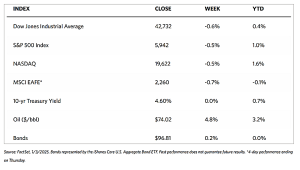

Stock Markets

The shortened New Year’s trading week provided little incentive for market activity, and most indexes were slightly down. The Dow Jones Industrial Average (DJIA) dropped 0.60% while the Total Stock Market came down by 0.30%. The S&P 500 Index gave up 0.48% and the Nasdaq Stock Market Composite lost by 0.51%. The NYSE Composite bucked the trend and ended up by 0.08%. Investor risk perception, as measured by the CBOE Volatility Index (VIX), rose slightly by 1.13% this week.

Although stocks ended the week mixed, they nevertheless closed the year strong. Broad gains on Friday helped the indexes to finish above their worst levels. The underperformance at the beginning of the week was partially due to some profit-taking that is only to be expected as the year’s end draws near. Tuesday was the fourth consecutive day of declines for the S&P Index. However, despite the year-end slump, 2024 still marked the second straight annual gain of over 20% for the S&P 500 Index. It also capped off the best two-year stretch in 25 years. Furthermore, the Nasdaq Composite also finished the year up by 20% for the sixth time in the past eight years.

Other stock headlines weighed on the broader sentiment on Thursday. These include Tesla’s fourth-quarter deliveries report, which failed to meet consensus expectations. Declining iPhone shipments to China likewise led to Apple shares plunging by 2.62% for the day.

U.S. Economy

Macroeconomic releases were light during this New Year’s week. The Atlanta Fed revised its fourth-quarter gross domestic product (GDP) forecast downward, from 3.1% to 2.6%. The revision was based on recent data releases from the US Census Bureau that resulted in a reduction in expectations, from 1.3% to 0.7%, for real gross private domestic investment growth. But there was also positive news. For the week ended December 28, the Labor Department reported initial jobless claims of 211,000. This was a reduction from the previous week’s reading of 220,000 and was the lowest level in eight months. There was also a decline in continuing claims for the prior week to a three-month low of 1.84 million.

Metals and Mining

The spot market for precious metals was up for the first week of the new year. Gold gained 0.72% from its last weekly close at $2,621.40 to end this week at $2,640.22 per troy ounce. Silver settled 0.78% above last week’s close of $29.39 to reach $29.62 per troy ounce. Platinum gained 1.51% from last week’s closing price of $925.54 to end at this week’s closing price of $939.51 per troy ounce. Palladium inched up by 1.01% from its close last week at $916.38 to this week’s close at $925.64 per troy ounce. The three-month LME prices of industrial metals were down for this week. Copper came from $8,982.00 last week to $8,802.50 per metric ton this week for a loss of 2.00%. Aluminum closed last week at $2,558.00 and this week at $2,529.00 per metric ton for an attrition of 1.13%. Zinc, which ended last week at $3,031.50, settled this week at $2,927.00 per metric ton, down by 3.45%. Tin ended this week at $28,557.00 per metric ton, 0.88% lower than its close last week at $28,810.00.

Energy and Oil

Tacit optimism marked the gradual return of oil market participants from the New Year’s Eve holidays as US stock draws tightened product availability. Cold snaps are threatening both the US and Europe. As forecasts indicated a series of Arctic cold snaps across the United States, the NYMEX ULSD futures contract climbed to $2.36 per gallon this week and hit a three-month high. The anticipated cold weather is bound to lift diesel and heating oil demand beyond seasonal patterns over January. Further, it is reported that outgoing US President Joe Biden is preparing to issue a decree to permanently ban offshore drilling in US coastal waters. These waters are to be considered biodiversity-sensitive under the 1953 Outer Continental Shelf Lands Act. Meanwhile, the spirits of those who gave up on the more robust policy coming from Beijing have been lifted, even if temporarily, by China’s promises to be more proactive with stimulus measures. These developments pushed the ICE Brent futures closer to $76 per barrel.

World Markets

The pan-European STOXX Europe 600 Index closed 0.20% higher in local currency terms on thin trading volume and light news flow. Most major stock indexes ended modestly lower. Italy’s FTSE MIB was slightly down, Germany’s DAX slid by 0.39%, and France’s CAC 40 Index eased by 0.99%. On the other hand, the UK’s FTSE 100 Index gained by 0.91%. Lending support to the index was a weaker British pound versus the US dollar, providing leverage to many multinational British companies that generate revenue overseas. The year started with a light macroeconomic data calendar, with Spain releasing its first estimate of consumer price inflation for December, at a rate stronger than initially forecasted. Non-seasonally adjusted annual inflation rose to 2.8% from 2.4% in November due to higher fuel prices. Core inflation, however, which excludes energy and food prices, exceeded the forecasted 2.4% to 2.6%. The uptick in Spain’s inflation rate appeared to bolster arguments from more restrictive policies in the European Central Bank (ECB) for a more gradual reduction in borrowing costs. Governing Council member Robert Holzmann suggested that rate-setters could take more time before once more cutting interest rates, in light of the rising energy prices and possible devaluation of the euro if the US introduces trade tariffs. In any case, President Christine Lagarde stated in a video that inflation was on track to achieve the 2% target in 2025, implying that rates remained on a downward trajectory.

In a holiday-shortened weekend, Japan’s stock market ended lower amid signs of profit-taking. On Monday, the last trading day of 2024, the Nikkei 225 Index gave up almost 1% to close at 39,894.54, its record-high year-end closing level. The benchmark index posted a 20% gain over last year due to share buybacks, corporate governance reforms, and a weaker yen that helped boost export-oriented companies and industries that generate their income from foreign markets. The broader TOPIX, on the other hand, dipped by 0.6% from last week, but posted an annual increase of 17.6%. The yen maintained its level at near JPY 157 on Friday in thin trading volumes, hardly changed from last week’s close. Over the year, it depreciated close to 11%, keeping traders on the lookout for signals that the Bank of Japan (BoJ) is intervening to support the currency. Investors continue to monitor the BoJ’s rate outlook after Tokyo’s consumer price inflation accelerated in December. The yield on the bank’s 10-year government bond moved lower to 1.09% on Monday, keeping close to its highest level in 13 and a half years. According to the minutes of the BoJ’s policy meeting, policymakers continue to debate the likelihood of a near-term rate hike. On the economic front, the final release of the au Jibun Bank Manufacturing PMI indicates that factory activity contracted for the sixth consecutive month in December, but the decline in new orders appeared to be stabilizing and backlogs of work were diminishing.

China’s equities markets retreated due to a weaker-than-expected manufacturing data release that impacted investor sentiment negatively. The Shanghai Composite Index dropped by 5.5%, while the blue-chip CSI declined by 5.17%. The Hong Kong benchmark Hang Seng Index dipped by 1.64%. For the third consecutive month, China’s factory activity expanded. According to the statistics bureau, the official manufacturing PMI slowed to 50.1 in December from 50.3 in November. This reading, while still in expansion territory, missed economists’ forecasts. The non-manufacturing PMI, a measure of construction and services activity, advanced to 52.2 in December from November’s 50, registering a better-than-forecasted level. The value of new home sales by the top 100 developers remained unchanged in December from one year ago according to the China Real Estate Information Corporation, compared to November’s 6.9% fall. New home sales increased by 24.2% month-on-month. Sales from the top 100 developers sank for the full year by 28.1% compared to a 16.5% drop in 2023. The data showed further evidence of a possible turnaround in China’s housing market after a rescue package was unveiled by Beijing in September to revive the troubled housing sector.

The Week Ahead

In the coming week, some of the important economic news scheduled for release are the ISM services PMI and the nonfarm payrolls report for December.

Key Topics to Watch

- S&P final U.S. services PMI for Dec.

- Factory orders for Nov.

- Richmond Fed President Tom Barkin speaks (Jan. 7)

- U.S. trade deficit for Nov.

- ISM services for Dec.

- Job openings for Nov.

- ADP employment for Dec.

- Minutes of Fed’s December FOMC meeting

- Consumer credit for Dec.

- Initial jobless claims for Jan. 4

- Wholesale inventories for Nov.

- Consumer sentiment (prelim) for Jan.

- U.S. employment report for Dec.

- U.S. unemployment rate for Dec.

- U.S. hourly wages for Dec.

- Hourly wages year over year

Markets Index Wrap-Up