Investing in your 70s isn’t like investing when you’re starting a career. You may not be looking for growth from your portfolio because you value safety and cash flow from your investments to fund retirement.

I’ve considered the different goals of those in their 70s and think Verizon Communications Inc. (NYSE: VZ), TerraForm Power Inc (NASDAQ: TERP), and Visa Inc. (NYSE: V) have a combination of stability and strong dividends that investors should love.

Verizon

Wireless communications have become a staple in the U.S., and Verizon is a leader in providing the services people use. With one of the best networks, it currently has 116.3 million retail customers paying for their connections each month, and that number is growing. This steady customer growth is driving cash from operations, as well as Verizon’s growing dividend.

The sharp drop in cash from operations that you see in the above chart may seem alarming, but it’s actually part of the natural business cycle. As 4G wireless networks have aged, lower-tier competitors like T-Mobile and Sprint have caught up and started attracting customers, thanks to their low prices. Verizon has had to respond with its own price reductions and incentives for customers. But later this year, Verizon will begin rolling out its 5G network across the U.S. and will be years ahead of smaller rivals.

5G is exciting for Verizon because it will enable the company to reach millions of residential users who currently use broadband cable for their internet connection. The technology also will enable self-driving cars, virtual reality, and greater adoption of wearables. If you want a strong dividend yield of 5% from a company leading in an industry that’s growing long term, Verizon is a great pick.

TerraForm Power

Energy is a volatile place to invest in today, with natural gas and oil prices rising and falling faster than I can keep track. But not all energy investments have to take on the risk of an underlying commodity.

TerraForm Power is a yieldco that owns renewable-energy projects that have an average of 14 years left on their contracts to sell electricity to customers like utilities. This ensures the cash flow from these projects, which ultimately pays the $0.76 per-share dividend that’s expected in 2018.

Long term, TerraForm Power will keep about 15% to 20% of its cash available for distribution to fund organic growth, helping drive a projected 5% to 8% annual dividend increase. The contracted cash flows that drive the current dividend along with the organic growth that will lead to dividend growth in the future make this a great stock for investors looking for consistent cash flow from their portfolios.

Visa

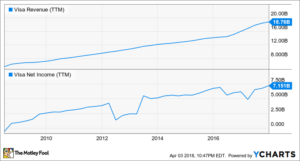

Credit cards have been around for decades, and companies like Visa still are growing and processing more and more payments. Visa’s operating revenue jumped 22% in 2017, to $18.4 billion, on 11% organic growth in payment volume. This growth is a continuation of a long-term trend.

Visa’s position in the payment market is tough to compete with because it’s an intermediary between banks, businesses, and customers. Unless the entire global payment structure changes, the company will maintain a valuable position.

Visa isn’t the best dividend stock on the market, with a current yield of 0.7%, but it has growth potential that tops Verizon and TerraForm Power.

Building a portfolio for retirement

If you’re looking for a way to generate a little more yield than bonds are paying and are turning to the stock market, these three companies are great places to start.