Still, only 29 percent of Americans know that 529 plans are an education savings tool, according to a new survey by the investment firm Edward Jones. That’s down from last year when 32 percent of the more than 1,000 people polled said they understood what the state-sponsored plans did.

These plans offer many tax benefits that are better than using a bank savings account. And, by having college money saved, you’re less likely tap your retirement savings.

Not only can you get a tax deduction or credit for contributions (over 30 states and the District of Columbia offer a direct state tax deduction for your contributions), earnings grow on a tax-advantaged basis and, when you withdraw the money, it is tax-free if the funds are used for qualified education expenses, such as tuition, fees, books and room and board.

The new tax law even expanded the use of plans to include private-school tuition from elementary through high school. Families now have the option to use up to $10,000 in annual tax-free 529 plan withdrawals to cover those early educational expenses. (While this addition sounds like a good idea, making early withdrawals could forfeit the benefit from long-term compounding.)

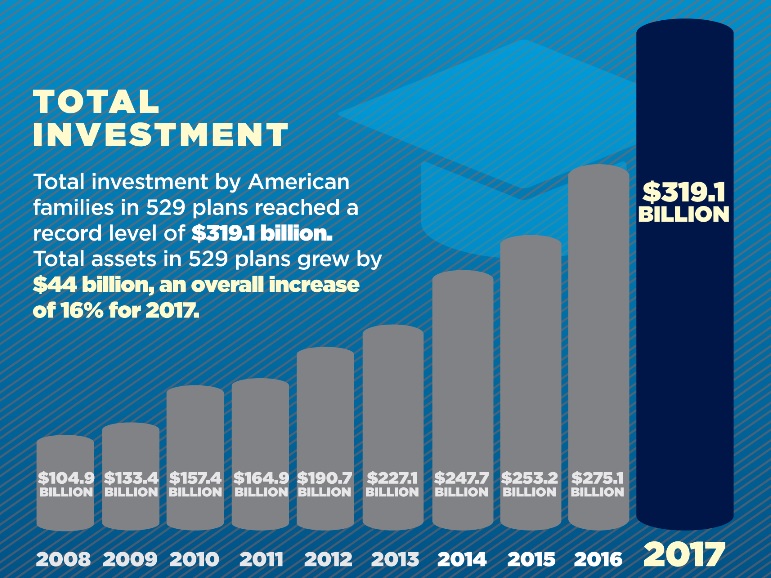

In 2017, the average account size jumped to a record high of $24,057, up 13 percent from the year earlier, according to the College Savings Plans Network, or CSPN.

Total investments in 529s also reached a record $319.1 billion last year, 16 percent higher than 2016 (see the chart below from the College Savings Plans Network).

While 529 balances have been growing, so have college costs.

All in, families with students in four-year private colleges spent almost $47,000 in 2017–18; that’s up 3.5 percent from the year earlier, according to the College Board.

“We are all concerned about [college] debt and 529 plans are part of the solution,” said James DiUlio, the chair of CSPN. “Any time you can start and any amount you can save is better than borrowing on the other end.”

However, many people are left out altogether when it comes to being able to afford higher education. Exactly half of Americans are not saving anything on an annual basis for future education expenses, Edward Jones found.

“A lot of people fall below the line when it comes to resources,” said Josh Andrews, the financial advice director for education at USAA, the credit union and financial services firm that specializes in customers with a military connection. “There’s just not any money left to fund a 529.”

To that point, “529s are a great vehicle if you are sure you want to allocate funds for higher education,” added Kyle Ryan, a certified financial planner and executive vice president of advisory services for Personal Capital in San Francisco. “However, it’s not the best thing for everyone.”

With an Roth IRA, for example, savers under the age of 50 can make after-tax contributions up to $5,500 a year, and then take tax-free withdrawals in retirement. Account holders can also withdraw their contributions at any time — say, to cover college expenses — without taxes or penalties.

“It gives you the flexibility to save for retirement and use it for education as well,” Ryan said.