Goldman Sachs (NYSE: GS) is a massive investment bank, and most people think of it as such. However, one of the bank’s most exciting long-term growth catalysts has little to do with Goldman’s traditional business segments.

Over the past few years, Goldman has been quietly focusing more and more of its efforts on expanding its consumer banking businesses, mainly through its Marcus by Goldman Sachs platform, which offers personal loans and high-yielding deposit accounts. However, recent comments by President and COO David Solomon indicate that Goldman’s consumer banking business could still be in its infancy.

Impressive growth so far

Although it’s still rather young, Goldman Sachs’ consumer banking platform has grown rapidly.

Since launching the Marcus by Goldman Sachs platform in late 2016, the bank has already originated more than $3 billion in loans and serves about 1.5 million customers. In addition, since acquiring General Electric’s deposit portfolio in early 2016, Goldman has grown its deposit base from about $9 billion to more than $20 billion.

Lots of possibilities for future growth

Even though Goldman’s consumer banking growth has been impressive, the bank’s platform is still quite small relative to those of the other big banks. I mentioned that Goldman has originated over $3 billion in loans and has over $20 billion in consumer deposits. For comparison, Bank of America’s consumer banking division has about $280 billion of loans and nearly $675 billion in deposits. So, there’s lots of room to grow Goldman’s existing consumer banking business.

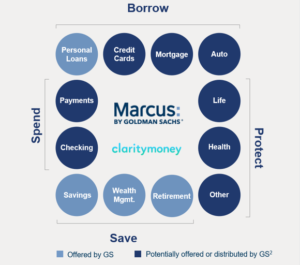

However, the real potential could be the other areas of consumer banking that Goldman could potentially expand into. “We have the ambition to build a large, differentiated, highly profitable digital consumer finance platform. We’re working to build an open architecture storefront that allows us to work with consumers to help them spend, borrow, save and protect in an integrated, coordinated way,” Goldman Sachs’ President and COO David Solomon said in a recent presentation.

In the presentation, Solomon highlighted some future areas of potential growth for the bank’s Marcus platform and other consumer banking initiatives. Specifically, the presentation mentioned that Goldman could offer checking accounts, payment solutions, credit cards, mortgages and auto loans, and insurance products.

Some of these may already been in the works. For example, it was recently reported that Goldman Sachs is gearing up to become Apple’s credit card co-branding partner to offer an Apple Pay credit card product. This is a huge partnership, and it could result in Goldman’s credit card business growing from zero to billions of dollars in loans in a relatively short period of time. Similar initiatives could be in progress for other areas as well.

As Solomon put it, “As the brand continues to build our consumer platform, we’re looking at expanding into several businesses that are adjacent to our core franchises and allow us to take advantage of our relationship or our position and add products and services that allow our clients to get a more wholesome approach from Goldman Sachs.”

Goldman’s competitive advantages

Here’s the billion-dollar question for investors: Why is Goldman in such a strong position to grow its consumer banking business in such a rapid manner?

First of all, Goldman has been able to design its consumer banking business from the ground up. As Solomon pointed out, Goldman has no legacy infrastructure to worry about. There is no branch network, and before it acquired GE’s deposit platform and started making loans through Marcus, it had virtually no consumer banking operations at all.

This allows Goldman to build a consumer banking business tailored to today’s customers, as well as to the current banking environment. A branch-free structure, for example, gives the bank a major cost advantage over rivals and also allows Goldman to offer deposit interest rates that rival even the best online banks. In fact, as of this writing, Marcus’ 1.70% APR on an online savings account is the highest among any major online bank.

Second, while there are online-only banks that have a similar advantage, none of them have the balance sheet and brand recognition that Goldman does.

Third, Goldman has a long history of developing its risk-management culture, giving it a key advantage over newer competitors. In other words, Goldman already knows how to responsibly lend money while maximizing profits.

In simple terms, Goldman’s consumer banking efforts enjoy the low cost structure of an online bank, combined with Goldman’s strong balance sheet and rock-solid brand name.

How big could Goldman’s consumer banking get?

To be clear, I don’t think Goldman Sachs’ consumer banking operation is going to be anywhere in the ballpark of Bank of America’s, JPMorgan Chase’s, or Citigroup’s anytime soon. However, the long-term potential to grow into a massive consumer bank is certainly there. Only time will tell, but suffice it to say that the next few years could be very interesting for Goldman Sachs’ consumer banking expansion.