If you’re like me, you love dividend stocks. However, it’s easy to get caught up in the search for a big yield and miss the bigger picture of what makes a great dividend investment.

So how do you find the best dividend stocks? It’s actually pretty easy to find a short list of great dividend-paying companies to select from if you follow these five simple steps:

Step 1: I like a streak

My first step is always to look at a company’s dividend-paying history. I’m looking for a company that has a long history of increasing its dividend, which shows a management commitment to returning value to shareholders over time. You should tailor the number of consecutive annual increases to your taste. For example, some investors will only consider Dividend Aristocrats or companies that have increased their dividends for 25 years or more. Others are willing to go down to a decade of annual hikes.

But you might want to be flexible here. For example, utility Southern Company (NYSE: SO) has increased its dividend for 17 consecutive years. That’s enough to pass most screens — but its dividend streak is actually even better than that because it has held its dividend steady or increased it every year for over six decades. I’m willing to go down to five years of annual dividend hikes if a company’s history doesn’t include any recent dividend cuts.

Step 2: Solid foundations

After you prune your list down to companies with solid dividend paying histories, you need to step back and think about what lets a company pay dividends. The answer is a solid business built on a solid financial foundation. So skim through your list and take out businesses that you don’t understand or that have weak business models. And then get rid of names that lack the financial strength needed to pay a dividend.

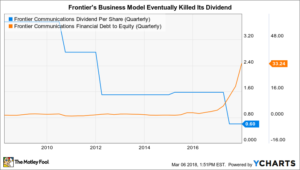

Comparing Verizon Communications Inc (NYSE: VZ) and Frontier Communications Corp (NASDAQ: FTR) provides an interesting look at this issue. A few years ago Verizon sold Frontier a collection of rural telecom assets focused around copper wires. Verizon was rejiggering its business to highlight wireless telecommunications, while Frontier was betting that it could continue to milk an old technology. Investors were questioning the validity of Frontier’s model from day one, pushing the yield into double-digit territory at one point. It wasn’t a huge surprise when Frontier recently eliminated its dividend in the face of a declining customer base as more and more people shifted to wireless. Verizon, which clearly backed the better industry trend, has now increased its dividend for 13 consecutive years.

FTR Dividend Per Share (Quarterly) data by YCharts

There’s a second layer to this, however. Not only was Frontier trying to execute a less desirable business plan, it had also made heavy use of debt to fund its efforts. Over the past decade, long-term debt at the telecom rose from around $5 billion to roughly $17 billion. Its earnings fell in all but one year over that span, partly because interest expenses were eating up more and more of its top line. There’s obviously a lot more detail to understand about what went wrong at Frontier, but stepping back from this specific example, you want to make sure that the companies you are looking at have the balance sheet strength to keep paying their dividends — Frontier clearly didn’t.

Step 3: Income now or income later

The next thing you want to think about is dividend growth versus yield. Someone trying to maximize current income will favor higher yielding stocks, while investors that don’t need income today should probably err on the side of dividend growth. This is important because inflation goes up around 3% a year, which erodes your buying power. At the very least, you want to find an investment that can, over the long-term, increase its dividend at roughly the rate of inflation.

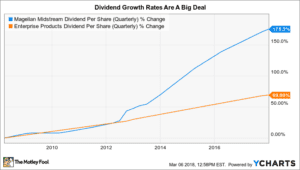

Another example will help here. Midstream limited partnership Enterprise Products Partners L.P. (NYSE: EPD) offers unitholders a yield of 6.75%, notably more than peer Magellan Midstream Partners, L.P.’s (NYSE: MMP) 5.7%. Part of the reason why investors are paying a premium price for Magellan is because it has historically increased its distribution at a higher rate than Enterprise. Over the past decade, Enterprise’s distribution has grown at roughly 5.7% a year, while Magellan’s distribution has increased at an annualized rate of 10.9%. (The difference is expected to be even more notable over the next couple of years.)

MMP Dividend Per Share (Quarterly) data by YCharts

While the annualized distribution growth rates above may not seem all that divergent, the impact over time is notable. As the chart above shows, Enterprise’s distribution has increased roughly 70% over the past decade, but Magellan’s distribution has expanded a massive 175%!

You need to decide first if you are looking to maximize your income now or if you are willing to take a lower yield in exchange for higher dividend growth rates. Then look for the highest growth rates you can get that meet your current income needs.

Step 4: Don’t forget to diversify

By this point your list of potential investments is probably relatively short, which is a good thing and a bad thing. The good news is that you don’t have to do a deep dive on lots of companies. The bad news is that you’re likely to find that you have a list that’s filled with clumps of roughly similar businesses. Don’t make the mistake of forgetting about diversification. As you start to research individual companies, make sure you’re working to pick names from various industries. Ideally, you’ll have 10 or more industries represented in your portfolio.

But don’t start buying anything just yet, even if you have created your ideal shortlist. There’s one more thing you need to think about…

Step 5: Buy the bargains

To paraphrase Benjamin Graham, the father of financial analysis, even a great company can be a bad investment if you pay too much for it. Your list of candidates might be filled with amazing businesses, but are they worth buying at current prices? That’s where looking at some financial metrics can help you decide what to do.

The go-to valuation metric is price to earnings, but don’t forget about metrics like price to sales, price to book value, and price to cash flow. Compare these ratios to the industry, the market, and the company’s own history. Also, consider examining a company’s yield history. If the yield is high relative to its history it could be a good buying opportunity. The idea is to find valuation metrics that make sense to you and that can help you focus on buying relatively inexpensive companies. My favorites are price to sales and yield relative to history.

If any of the companies you are looking at pass the first four steps and appear to have a desirable valuation, then, by all means, consider jumping in. Just don’t make the mistake of throwing out a stock that passes the first four screens because it appears expensive today. Using another Graham reference, the market is a voting machine over the short term, and a weighing machine over the long term. In other words, investors often push prices to extreme highs and lows without consideration of the underlying value of a business. If you have a great stock that seems too expensive today, keep watching and you might find it eventually goes out of favor — opening up a buying opportunity for patient investors.

Five “simple” steps

So there you have it, a step by step guide to finding great dividend stocks. If you take the time to apply these steps I’m sure you will be able to create a portfolio of solid dividend payers that meet your individual needs.