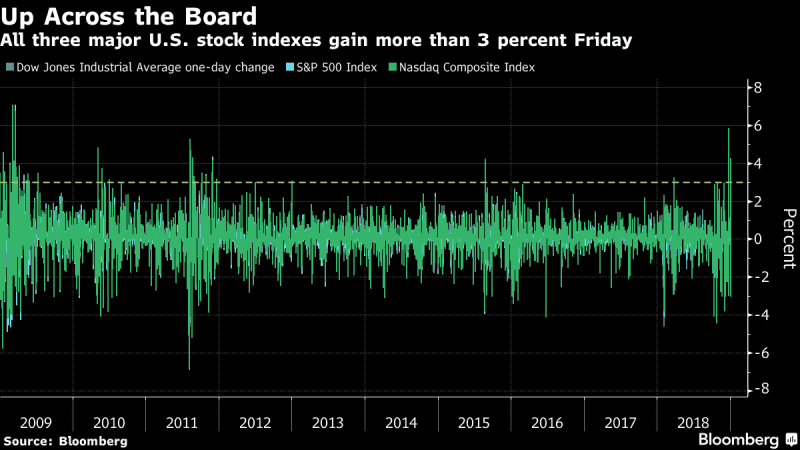

The MSCI Asia Pacific Index climbed for a third day, gaining 1.9 percent as of 4:18 p.m. in Tokyo.Futures on the S&P 500 gained 0.5 percent. The S&P 500 Index climbed 3.4 percent Friday, when the Dow Jones Industrial Average advanced 3.3 percent. FTSE 100 Index futures gained 0.1 percent.Japan’s Topix index rallied 2.8 percent at the close. Hong Kong’s Hang Seng Index rose 0.7 percent.The Shanghai Composite Index advanced 0.7 percent.

Currencies

The yen gained 0.3 percent to 108.19 per dollar. The offshore yuan added 0.3 percent to 6.8471 per dollar. The Bloomberg Dollar Spot Index dipped 0.2 percent.The euro bought $1.1415, up 0.2 percent.The pound rose 0.2 percent to $1.2749.

Bonds

The yield on 10-year Treasuries dipped to 2.66 percent.Australia’s 10-year bond yield rose four basis points to 2.27 percent.

Commodities

West Texas Intermediate crude climbed 1.7 percent to $48.8 a barrel.Gold was at $1,291.55 an ounce, up 0.4 percent.