Streaming video veteran Netflix (NASDAQ:NFLX) is gearing up for a second-quarter report next Monday evening. Stock prices have more than doubled in 2018 and nearly tripled in 52 weeks as the company kept beating its own estimates of how quickly the subscriber base might grow.

Will this report be any different? Let’s have a look at what to expect from Netflix’s next business update.

Guidance targets

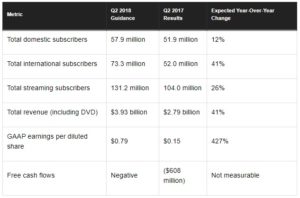

Hitting these subscriber numbers on the nose would work out to 1.2 million net new domestic subscribers coming aboard during the second quarter and 5.0 million new international customers. That would be 6.2 million new members on a global level. Analysts and investors will keep a close eye on these particular metrics because they provide the best measuring stick for Netflix’s subscriber-growth ambitions.

You’ll find that top-line revenue keeps growing faster than the subscriber additions might suggest. The extra boost comes from a steady stream of small price increases, and there seems to be a steady flow of subscribers opting for pricier plans with higher video quality and the ability to concurrently stream Netflix content on more devices. Expect these trends to continue, especially in the international division.

For what it’s worth, analyst firms Cowen and Baird recently raised their target prices on Netflix thanks to strong growth indicators in each firm’s own survey of domestic and international video consumers. Baird said that international growth is coming in particularly hot while Cowen underscored Netflix’s “outsized” share of viewing hours among younger audiences.

IMAGE SOURCE: GETTY IMAGES.

Going beyond the raw numbers

To keep the subscriber additions coming, Netflix is making heavy investments to create a strong portfolio of original content. The English-speaking portion of this catalog is shrinking at the company leans on production teams in other markets. In the latest earnings call, content chief Ted Sarandos highlighted titles from Germany, Brazil, Spain, and Denmark as border-crossing wins.

“There’s incredible storytellers and producers around the world that just have not had access to a global audience before, and we’ve been able to find them pretty effectively,” Sarandos said. This is now a core concept at the heart of Netflix’s evolving content production strategy.

Netflix’s management continues to expect negative free cash flows “for several more years,” including this quarter. You can pin that cash burn on the large cash expenses Netflix is pouring into content production, which is different from paying smaller licensing fees to other studios for the right to stream their movies and shows. The company raised another $1.5 billion of new debt in April, all earmarked for content production budgets. It’s a little early to expect another reach for capital right now, but I wouldn’t be surprised to see a return to the debt market around the third-quarter report.

This article originally appeared on The Motley Fool.