Whether you’re looking for a steady and dependable source of income, potential for big capital growth, or both, these Motley Fool contributors have identified three top dividend stocks that should be at the top of your “buy” list this month.

Their recommendations include a technology leader with a dominant position in its niche in Garmin Ltd. (NASDAQ: GRMN), one of the leading healthcare companies in the world in Johnson & Johnson (NYSE: JNJ), and high-growth, high-yield Pattern Energy Group Inc (NASDAQ: PEGI). Keep reading to discover why these companies caught the attention of three Foolish contributors and what makes them worth buying now.

Navigate to a 3%-plus yield

Demitri Kalogeropoulos (Garmin): The consumer technology industry can be a brutal place to do business if your product launches fail to keep pace with shifting consumer tastes. Companies like GoPro and Fitbit have firsthand knowledge of that fact, and both stocks are down over 80% in the past three years.

GPS device specialist Garmin, on the other hand, managed to boost sales last year despite challenges in two of its biggest market niches. That success is a testament to a diversified portfolio that includes smartwatches, fitness trackers, dashboard navigation, and equipment for boating and aviation.

The company set a record for profitability in 2017, and management sees another profit margin uptick in the cards this fiscal year as sales inch up to $3.2 billion from $3.1 billion. Meanwhile, its shares are valued at an attractive 19 times the $3 per share Garmin is expected to generate over the next 12 months.

Its dividend, while lacking consistent growth, was recently raised to an over 3.5% yield. That payout should help pad income investors’ returns while they wait to find out whether Garmin’s latest product launches resonate with GPS tech fans, just as most prior releases have done over the last few years.

The best income stock in healthcare

George Budwell (Johnson & Johnson): I think the healthcare behemoth Johnson & Johnson is worth buying this month ahead of the company’s scheduled first-quarter earnings release on April 17th.

Apart from the company’s strong track record of beating analysts’ estimates for its top line, I expect the company to announce a larger than normal hike to its dividend this quarter, thanks to an influx of cash from the Tax Cuts and Jobs Act of 2017.

The drugmaker, after all, is due for another dividend hike based on its prior history. Investors have also been clamoring for a healthy hike after last year’s somewhat modest increase. So, in short, J&J could very well end up offering a yield close to 3% later on this year, which would make it one of the most generous income stocks in all of healthcare.

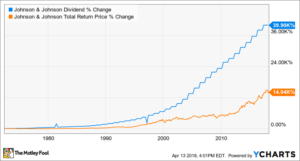

In addition to its juicy yield, J&J is also a great income stock to own because of its 55-year history of consecutive dividend increases, triple-A rated balance sheet, and of course, its top-notch pharma pipeline that’s been ranked the best-in-class by Idea Pharma for five out of the last six years.

Keeping with this theme, J&J has over 30 drugs in late-stage programs at the moment, and several product candidates with megablockbuster potential. The company also has the financial flexibility to execute value-creating M&A deals to keep its pharma pipeline in tip-top shape moving forward. So, there’s no reason to think that J&J’s fortunes are about to change anytime soon.

In all, J&J should make a great addition to any investor’s portfolio because of the company’s stellar shareholder rewards and proven ability to bring major new drugs to market in a timely fashion.

The reward outweighs the risk

Jason Hall (Pattern Energy Group): Over the past six months, independent renewable energy producer Pattern Energy’s stock price has fallen a painful 33% from its high, pushing the dividend yield up to an insanely high 9.6%. So what’s happening? In short, the market is getting spooked after changes to tax equity investing rules that could lead to reduced access to capital for Pattern and other renewable energy companies. Add in climbing interest rates, and it seems like investors are afraid Pattern’s growth story will end before it really gets going.

This may look like a company that’s heading toward a dividend cut, and there is some risk of that happening if the changes to tax equity investing rules put a squeeze on Pattern’s access to capital. But it wouldn’t be because the company can’t afford the dividend, but rather it needed to reduce the yield in order to issue shares to raise cash at a decent rate of return. But I think that’s a relatively low probability, and the market has already priced that risk into the stock.

Furthermore, Pattern operates in Canada and Japan in addition to the U.S., so U.S. tax equity investors aren’t its only source of capital, and the company’s leadership has decades of experience navigating through changing regulatory and economic cycles. Looking at the big picture, I expect the market’s current reaction will be just a blip on the radar for Pattern, and shareholders who invest at current prices will come out incredibly well over the long term (even if we see a dividend cut in the short term).