On April 25, wireless chip giant Qualcomm (NASDAQ: QCOM) announced its financial results for the second quarter of its fiscal year 2018.

Although the company’s licensing business, which was previously responsible for generating most of Qualcomm’s operating profits, plunged amid an ongoing dispute with a few major smartphone manufacturers, its chip business continued to hum along.

Let’s go over the results for each of these business segments and put them into broader context for investors.

The licensing problem

Qualcomm operates a technology licensing business known as Qualcomm Technology Licensing (QTL). Essentially, Qualcomm has a boatload of fundamental patents relating to key cellular communications standards and licenses that portfolio to major cellular device manufacturers in exchange for a percentage of the selling prices of those devices.

Apple (NASDAQ: AAPL) recently stopped making royalty payments because it doesn’t believe that it’s fair for Qualcomm to get a percentage of the selling prices of its devices. Apple and Qualcomm are currently in a bitter legal battle to try to sort this all out.

Another smartphone maker, believed to be China’s Huawei, has also stopped making royalty payments.

Given that Apple made up a large portion of Qualcomm’s QTL revenue (and Huawei is a pretty sizable player in the smartphone market, too), the fact that it has stopped paying has devastated Qualcomm’s licensing business. Last quarter, QTL revenue dropped 44% year over year to just $1.26 billion. Earnings before tax dropped 57% to $850 million.

Until Apple and Qualcomm settle their dispute, Qualcomm’s QTL business continues to be a source of risk and uncertainty. It’s even possible Qualcomm could be forced to revise its licensing scheme to simply charge a percentage of the selling prices of cellular chips in devices rather than a percentage of the whole device.

Good chip performance

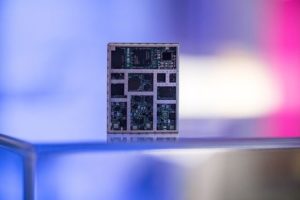

Qualcomm reported that revenue from its Qualcomm CDMA Technologies (QCT) business segment (the company’s wireless chip business) grew 6% year over year to about $3.9 billion. The company reported that QCT chip shipments were up 4% year over year to 187 million, so the revenue growth figure implies that the company saw an increase in chip average selling prices year over year.

This segment also saw earnings before tax grow to $608 million in the quarter, up 28% year over year. QCT earnings before tax were 16% of revenue during the quarter, up from 13% in the prior quarter, so this business unit’s operating margin grew nicely year over year.

Unfortunately, the decent performance in QCT wasn’t enough to offset the substantial decline in QTL. Although QCT has historically generated most of Qualcomm’s revenue, QTL was responsible for most of its profits. Unless Qualcomm can substantially boost the profitability of its chip business — something that would likely happen slowly and steadily — continued strength in QCT simply won’t be enough to sustain Qualcomm’s valuation over the long term.

As of this writing, Qualcomm shares are up slightly following its earnings report. While the company’s improving chip business is certainly nice to see, the reality is that until the dispute between Qualcomm and Apple is settled, Qualcomm is probably going to be a tough stock to invest in. There’s no guarantee that any settlement would be in Qualcomm’s favor, either.