What’s bad news for U.S. oil drillers is great news for American petroleum refiners.

Crude oil production in the Permian Basin, arguably the most important energy-producing region on the planet, has outpaced pipeline capacity expansion. The bottleneck means the region — and now the nation’s central oil depot in Cushing, Oklahoma — is swimming in a glut of oil. Meanwhile, companies racing to export crude oil are pushing the country’s pipeline utilization rates closer to full capacity.

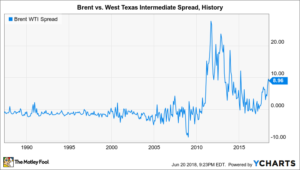

The combination of pipeline bottlenecks is now dragging down the price of West Texas Intermediate (WTI) crude oil to levels well below that of Brent crude. The difference between the two is called the Brent-WTI spread — and it’s now at levels last witnessed in 2015, and never before 2011. This single metric also explains why oil refinery stocks such as Marathon Petroleum (NYSE: MPC), Phillips 66 (NYSE: PSX), and Delek US Holdings (NYSE: DK) are up by as much as 51% this year.

Image source: Getty Images.

The wider the spread, the bigger the profits

Why are there two major oil price benchmarks to begin with? It has to do with quality. Crude oil priced at WTI is a lighter and sweeter blend, which makes it easier to blend with heavier crudes and/or easier to refine into petroleum products like gasoline and diesel. Shale oil is priced at the WTI benchmark (or below it, when there isn’t enough pipeline capacity).

Brent crude is light and sweet, too, but slightly less so than WTI. In fact, the premium chemistry of WTI blends means they have historically traded at a premium price to blends priced at Brent, but the American shale boom has flipped that on its head in the last seven years or so. Lately, the good stuff has actually been cheaper.

The pricing mismatch is a boon for American refiners. Right now domestic refiners have significantly lower input costs than their international peers. That means they can produce refined petroleum products such as diesel at much lower cost, and then export it into markets where prices are significantly higher (because higher-priced and heavier Brent crude is the starting input). The price difference is pocketed as a handsome profit.

Wall Street is starting to catch on, with extra credit being awarded for those with sizable operations in the Permian Basin or along the Gulf Coast. Marathon Petroleum stock has gained 12% this year. While it has slipped since announcing in April a merger with Andeavor to create a $90 billion refining, marketing, and midstream Goliath, the combined company will have a huge footprint in the Permian Basin and the West Coast. The deal is expected to close in the second half of 2018, but some industry analysts expect U.S. production to outpace pipeline capacity by an even wider margin by then, which could mean the Brent-WTI spread will be even larger six months from now. In other words, the company should be able to cash in now and later — with an even bigger footprint.

Phillips 66 stock has gained 13% year to date thanks largely to the Brent-WTI spread. The company completed yield-enhancing upgrades at its Bayway and Wood River refineries in addition to major turnarounds (taking the entire facility offline for maintenance) of several other refineries in the opening three months of this year. So although the refining segment reported a 75% drop in net income from the fourth quarter of 2017, the timing of the maintenance projects allows the business to capture favorable market conditions with optimized equipment at multiple refineries going forward. It could lead to a huge second-quarter performance.

Meanwhile, Delek US Holdings stock is up a whopping 51% this year. That’s because the recent acquisition of Alon USA Energy and divestiture of non-core assets on the West Coast has shifted its core operational footprint to the Permian Basin. That gives it access to crude oil that’s priced even lower than WTI as the bottleneck in the region really is that bad at the moment, with some crude priced $12.50 per barrel less than WTI. That also explains why it has been one of the best-performing refining stocks in 2018 — perhaps no other company can capture the same eye-popping margins.

This time is different

In the past, a generous Brent-WTI spread was captured entirely by refiners. However, this is the first time the spread has been this high since the ban on American crude oil exports was lifted at the end of 2015. Drillers will certainly want to cash in on the opportunity, too. That could make this time around unlike anything investors have ever seen.

A larger Brent-WTI spread makes American crude more competitive in international markets, which could accelerate an already booming trend in crude exports. That would require higher levels of crude oil production, which would keep pipelines operating close to full capacity for the foreseeable future. That could keep WTI prices subdued for a sustained period of time, which would extend the timeline refiners have to capture this windfall. Put another way: Oil refinery stocks could just be getting started.

This article originally appeared on The Motley Fool.