Global Blood Therapeutics Inc. (GBT) had a good day on the market for Tuesday November 26 as shares jumped 5.07% to close at $62.99. About 6.12 million shares traded hands on 45,236 trades for the day, compared with an average daily volume of n/a shares out of a total float of 60.23 million. After opening the trading day at $67.08, shares of Global Blood Therapeutics Inc. stayed within a range of $69.69 to $59.21.

With today’s gains, Global Blood Therapeutics Inc. now has a market cap of $3.79 billion. Shares of Global Blood Therapeutics Inc. have been trading within a range of $64.94 and $30.15 over the last year, and it had a 50-day SMA of $n/a and a 200-day SMA of $n/a.

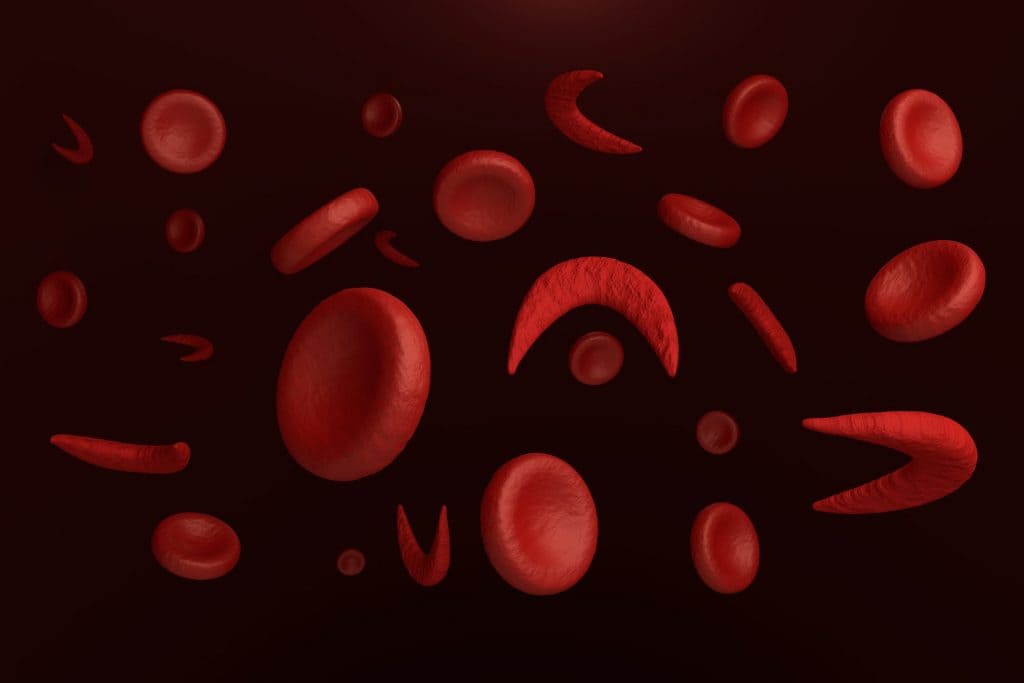

Global Blood Therapeutics Inc operates in the healthcare sector of the United States. It discovers and develops novel therapeutics to address blood-based disorders. GBT440, its lead drug candidate targets the underlying mechanism of red blood cell (RBC) sickling, which provides the potential to treat sickle cell disease. GBT440. an oral, once-daily therapy arrests abnormal hemoglobin polymerization, the underlying mechanism of RBC sickling. In addition, the company is engaged in other research and development activities targeted at hereditary angioedema and owns exclusively licensed rights to its portfolio of product candidates in the United States, Europe, and other major markets.

Global Blood Therapeutics Inc. is based out of South San Francisco, CA and has some 171 employees. Its CEO is Ted W. Love.

Global Blood Therapeutics Inc. is also a component of the Russell 2000. The Russell 2000 is one of the leading indices tracking small-cap companies in the United States. It’s maintained by Russell Investments, an industry leader in creating and maintaining indices, and consists of the smallest 2000 stocks from the broader Russell 3000 index.

Russell’s indices differ from traditional indices like the Dow Jones Industrial Average (DJIA) or S&P 500, whose members are selected by committee, because they base membership entirely on an objective, rules based methodology. The 3,000 largest companies by market cap make up the Russell 3000, with the 2,000 smaller companies making up the Russell 2000. It’s a simple approach that gives a broad, unbiased look at the small-cap market as a whole.