One of the best ways for investors to juice their returns is to take advantage of the market’s propensity to occasionally overlook a great company and put it on sale. Three current examples: LGI Homes Inc (NASDAQ:LGIH), Cardinal Health Inc (NYSE:CAH), and Berkshire Hathaway Inc (NYSE:BRK-B)(NYSE:BRK-A). So far this year, investors have turned away, run away, and forgotten about these wonderful companies that should make for excellent long-term investments going forward.

If you’re looking for the right opportunity to take advantage of Mr. Market mispricing a great stock, keep reading below to learn why three real-world investors have identified these three companies as ideal overlooked stocks. Chances are, one or more of them could fit perfectly in your portfolio.

HERE ARE THREE CHANCES TO ZIG WHILE THE MARKET ZAGS. IMAGE SOURCE: GETTY IMAGES.

An opportunistic buy in a growth industry

Jason Hall (LGI Homes): Wall Street has turned its back on just about every homebuilder this year:

LGIH DATA BY YCHARTS.

A combination of rising interest rates, record-low personal savings paired with rising personal debt balances, and climbing home prices that keep many buyers out of the market has turned Mr. Market decidedly bearish on housing.

While there could be some short-term challenges for many homebuilders, I think the big sell-off is generally overdone and has created a solid opportunity to buy and hold over the long term, particularly LGI Homes.

This small homebuilder is squarely focused on the segment of the market with the biggest mismatch between supply and demand: starter homes. After almost a decade of underbuilding coming out of the Great Recession, the confluence of Millennials entering the housing market, and Baby Boomers looking to downsize in retirement could result in a decade or more of high demand. LGI Homes is already taking advantage, recently announcing it built 30% more homes in the first half of 2018 than last year, and more than doubled earnings per share last quarter.

But the market isn’t pricing it like a growth stock. At recent prices, you can buy LGI Homes for less than 10 times the low end of the company’s guidance for 2018 earnings. That’s a bargain for even half the growth it is delivering.

Short-term issues could lead to a long-term bargain

Sean Williams (Cardinal Health): In recent months, all eyes have been on companies like Amazon to reform the healthcare sector and pharmaceutical supply chains. On June 28, Amazon lived up to the hype by announcing the purchase of online pharmacy PillPack for $1 billion. In response to this potentially disruptive acquisition, practically every pharmacy and pharmaceutical supply chain company tanked on the news.

But lost in this hoopla is Cardinal Health, a generic-drug and medical device supplier for hospitals, medical offices, and ambulatory surgical centers that now looks exceptionally inexpensive. If Wall Street doesn’t wise up, it could miss an incredible bargain.

You see, Cardinal Health suffered through its worst day in more than a decade in early May after announcing its third-quarter operating results and, ultimately, lowering its full-year EPS forecast to a range of $4.85 to $4.95 from a prior forecast of $5.25 to $5.50. That’s certainly not great news on the surface, but the reasoning behind the move offers hope that the company’s issues can be resolved rather quickly.

For instance, a major reason behind the reduced full-year forecast was a higher-than-expected tax rate tied to write-offs associated with medical device subsidiary Cordis. The issue for Cardinal Health has been in working out problems in Cordis’ supply chain. While those fixes aren’t going to come with the flip of a switch, management has begun addressing them. My expectation is that within a year or two, Cordis’ supply chain woes will be in the rearview mirror. And that’s great news, because Cordis’s top line has consistently been expanding. Packing on juicier margins will simply be icing on the cake.

A stabilization in generic-drug prices should be a positive for Cardinal Health, too. Though it’s unclear when generic drug pricing will officially bottom, most companies in the industry anticipate a stabilization within the next couple of quarters.

CAH DIVIDEND YIELD (TTM) DATA BY YCHARTS.

With Cardinal Health yielding nearly 4%, being valued at less than 10 times forward earnings, and expected to grow EPS by nearly 10% per year after 2019, it looks to be one heck of an overlooked value stock.

A bargain hidden in plain sight

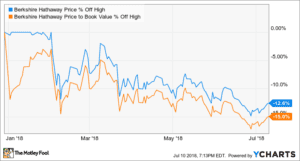

Jordan Wathen (Berkshire Hathaway): This holding company may be one of the largest on the market, and managed by the world’s best investor, but I believe Wall Street is overlooking the opportunity presented by its market-lagging performance in 2018.

I see Berkshire Hathaway as offering a favorable balance of risk and reward because of Buffett’s promise to buy back stock at about 1.2 times book value. Currently, shares trade at about 1.35 times book value.

BRK.B DATA BY YCHARTS.

Thus, if Berkshire were to drop about 11% from here, Buffett would be snapping up shares in droves, putting the company’s excess cash to work, increasing the company’s earnings per share, and supporting its stock price all along the way.

If Berkshire shares decline as part of a broader drop in stock prices (thus weighing on its stock portfolio and book value), Buffett, who complained about business valuations in his letter to shareholders this year, will have more places to put Berkshire’s cash to work in other companies, public or private.

Given the promise of large buybacks at 1.2 times book, and the opportunity to deploy excess cash in a broad market decline, I think of Berkshire as having substantially more upside potential than downside risk at a price of only 1.35 times book value.

This article originally appeared on The Motley Fool.