Boston Family Office LLC trimmed its holdings in Medtronic PLC (NYSE:MDT) by 9.9% in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 7,836 shares of the medical technology company’s stock after selling 862 shares during the quarter. Boston Family Office LLC’s holdings in Medtronic were worth $713,000 at the end of the most recent reporting period.

Other hedge funds have also modified their holdings of the company. Tributary Capital Management LLC bought a new position in Medtronic during the 4th quarter valued at $27,000. Highwater Wealth Management LLC purchased a new stake in shares of Medtronic in the fourth quarter valued at $39,000. IMS Capital Management purchased a new stake in shares of Medtronic in the third quarter valued at $41,000. Contravisory Investment Management Inc. raised its holdings in shares of Medtronic by 220.0% during the fourth quarter. Contravisory Investment Management Inc. now owns 480 shares of the medical technology company’s stock worth $44,000 after acquiring an additional 330 shares in the last quarter. Finally, Karp Capital Management Corp purchased a new stake in shares of Medtronic during the fourth quarter worth $46,000. 81.46% of the stock is owned by institutional investors and hedge funds.

Several analysts recently issued reports on MDT shares. Barclays reiterated a “buy” rating and set a $104.00 price objective on shares of Medtronic in a report on Wednesday, February 20th. Oppenheimer set a $104.00 price target on Medtronic and gave the company a “buy” rating in a research report on Wednesday, February 20th. BTIG Research raised Medtronic from a “neutral” rating to a “buy” rating and set a $100.00 price target on the stock in a research report on Tuesday, January 15th. Deutsche Bank assumed coverage on Medtronic in a research report on Wednesday, January 2nd. They set a “buy” rating and a $99.00 target price on the stock. Finally, Morgan Stanley lifted their target price on Medtronic from $98.00 to $102.00 and gave the stock an “equal weight” rating in a research report on Wednesday, January 2nd. Ten investment analysts have rated the stock with a hold rating, fourteen have issued a buy rating and one has given a strong buy rating to the company’s stock. The stock presently has a consensus rating of “Buy” and a consensus target price of $103.43.

In other Medtronic news, CEO Omar Ishrak bought 12,000 shares of the business’s stock in a transaction that occurred on Wednesday, January 9th. The stock was purchased at an average cost of $84.05 per share, with a total value of $1,008,600.00. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, CFO Karen L. Parkhill acquired 3,000 shares of the company’s stock in a transaction on Wednesday, January 9th. The shares were purchased at an average cost of $83.87 per share, with a total value of $251,610.00. The disclosure for this purchase can be found here. Company insiders own 0.28% of the company’s stock.

Shares of MDT stock opened at $91.08 on Monday. Medtronic PLC has a 52-week low of $76.62 and a 52-week high of $100.15. The company has a current ratio of 2.36, a quick ratio of 1.92 and a debt-to-equity ratio of 0.47. The stock has a market capitalization of $122.15 billion, a PE ratio of 19.09, a PEG ratio of 2.20 and a beta of 0.82.

Medtronic (NYSE:MDT) last released its earnings results on Tuesday, February 19th. The medical technology company reported $1.29 EPS for the quarter, topping analysts’ consensus estimates of $1.24 by $0.05. Medtronic had a net margin of 16.10% and a return on equity of 13.85%. The company had revenue of $7.55 billion for the quarter, compared to analysts’ expectations of $7.53 billion. During the same quarter last year, the business earned $1.17 EPS. The firm’s revenue was up 2.4% compared to the same quarter last year. As a group, equities analysts forecast that Medtronic PLC will post 5.15 earnings per share for the current year.

The business also recently disclosed a quarterly dividend, which will be paid on Friday, April 12th. Shareholders of record on Friday, March 22nd will be issued a dividend of $0.50 per share. This represents a $2.00 dividend on an annualized basis and a yield of 2.20%. The ex-dividend date of this dividend is Thursday, March 21st. Medtronic’s dividend payout ratio (DPR) is currently 41.93%.

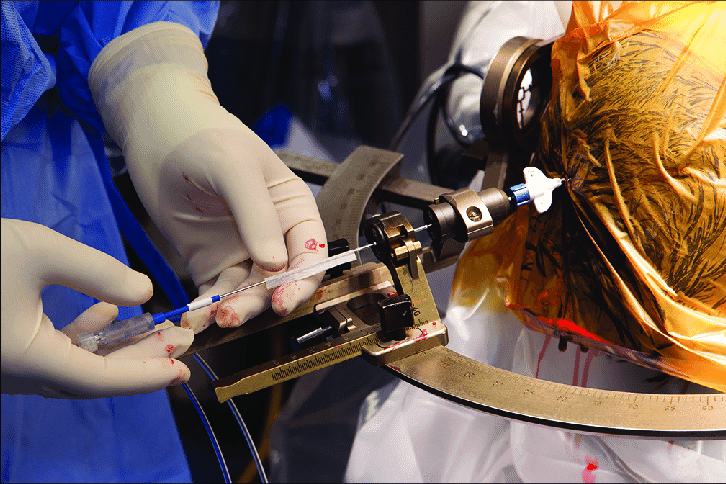

About Medtronic

Medtronic plc develops, manufactures, distributes, and sells device-based medical therapies to hospitals, physicians, clinicians, and patients worldwide. It operates through four segments: Cardiac and Vascular Group, Minimally Invasive Therapies Group, Restorative Therapies Group, and Diabetes Group.