40 per cent of Chinese steel imports – and just 2 per cent of Canadian imports – excluded from U.S. tariff

If the Trump administration’s tariff policy is meant to target unfair Chinese trade, it sure has a funny way of going about it.

So far, the U.S. Department of Commerce has excluded about 40 per cent of imports of Chinese steel from facing its 25 per cent tariff. But to date, only two per cent of the total volume of Canadian steel imports to the U.S. has been cleared to dodge the tariff.

The head-scratching discrepancy gets even stranger with the United States’ 10 per cent tariff on aluminum imports.

About 86 per cent of Chinese aluminum imports now enter the U.S. tariff-free, while less than one per cent of Canadian aluminum shipments do.

“If the whole point was to do this for China in the first place, then why are the approval rates for China so much higher than other countries?” said Christine McDaniel, a former White House economic adviser, now a senior research fellow with the Mercatus Center at George Mason University.

“It just doesn’t make sense.”

The recent U.S. government shutdown gave McDaniel and her research colleague Danielle Parks an opening to comb through all the exclusion applications submitted last year and group the results by country of origin. Exclusion applications are filed by importers — manufacturers, retailers or construction companies, for example — who want to import tariff-free. McDaniel said the results of their research were so surprising, they ran the numbers a second time just to make sure.

“It does correspond with what we’re hearing anecdotally from steelmakers in Canada — that they’re not getting anything through,” McDaniel said.

Catherine Cobden, the new president of the Canadian Steel Producers Association, said the analysis tells a pretty troubling story.

“Canada’s getting hurt more than others through the tariffs,” she said. “Are these tariffs doing what they were intended to do?”

The tariffs aren’t giving North American suppliers a boost, she said. Quite the opposite.

“Whatever process they’re using, it’s unfairly tilted towards China, which is crazy,” she said. Her association’s members suspected the tariffs were distorting markets, she said, but this work “demonstrates with real data what that picture looks like.”

U.S. steelmakers objecting to exclusions

While the results for China conflict with the Trump administration’s rhetoric, the large exporting country that’s been most successful in the exclusion process so far is Japan: 62 per cent of its steel imports to the U.S. no longer face the tariff.

The Japanese manufacture specialty metals; comparable U.S. substitutes tend not to be available for them. It’s possible that what Canadian mills produce is more easily swapped with American product.

Exclusion applications are considered according to specific criteria, such as whether the same product is available in the U.S. Domestic steel companies can monitor these applications and file objections, according to their own business interests. The complicated process also allows for a rebuttal from the company trying to get its shipments excluded.

In some cases, the arguments have sought to interfere in companies’ right to make their own business decisions, McDaniel said. One company, she said, was told it shouldn’t be able to import pipe of a certain length tariff-free when it could buy American pipe and weld pieces together to make up the right length — notwithstanding the extra labour and environmental effects involved.

“The vast majority of objections are filed by a small handful of U.S. steelmakers,” McDaniel said.

And some aren’t even realistic. “These steelmakers are objecting to way more than they could produce themselves,” based on their annual production capacity, she said.

Those objections are influencing results. Nearly every denied application McDaniel examined resulted from an objection.

The process the U.S. Commerce bureaucrats are using is quite antiquated, she said, and is not tracking cumulative amounts to test what’s realistic, or whether certain countries are emerging as winners or losers: each case is considered in isolation, with no unified strategy driving the results.

“The law firms love this because the more complicated this is, the better for them,” she said. All the separate applications, objections and rebuttals — “they’re billing all of that.

“It’s a big boondoggle.”

Killing jobs instead of creating them?

But while profits may be up for the U.S. steel industry, it’s not clear that employment in the sector will rise as well, since automated production at many plants can boost capacity without significantly increasing employment.

Meanwhile, economists like McDaniel warn that — as the second Bush administration’s levying of steel tariffs in 2002 showed — employment in downstream manufacturing suffers from higher metal costs. One analysis of that previous tariff found more jobs were lost in steel-using industries than were protected in steel production.

Separately, Canada’s embassy in Washington is keeping a close eye on the same process McDaniel is analyzing. Its lobbying campaign against the tariffs continues, with Foreign Affairs Minister Chrystia Freeland in town last week to meet with the head of the Senate finance committee, among others.

Canada is the top international supplier of both steel and aluminum to the U.S. by a significant margin.

Even though data are only available for the first four months after the steel tariffs took effect last Canada Day, there’s already evidence that Canadian shipments to the U.S. have dropped.

“It’s almost like steel tariffs are just diverting our sources of product. What would normally be from Canada and Brazil and Mexico … now we see the approval rates are much higher for Japan, Thailand, the Netherlands, Poland …” McDaniel said.

For some smaller exporting countries, the U.S. Department of Commerce has approved exclusion requests in volumes far exceeding historical trade volumes. Polish steel, for example, has been approved for exclusions covering nearly nine times the volume of its exports to the U.S. in 2017.

A final analysis of winners and losers in this process is months away: 64 per cent of Canada’s steel applications are still pending, so Canada’s eventual approval rate could improve once the backlog built up during the government shutdown clears.

Only 8 per cent of the applications to exclude Canadian steel from the tariffs have been denied so far. The vast majority of applications for Canadian aluminum (97 per cent) are still sitting in the queue.

Political pressure

McDaniel and Parks mapped the exclusions approved so far by Congressional district to enable future analyses to determine whether politics could be playing a role in some of the decisions.

A bipartisan group of senators has endorsed an ongoing D.C. lobbying campaign — “Tariffs Hurt the Heartland” — which is trying to force the administration to bend.

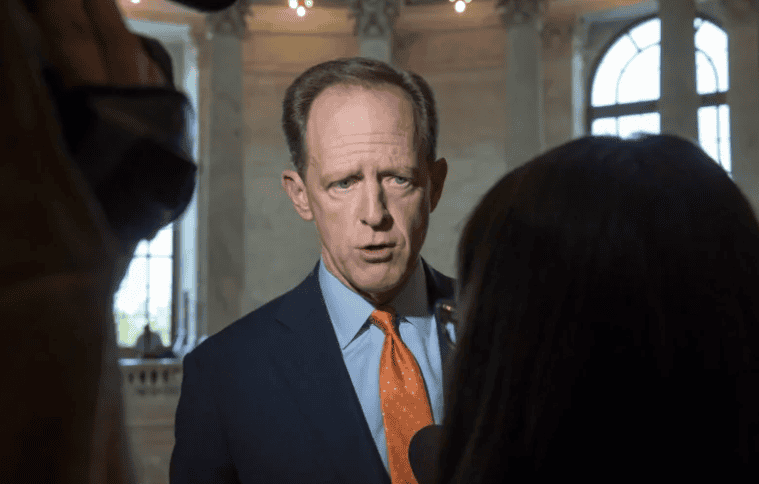

Pennsylvania Sen. Pat Toomey, a Republican who recently made headlines declaring the new NAFTA “dead on arrival” in Congress, outlined how much steel tariffs were costing companies in his state during a news conference Wednesday.

“There are about 140,000 workers who are employed by steel companies who are meant to benefit from these steel tariffs. There are six and a half million people employed in companies that use steel,” he said. “It shouldn’t be so easy … to impose tariffs that can be so economically disruptive and so problematic, and to do it unilaterally.”

Toomey is working on bipartisan legislation to curb the president’s tariff powers.

Politicians are “hearing from their constituents: this is killing us,” McDaniel said.