Stock Markets

The 30-stock Dow Jones Industrial Average (DJIA) was up 0.27% for the week, although the broader stock indexes were generally down week-on-week. The Total Stock Market Index fell by 0.95%, while the broad S&P 500 Index slumped by 1.00%. The technology-heavy Nasdaq Stock Market Composite dropped by 1.64%, although the NYSE Composite ticked up by 0.01%. The CBOE Volatility Index (VIX), the indicator of investor risk perception, rose by 10.64%. The DJIA’s modest rise has garnered its third straight week of gains.

The Nasdaq Composite took a particularly deep plunge on Monday due to a sell-off in tech stocks in response to the rise of DeepSeek, a Chinese artificial intelligence (AI) developer. According to reports, DeepSeek released a new open-source large language model that requires much less energy and processing power than the other leading AI applications. This has led to competitive concerns among the established leaders in the AI industry. As a result, shares of NVIDIA dropped by almost 17% on Monday,

The earnings season also proceeded with companies comprising about 40% of the S&P 500 Index’s market capitalization reporting results during the week. Several positive earnings surprises appeared to be a tailwind for stocks late in the week and helped most of the major indexes recover some of the losses encountered at the beginning of the week. Most of these stocks that reported stellar and upbeat forward guidance were some notable large-cap tech companies, including Meta Platforms and Apple.

U.S. Economy

Fourth-quarter GDP appears to indicate that the U.S. economy remains on solid footing. Although the economy grew by 2.3% annualized, this is still slightly below the forecasts called for 2.4%. The main driver of the expansion was consumer spending, which accounts for about 68% of the economy. It rose by a 4.2% annualized rate, which was the highest reading since the first quarter of 2023. The primary detractors were downturns in investment and exports which contributed to a decline in real GDP growth from the prior quarter. For 2024, real GDP grew by 2.8%, down from 2,9% in 2023.

With the unemployment rate at 4.1% and job openings exceeding unemployment, it is likely that a healthy labor market could keep wage gains above inflation to provide positive real wages. Furthermore, the U.S. manufacturing sector showed signs of stabilizing this month despite remaining in contraction for most of the past two years. A healthy labor market and positive real wages may be expected to support consumer spending. Together with the stabilizing manufacturing sector, these factors should continue to sustain the economy’s momentum for 2025. A recession is unlikely although growth could cool in the first semester of this year as consumers, especially those in the lower income bracket, potentially pull back on discretionary spending. The latter half of the year has the potential for growth to resume acceleration due to Fed interest-rate cuts, together with deregulation, tax cuts, and other pro-growth policies.

Metals and Mining

As the world braces for a new trade war in less than 24 hours, it is not surprising that gold has surged to record highs above $2,800 per ounce. Donald Trump announced that on February 1, he would impose 25% tariffs on goods from Canada and Mexico and 10% on goods from China. Canada and Mexico have responded by preparing a list of retaliatory tariffs on American goods. Some provinces in Canada have threatened to halt energy exports to the U.S. A global trade war would heighten geopolitical uncertainty, in addition to driving inflation higher and weakening global economic growth. Investors recognize this as an ideal environment for gold, which carries no third-party risk and serves as a hedge against inflation.

The spot prices of precious metals mostly gained for the week. Gold climbed by 1.00% from its close last week at $2,770.58 to end this week at $2,798.41 per troy ounce. Silver added 2.32% to last week’s closing price of $30.59 to close at $31.30 per troy ounce, Platinum rose by 3.27% from its last weekly price of $951.45 to settle at $982.56 per troy ounce. Palladium ascended by 2.88% from its close last week at $987.93 to settle this week at $1,016.35 per troy ounce. The three-month LME prices of industrial metals were generally down. Copper dipped by 2.46% from its close the prior week at $ 9,276.00 to close at $9,048.00 per metric ton. Aluminum dropped by 1.78% from its price last week at $2,641.00 to end at $2,594.00 per metric ton. Zinc, which ended last week at $2,827.50, closed this week at $2,742.00 per metric ton for a loss of 3.02%. Tin closed last week at $30,156.00 and this week at $30,102.00 for a slide of 0.18%.

Energy and Oil

This week, oil prices finished this week about $2 per barrel lower than last week. The January ICE Brent futures contract was set to expire just below $77 per barrel. While this is the second straight week the price of oil declined, there is every reason to believe that oil prices may spike next week. Donald Trump has set February 1 as the deadline for the imposition of 25% trade tariffs for Canada and Mexico. Should this threat materialize, the oil bulls will likely drive Brent prices back above the $80 per barrel level. In the meantime, the new U.S. Transportation Secretary Dean Duffy directed U.S. regulators to rescind the Biden-era fuel economy standards, raising CAFÉ requirements for light-duty vehicles to 50.4 miles per gallon by 2031 from the present 39.1 miles per gallon.

Natural Gas

For the report week from Wednesday, January 22, to Wednesday, January 29, 2025, the Henry Hub spot price fell by $0.60 and from $3.89 per million British thermal units (MMBtu) to $3.29/MMBtu. Regarding Henry Hub futures, the February 2025 NYMEX contract expired by the week’s end at $3.535/MMBtu, down by $0.43 from the start of the report week. The March 2025 NYME contract price dropped to $3.170/MMBtu, down by $0.34 through the report week. The price of the 12-month strip averaging March 2025 through February 2026 contracts decreased by $0.25 to $3.813/MMBtu. As for select regional spot prices, natural gas spot prices fell at all major pricing locations. Price drops ranged from $3.97 at Transco Zone 6 NY to $0.03 at PG&E Citygate.

International gas futures prices rose for this report week. Weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.06 to a weekly average of $14.08/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands increased by $0.52 to a weekly average of $15.08/MMBtu. For the week last year corresponding to this week (beginning January 24 and ending January 31, 2024), the prices were $9.42/MMBtu in East Asia and $9.13/MMBtu at the TTF.

World Markets

The pan-European STOXX Europe 600 Index reached a record high this week when it rose by 1.78% in local currency terms. The stellar performance was driven by strong earnings results and the European Central Bank’s (ECB’s) decision to cut interest rates which boosted investor sentiment. France’s CAC 40 Index added 0.28% and Italy’s FTSE MIB rose by 0.78%. Germany’s DAX outperformed, climbing by 1.58% and hitting a new intraday peak during the week. The UK’s FTSE 100 Index surged by 2.02% as the pound sterling depreciated against the U.S. dollar. The currency adjustment helped to support the index, which includes many multinational companies that are generating overseas revenues. As the market expected, the ECB reduced its key deposit rate by 25 basis points to 2.75%. The disinflation process was “well on track” and the decision was unanimous, according to ECB President Christine Lagarde. She did not indicate, however, how long the ECB might keep cutting rates. On the economic front, the eurozone economy stalled in the final three months of last year relative to the third quarter of 2024. Germany and France, the bloc’s largest economies, contracted in comparison to the third quarter. Spain, on the other hand, had a GDP growth of 0.8%. Italy’s GDP was flat, neither expanding nor contracting. The EU-harmonized 12-month inflation rate for January registered at 1.8% in Spain, remained at 2.8% in Germany, and accelerated to 2.9% in Spain.

Over the week, Japan’s stock markets demonstrated mixed performance. The Nikkei 225 Index dropped by 0.9%. The broader TOPIX Index, on the other hand, gained 1.37%. Weighing on the share prices of Japanese chip companies was a sell-off in major technology stocks early in the week in response to the emergence of Chinese company DeepSeek. The firm is a potential challenger to what has hitherto been seen as U.S. artificial intelligence dominance. DeepSeek caught the market off-guard and created downward pressure on the share prices of American and Japanese chip companies. Domestic stocks also reacted to the hawkish position of the Bank of Japan (BoJ) which raised interest rates for the third time within a year and revised its inflation forecast upward in its monetary policy meeting held on January 23-24. The yen strengthened to the high end of JPY 154 against the U.S. dollar from JPY 156 at the end of the week preceding. Regarding economics, the Tokyo-area core consumer price index, a leading indicator of nationwide trends, rose by 2.5% year-on-year in January, up from 2.4% in December and in line with expectations. The trend reinforced a hawkish outlook for BoJ monetary policy, although a relatively weak growth backdrop remains a downside risk and supports a gradual hiking pace.

Markets on the mainland will remain closed from January 28 to February 4 for the Lunar New Year holiday and will resume trading on February 5. During this holiday-shortened week, Chinese stock markets edged lower. The onshore benchmark CSI 300 Index and the Shanghai Composite Index on Monday, the last trading day preceding the nationwide holiday. The Hong Kong benchmark Hang Seng Index registered slight gains on Monday and a half-day session on Tuesday before the markets suspended trading for the rest of the week. On Monday, government data released showed that China’s economy launched 2025 on a weak footing. According to the country’s statistics bureau, the official manufacturing Purchasing Manager’s Index (PMI) surprisingly fell to 49.1 in January. The nonmanufacturing PMI (a measure of construction and services activity) dipped to 50.2 from 52.2 in December. Index readings above 50 signal expansion while those below 50 indicate contraction. Because millions of workers return to their hometowns for the Lunar New Year, it is typical for China’s manufacturing PMI to weaken in January. Other data released on Monday, however, pointed to weakness in China’s economy at the end of 2024. According to the statistics bureau, profits at large industrial companies descended by 3.3% in 2024. This marks the third consecutive year of declines. The fall in industrial profits is seen by economists to reflect the deflationary pressures on China’s economy. Domestic demand appears to have been curbed by the three straight years of economy-wide declines amid a yearslong real estate downturn.

The Week Ahead

The ISM Manufacturing PMI, the ISM services report, and the employment and nonfarm payrolls report are some of the important economic releases scheduled for the coming week.

Key Topics to Watch

- S&P final U.S. manufacturing PMI for Jan.

- Construction spending for Dec.

- ISM manufacturing for Jan.

- Atlanta Fed President Raphael Bostic speaks (Feb. 3)

- Auto sales for Jan.

- Job openings for Dec.

- Factory orders for Dec.

- Atlanta Fed President Raphael Bostic speaks on housing (Feb. 4)

- San Francisco Fed President Daly speaks (Feb. 4)

- Federal Reserve Vice Chairman Philip Jefferson speaks (Feb. 4)

- ADP employment for Jan.

- U.S. trade deficit for Dec.

- Richmond Fed President Tom Barkin speaks (Feb. 5)

- S&P final U.S. services PMI for Jan.

- ISM services for Jan.

- Chicago Fed President Goolsbee speaks (Feb. 5)

- Fed Governor Michelle Bowman speaks (Feb.5)

- Fed Vice Chairman Philip Jefferson speaks (Feb 5)

- Initial jobless claims for Feb. 1

- U.S. productivity for Q4

- Fed Governor Christopher Waller speaks (Feb. 6)

- Dallas Fed President Lorie Logan speaks (Feb. 6)

- U.S. employment report for Jan.

- U.S. unemployment rate for Jan.

- U.S. hourly wages for Jan.

- Hourly wages year over year

- Fed Governor Michelle Bowman speaks (Feb, 7)

- Wholesale inventories for Dec.

- Consumer sentiment (prelim) for Jan.

- Consumer credit for Dec.

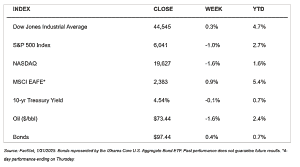

Markets Index Wrap-Up