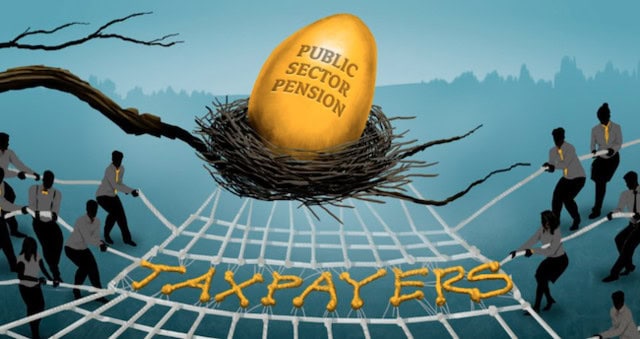

Canadian taxpayers subsidize government pensions to the tune of $22 billion a year, a new study by the Fraser Institute reveals.

The most striking feature of Canada’s retirement system is arguably the large and growing gap between pensions in the public and private sectors, the think-tank says.

“Eighty per cent of public sector workers participate in defined benefit pension plans. Only 10 per cent of private sector workers can make the same claim,” says report co-author Philip Cross.

Defined benefit plans typically offer larger pensions, earlier retirement, and full inflation protection.

“The issue is not whether government employees should have defined-benefit pensions, but rather how much they should pay for these pensions,” says Cross.

The study finds that public sector pay less for their pensions than private sector workers would be expected to.

“There is nothing wrong with government workers having good pensions – as long as they pay a fair price for these pensions,” Cross adds.

Furthermore, poor accounting of public sector pension plans leads to government, ie. taxpayers, propping them up.

“The exceptional feature of Canada’s public sector DB plans is not ‘world-beating’ investment strategies or good governance. It is the ability to enrich public employees by shifting large, undisclosed investment risks to taxpayers without fair compensation. By our estimate, this provides an unacknowledged $22 billion annual subsidy to Canada’s public sector DB plans and, ultimately, to the members of these plans,” the report states.