Since 1950, no other month has posted a higher average return than December

Stocks kicked off the first trading day of December with gusto, helping investors to usher in the month on a festive note and sparking hopes for a so-called Santa rally.

“Although the well-known Santa Claus rally is technically the last five days of the year and the first two of the new year, you can’t deny the fact that December tends to bring with it good vibes and stocks gains,” said Ryan Detrick, senior market strategist at LPL Financial, in a blog post.

Since 1950, no other month has recorded a higher average return or has finished higher as often as December, he said.

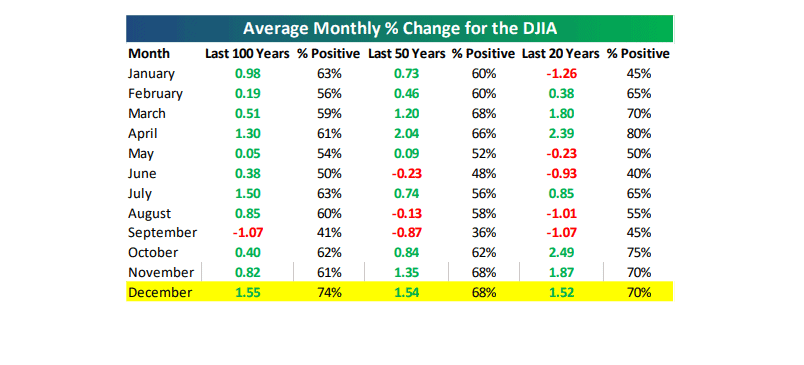

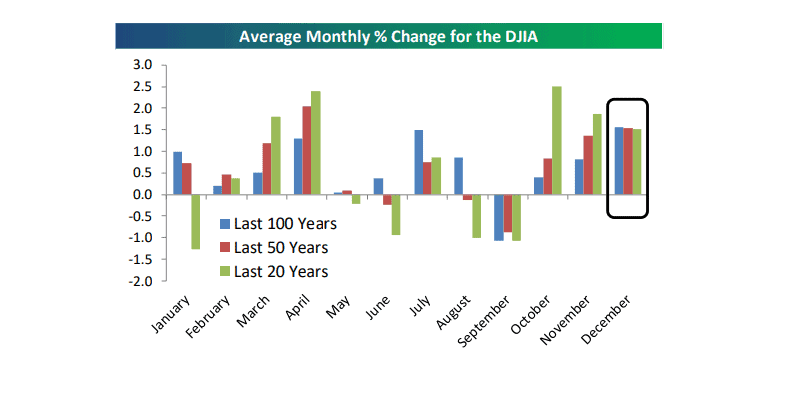

Data from Bespoke Investment Group also supported the consensus that December is good for the market and the Dow Jones Industrial Average DJIA, +1.13% in particular.

Over the last 100 years, the Dow has averaged a gain of 1.55% in December, with gains 74% of the time.

“In this time period, there has been no month that has been stronger or more consistent to the upside,” said analysts at Bespoke in a report.

Over just the last 20 years, December is only the fifth-best month — but nonetheless sports an average gain of 1.52%.

All major indexes rallied Monday with the S&P 500 logging its best start to December since 2010 as trade tensions eased after President Donald Trump and Chinese President Xi Jinping agreed to launch negotiations to resolve outstanding issues with the U.S. agreeing to postpone plans to raise tariffs on $200 billion in Chinese goods.

The move higher follows last week’s powerful gains on the belief that the Federal Reserve is inclined to be more flexible about hiking interest rates after Chairman Jerome Powell delivered a speech that was perceived to be dovish.

Related: Trump view on Powell has changed from ‘not even a little bit happy’ to ‘pleased’ after the chairman’s ‘just below’ speech

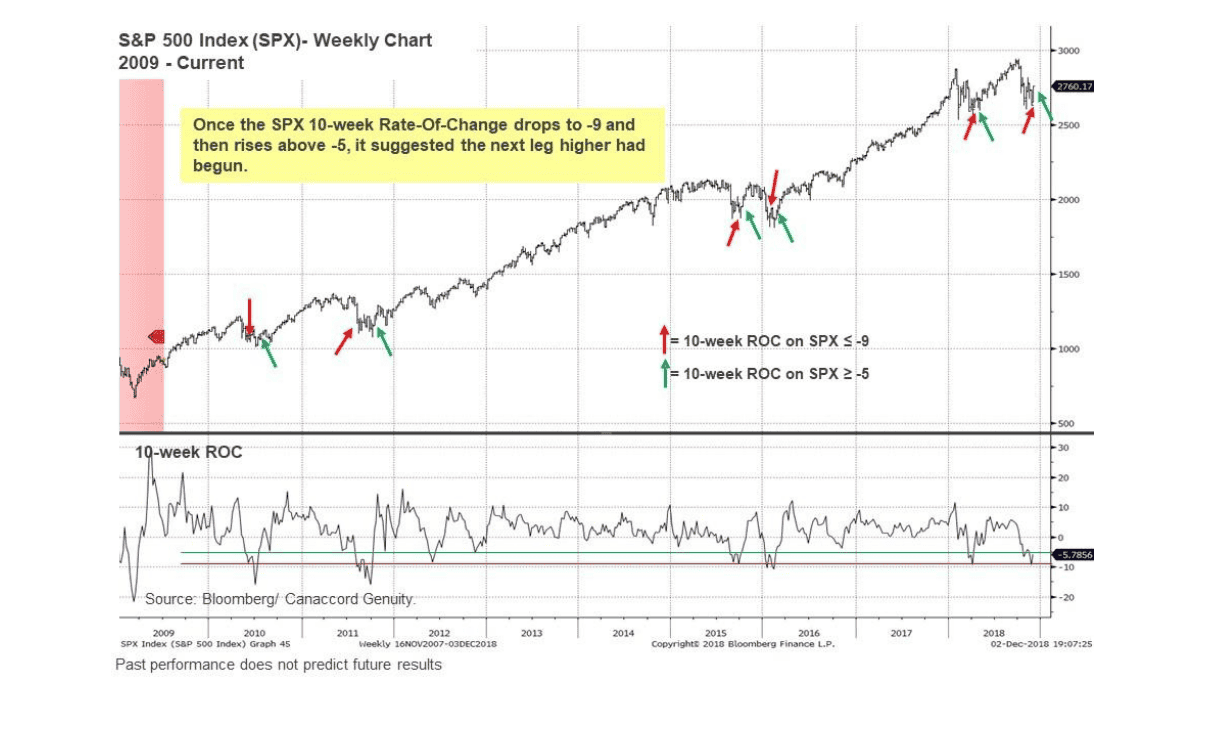

That combination of trade breakthrough and a more benign Fed may give the market the catalyst it needs for a “leg higher,” according to Tony Dwyer, an analyst at Canaccord Genuity and a noted bull.

The three factors that had triggered the downward correction earlier in the year—a fear that the Democrats will take control of both the House and the Senate in the midterm election; a prolonged trade war with China; and a hawkish Fed—have been partially resolved, in his view.

Furthermore, the S&P 500 SPX, +1.09% rate-of-change indicator that tracks momentum has shifted and is signaling a rally ahead, he said.

As Dwyer illustrates, the S&P 500’s 10-week rate of change dropped to negative 9, and then bounced to negative 5, suggesting there is more room for the index to retest 2018 highs, he said.

Given the temporary truce in the trade war and a more data-conscious Fed, the analyst is recommending financials, industrials, and information technology as sectors that are likely to benefit.

There is no such thing as a sure bet in the market but December may come close since it has never been the worst month of the year for stocks.

“Since 1950, the S&P 500 index has never had its largest monthly drop in December. Given that the worst month this year was October with its 6.9% drop, history would say to not expect a similar big drop to end 2018,” said Detrick.