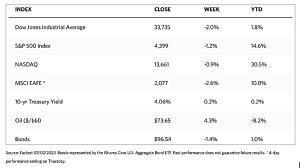

Stock Markets

The markets were mostly down last week in an apparent retracement after a strong and optimistic first-semester rally. The Dow Jones Industrial Average (DJIA) was down by 1.96% and the total stock market by 1.12% for the week with only the transportation sector remaining in positive territory. The broad S&P 500 Index slid by 1.16% and the technology-tracking Nasdaq Stock Market Composite dipped by 0.92%. The NYSE Composite Index shaved off 1.29% of its value. Predictably, the CBOE Volatility Index, the indicator of stock market risk perception, was up substantially by 9.12%. Overall, small-cap stocks underperformed large-cap stocks in a week of quiet trading. The markets were closed on Tuesday for the Fourth of July celebration.

The lackluster trading was likely the result of a shortened trading week and investors anticipating the release of companies’ second-quarter earnings results. Growth stocks modestly outperformed value stocks. Tesla provided some buying interest after it reported better-than-expected sales. The stock weighs heavily in the Nasdaq Composite and growth indexes, thus providing a boost to these indicators. A smaller tech stock, electric vehicle manufacturer Rivian, also contributed to the buying activity in this sector. On the other hand, Astra Zeneca’s new lung cancer drug suffered disappointing trial results and caused the stock to weigh down the healthcare sector.

U.S. Economy

On Wednesday, the minutes of the Federal Reserve’s last policy meeting were released. They revealed that some members of the Fed would have preferred another round of rate increases, although for the time being June’s rates were maintained at their levels by the unanimous decision, On Thursday, expectations that rate would remain “higher for longer” were solidified on Thursday after Dallas Fed President Lorie Logan said she anticipated two more rate increases before the end of 2023. The yield on the benchmark 10-year U.S. Treasury note fluctuated after the payroll report released on Friday, but ended higher for the week and well above 4% for the first time in eight months since bond prices and yields move in opposite directions.

In the meantime, the Labor Department reported that 209,000 nonfarm jobs were added to the jobs market in June. This was slightly below expectations and also the lowest number since December 2020. The previous two months’ additional jobs were also adjusted downward by a total of 110,000 jobs. The unemployment rate dipped from 3.7% in May to 3.6% in June while the number of people employed part-time for economic reasons rose by about 11% in June. This is likely indicative of the growing number of people whose hours were trimmed as a result of slack work or business conditions. While there are early signs of a cooling labor market, it currently remains relatively healthy and broadly supportive of consumption and economic growth.

Factory and services workers appeared to be facing very different job markets, however. The Institute for Supply Management’s (ISM) Purchasing Managers’ Index (PMI) report for manufacturing that was released on Monday seemingly confirmed a continued slowdown in job growth resulting from a contraction in hiring trends in the sector for the first time since March. While manufacturing remains in contraction, the ISM’s corresponding gauge for employment in the service sector indicates the opposite, surging to its highest level since February (53.1, with numbers above 50 signifying expansion). The ISM’s overall Services PMI also ascended to its highest level since February, charting 53.9 which is well above the estimated figure. Overall, the silver lining in this week’s economic data points to the gradual cooling of inflation’s leading indicators.

Metals and Mining

Despite the recent price performance of gold, which currently trades within a narrow range, it is heartening to note that the precious metal is consistently showing much resiliency in this uncertain market. To be certain, there does not appear to be any indication that gold prices will see any bullish momentum soon. What is apparent is the seemingly strong support for the yellow metal even at these elevated prices. This week, the price of gold maintained its support above $1,900 per ounce even as investors anticipate the Fed to continue tightening its monetary policy, and the yield on 10-year government bonds has been pushed back to 4%. Historically, higher yields would have sent the price of gold lower, but, at the moment, the precious metal appears to be shrugging off these headwinds on the eventuality that central banks will reverse course on their tightening monetary policy.

The past week saw the spot prices of precious metals recover from last week’s sell-down. Gold, which ended a week ago at $1,919.35, recovered by 0.30% to close this week at $1,925.05 per troy ounce. Silver rose by 1.41% from the previous week’s closing price of $22.77 to end this week at $23.09 per troy ounce. The price of platinum ascended by 0.84%, from its previous week’s close at $ 906.30 to its close this week at $913.87 per troy ounce. Palladium added on 1.60% from last week’s closing price of $1,230.42 to this week’s close at $1,250.11 per troy ounce. The three-month LME prices of base metals were mixed. Copper ended this week at $8,261.50 per metric ton, up by 1.03% from last week’s close at $8,177.50. Zinc closed this week at $2,363.50 per metric ton, up by 0.94% from last week’s ending price of $2,341.50. Aluminum bucked the trend for industrial metals, closing this week at $2,129.00 per metric ton which is lower by 1.44% from last week’s close at $2,160.00. Tin closed this week at $28,530.00 per metric ton, up by 9.32% from last week’s close at $26,098.00.

Energy and Oil

Oil prices ended the week with a slight gain after the market eventually discounted Saudi Arabia’s production cut extension into August, together with another steeper-than-expected drop in U.S. crude inventory that has pushed ICE Brent nearer to $77 per barrel. There remains a narrow upside, however, due to the likelihood of another U.S. interest rate hike. The prospect of an imminent increase in interest rates has become part of mainstream expectations, particularly since the recently released minutes of the Fed meeting confirmed that two more rate increases are on the agenda before the end of the year. As for the oil producers, Saud Arabian energy minister Prince Abdulaziz bin Salman confirmed at the OPEC seminar held in Vienna that OPEC+ still has measures they can adopt to flexibly manage supply.

Natural Gas

For the first half of 2023, the average monthly spot natural gas price at the U.S. benchmark Henry Hub dropped by 34% or $1.12 per million British thermal units (MMBtu). This averaged $2.18/MMBtu in June. This was the lowest average monthly Henry Hub price since June 2020, when prices averaged $1.93/MMBtu when adjusted for inflation. Prices for the first half of the year are down 62% compared to the first half of 2022. This is attributable to lower natural gas demand for space heating combined with high production, resulting in less natural gas withdrawn from storage during the winter and more natural gas injected into storage in the spring. Storage inventories remain well above the five-year average so far this summer injection period.

For the week beginning Wednesday, June 28, and ending Wednesday, July 5, 2023, the Henry Hub spot price fell by $0.06 from $2.70/MMBtu to $2.64/MMBtu. The July 2023 NYMEX contract price decreased to $2.603/MMBtu. The August 2023 NYMEX contract price decreased to %2.657/MMBtu, down by $0.01 for the week. The price of the 12-month strip averaging August 2023 through July 2024 futures contracts increased by $0.02 to $3.209/MMBtu.

International natural gas futures prices increased this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.18 to a weekly average of $12.14/MMBtu. Natural gas futures for delivery at the Title Transfer Facility in the Netherlands, the most liquid natural gas market in Europe, increased by $0.50 to a weekly average of $11.22/MMBtu. During the corresponding week last year (the week from June 29 to July 6, 2022), the prices were $39.01/MMBtu and $47.58/MMBtu in East Ais and at the TTF, respectively.

World Markets

European stocks fell on worries that despite signs of slowing inflation, hawkish pronouncements by European Central Bank officials may prompt central banks in the region to continue tightening monetary policies. The pan-European STOXX Europe 600 Index lost 3.09% of its value in local currency terms. Major stock indexes also declined in tandem with the regional index. France’s CAC 40 Index plummeted by 3.89%, Germany’s DAX gave up 3.37%, and Italy’s FTSE MIB slid by 1.60%. The UK’s FTSE 100 Index fell by 3.65%. Aside from rate hike fears, investors were likewise disappointed by a lack of specific measures by the Chinese government to bolster its economy, notwithstanding pronouncements and pledges of support by government officials. Correspondingly, European government bond yields moved up. In the UK, yields ascended to their highest levels since mid-2008. The yield on the benchmark German 10-year bond closed above 2.6%, and the French and Italian bond yields likewise ended higher.

Japan’s stock markets declined over the week, as the Nikkei 225 Index lost by 2.4% and the broader TOPIX Index dropped by 1.5%. The declines appear to be corrections as both indexes are retreating from their 33-year highs and investors sold to lock in their profits, particularly those realized in strongly performing technology stocks. The sentiment was somewhat weighed down by indications that the U.S. Federal Reserve would likely raise interest rates in the second semester of 2023. Losses were cushioned by continuance by the Bank of Japan (BoJ) in its ultra-accommodative monetary policy and the historic weakness in the yen that boosts Japan’s export-oriented industries. The yield on the 10-year Japanese government bond (JGB) rose to 0.44% from 39% during the previous week. According to pronouncements by BoJ Deputy Governor Shinichi Uchida, the central bank will maintain its yield curve policy despite speculation that the BoJ may adjust its policy of yield curve control at its July meeting. The government must continue to support the economy, according to Uchida, although the policy may have side effects such as the impact on market functions.

China equities pulled back in light of the latest economic data released during the week. The economic reports raised concerns about the sustainability of the country’s post-pandemic recovery. The Shanghai Stock Exchange Index corrected downward by 0.17% and the blue-chip CSI 300 gave up 0.44% of its value. Hong Kong’s benchmark Hang Seng Index plunged by 2.91%. As the expansion of manufacturing output and new orders softened, the private Caixin/S&P Global survey of manufacturing activity descended to 50.5 in June from 50.9 in May, thus moving closer to 50. Below this level, contraction is indicated. The Caixin survey of services activity also dropped to a lower-than-expected 53.9 in June from 57.1 in May. This is its sixth successive monthly expansion, but it is also its lowest reading since January. The weak Caixin data were consistent with the official Manufacturing Purchasing Managers’ Index which contracted in June for the third straight month.

The Week Ahead

Expected for release this week are important economic data including the Consumer Price Index (CPI) and Producer Price Index (PPI) for June.

Key Topics to Watch

- Wholesale inventories

- Fed Vice Chair Barr speaks

- San Francisco Fed President Daly speaks

- Cleveland Fed President Mester speaks

- Consumer credit

- NFIB optimism index

- Consumer price index

- Core CPI

- CPI year-over-year

- Core CPI year-over-year

- Richmond Fed President Barkin speaks

- Atlanta Fed President Bostic speaks

- Fed Beige Book

- Initial jobless claims

- Producer price index

- Core PPI

- PPI year-over-year

- Core PPI year-over-year

- Federal budget

- Fed Governor Waller speaks

- Import price index

- Import price index minus fuel

- Consumer sentiment

Markets Index Wrap Up