Reliable, relatively inexpensive, and easily portable, oil and natural gas are two of the primary sources we rely on to move our society. However, as commodities, oil and gas are subject to large and often swift price swings. Magellan Midstream Partners, L.P. (NYSE: MMP), Buckeye Partners, L.P. (NYSE: BPL), and ONEOK, Inc. (NYSE: OKE) are three high yield names that let you benefit from energy demand while largely avoiding the commodity risk.

1. A conservative player

Magellan Midstream Partners offers investors a distribution yield of roughly 5.4%. It has increased its distribution for 18 consecutive years. The vast majority of its revenues come from the fees it charges customers to use its collection of pipelines and other midstream oil and gas infrastructure. Like all of the midstream players here, the partnership doesn’t really care what the price of the commodities flowing through its system happen to be, it’s just a toll taker. That means you can get paid well even when volatile energy prices are forcing oil and gas drillers to cut dividends.

Magellan happens to be one of the most conservatively run midstream companies in the United States, focusing on low leverage and self funding its own growth (which avoids dilutive unit sales). What’s impressive here, however, is that Magellan has rewarded investors with significant dividend growth even while maintaining a low-risk profile. That includes annualized distribution growth of 10% over the past decade driven by $5 billion worth of growth spending.

Magellan is currently calling for 8% distribution growth in 2018 with coverage of 1.2 times. That’s backed by plans for $800 million in capital spending. The key feature here is that virtually all of the projects the partnership is funding either have customers lined up already or are at existing assets where demand is large enough to justify the additional investment. Magellan lets you be conservative and get a fat yield and a growing distribution.

2. Adding some risk

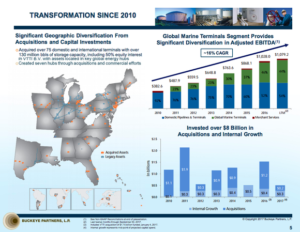

Buckeye Partners is a much riskier midstream partnership than Magellan, but the roughly 9.5% yield is pretty enticing. That’s especially true when you consider that Buckeye’s largely fee-based business has allowed it to increase its distribution annually for 22 consecutive years. The problem is that management is embarking on a large investment program at a time when distribution coverage has fallen below 1. This has, justifiably, been a major headwind for the units lately.

If you can stomach the uncertainty, however, there’s still a lot to like here. For starters, Buckeye has been down this road before. Coverage dipped below 1 in 2013 and 2014 while the partnership was spending on growth. The distribution continued to be increased each year, and coverage was back over 1 in 2015 and 2016 as the company’s investments started to bear fruit. Essentially, Buckeye has a history of thinking long term. The high yield today could be an opportunity to buy when others are fearful.

Another interesting thing about Buckeye is that it has a truly global reach, since roughly 45% of its adjusted EBITDA comes from its international terminals business. Most U.S. midstream partnerships only provide you exposure to the domestic market, which is just a small piece of the global demand for oil and natural gas. If you want to get paid well and own a global energy player, then Buckeye and its high yield are worth a deep dive.

3. Avoiding some headaches

Buckeye and Magellan are both partnerships, which can create complications come tax time, and they don’t play nicely with tax advantaged retirement accounts — which is why you might also want to consider 5.5% yielding ONEOK, which is structured as a regular corporation but still has a largely fee-based midstream business. In fact, ONEOK recently bought its controlled partnership in an attempt to simplify its operations. ONEOK, just for reference, has increased its annual dividend for 16 consecutive years.

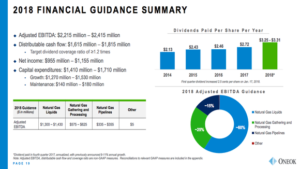

With the recent merger there are a lot of moving parts right now, including a plan to reduce the company’s leverage. However, ONEOK is still projecting 10% dividend growth each year through 2021. Over the near-term that’s backed by roughly $1.8 billion worth of investments, which are expected to come online later this year and in 2019. The largest of the projects, the $1.4 billion Elk Creek Pipeline, already has contracts in place.

When ONEOK bought its controlled partnership and presented its growth plans, investors were skeptical that it could grow the business, reduce leverage, and materially increase the dividend all at the same time. However, the growth projects it has announced since that point increasingly show that management is working hard to live up to its commitment here. If you don’t like the idea of a partnership, you can still get paid well in the midstream space by owning a company like ONEOK.

Watching the fireworks

Oil and natural gas prices can get exciting at times; look at the deep plunge that oil prices took in mid-2014. It’s understandable if you want to avoid being a part of that show even though some oil drillers have enticing dividend yields. But you can still get paid in the energy sector and wait out the price volatility without worrying too much by owning midstream businesses like high-yielding Magellan, Buckeye, and ONEOK. There are nuances to know about each, like Buckeye’s weak distribution coverage, but if you do your homework you might find that one of these vital infrastructure providers fits nicely in your income portfolio.