Stock Markets

While the small-cap Russell 2000 Index registered a minor loss, most of the benchmark indexes surged to record highs. Although the broad-market S&P 500 Index gained 2% over last week’s close, it was outperformed by the Nasdaq, which tracks mostly technology counters. Despite its strong showing, the Nasdaq fell short of its February peak. Within the S&P 500, technology shares led the rest of the stocks due to stellar performances by Apple and Microsoft accounting for about 40% of the sector’s market capitalization. Coming second are casino and cruise line shares which also registered strong gains. Lagging the market are energy stocks due to the oil price pullback earlier in the week. Value shares were outperformed by growth stocks, which narrowed the year-to-date performance gap.

U.S. Economy

Investor optimism about the recovering economy continued to move the markets this week. The bull market is quite young, however, therefore, there is substantial speculation about what developments in the economy will continue to push the indexes upward.

- One reason for the bull market to advance is the improving labor-market situation during a post-covid scenario. Over the past year, the unemployment rate has already fallen by 9%, higher than the 6.5% record unemployment decline within the period October 2009 to February 2020. Looking at the larger picture, however, the deep slide comes after the extraordinary pandemic situation that put a record number of people out of work within a short time. The current unemployment figure of 6% is still historically high, and the weekly initial jobless claims increased in the past week, indicating the need to maintain caution in forecasting the future trend.

- The earnings yield on stocks relative to the benchmark 10-year Treasury rate still stands at slightly below 3%, the lowest level since 2018. This is due to two continuing trends – the increase in interest rates and rising stock prices. The receding trend in earnings compared to bond yields is an indication that investors are being compensated less for assuming the risk of investing in equities compared to investing in the much safer Treasury yields. The bull market remains intact, but equities will likely see more moderate returns in the future.

- Although the economic recovery will proceed unhampered, it may face challenges in the fiscal and monetary policies proposed by the current administration. The proposed $2 trillion infrastructure bill will raise the pandemic stimulus higher than 30% of GDP, with accompanying tax hikes as revenue-raising measures to fund the federal deficit. This may undermine the earnings growth rate next year while leaving this year intact. There may also be occasions for Fed rate hikes in attempts at monetary policy tightening, in response to possible inflation rate hikes, although the Fed reiterated in the past week that it will maintain an accommodative policy to further drive the present economic expansion.

Metals and Mining

In the past week, gold reached $1,757 per ounce, its peak over the last four weeks and a welcome development over a dismal March performance. The rally is a reaction to the weaker US dollar and falling 10-year Treasury yields. The metal opened the week by descending to a six-month low of $1.721 on Monday, then rising sharply to breach the $1.750 threshold on Thursday. Gold prices corrected to $1,745 when the dollar and yields began to recover. It traded Friday at $1,747.23. Silver, on the other hand, sold at $25.23 per ounce on Friday.

Platinum traded with some volatility over the week, opening on Tuesday at $1,194 per ounce then soaring to $1,239 at the end of the trading day. By Friday, platinum slid to $1,191, then traded at $1,194 by midday. Palladium climbed to $2,600 per ounce, a year-to-date high, during the week before it later corrected to $2,548 by midday on Friday.

Mirroring the upward movement of precious metals, base metals also rose earlier in the week before corrected towards the week’s end. Copper rose above $9,000 per tonne, rallying from $8.768 at the start of the week. The price swing was reflective of the metal’s stores in London’s warehouses. It reached $9,104, its peak in two weeks. But steady deliveries of copper into LME warehouses brought prices lower by Friday to trade at $8.947.50.

Zinc rose 2.2% during the week and surged to $2,813 per tonne on Tuesday, later on to $2,825. The furtherance of the rally sent it to trade Friday at $2,827.50. Nickel gained 5%, climbing from $16,001 per tonne on Monday to trade at $16,828 on Thursday, only to slide back to $16,595 on Friday. Lead increased by $20 and held at $1,969 per tonne at the end of trading.

Energy and Oil

Oil prices are expected to register a loss for the week following significant trading volatility. Speculation was fueled by concerns between tightness in the market and the expectations of increasing demand, confounded by lockdown measures to arrest the continued spread of covid cases. Continued uncertainty dogged the ultimate fate of the Dakota Access Pipeline as the Army Corps of Engineers was scheduled to appear in court to continue to litigate the matter on Friday. The pipeline remains open pending a more thorough environmental assessment.

In the meantime, the industry appears to make a move towards more sustainable energy. Oil majors are making bids for offshore wind auctions in the North Sea, crowding out big developers by pushing auction prices upward. The EPA likewise announced its proposal for new car and light0duty truck fuel economy standards by the end of July. The EIA also lowered its 2022 forecast for U.S. oil output by 100,000 barrels per day, estimating an average of 11.04 million bpd compared to last month’s estimate of 11.15 million bpd after the Texas grid crisis.

Natural Gas

As temperatures climbed to more moderate levels across the nation, natural gas spot prices dropped at most locations from March 31 to April 7. The Henry Hub spot price dropped to $2.38 per million British thermal units (MMBtu) on April 7 from $2.49/MMBtu one week earlier.

The price of the May 2021 contract at the New York Mercantile Exchange (NYMEX) slid by $0.09 to $2.520/MMBtu from $2.608/MMBtu for the week. The 12-month strip averaging May 2021 through April 2022 futures contracts price fell $0.03/MMBtu to $2.750 /MMBtu.

World Markets

Growing optimism that a global economic recovery will be brought about by the infusion of fresh fiscal stimulus and supportive central bank policies was the catalyst of price increases in European stocks in the past week. The pan European STOXX Europe 600 Index closed the week’s trading with a gain of 1.16% in local currency terms. The major stock indexes were mixed, with France’s CAC 40 gaining 1.09% and Germany’s Xetra DAX Index also rising 0.84%. Italy’s FTSE MIB, on the other hand, lost 1.14%. UK’s FTSE 100 Index grew by 2.65% due to the weaker currency. The UK pound lost ground on the back of worries concerning vaccine supply, coinciding with technical profit-taking after a strong first quarter. When the pound falls, the UK’s equities rise since many of the FTSE 100 listed companies generate their revenues abroad.

Japan’s Nikkei 225 Stock Average broker through the 30,000-resistance level early in the week. The strong opening was followed by more moderate trading as the Nikkei 225 corrected slightly by the week’s end. The broader TOPIX also closed slightly lower. The yen rose against the U.S. dollar to end the week at the high JPY 109 bracket. The benchmark 10-year government bond yields lost some ground to close just above 0.10%. Meanwhile, in China, stocks fell for the week in a continuation of the bourse’s underperformance against the world markets. The large-cap CSI 300 dipped by 2.4% and the benchmark Shanghai Composite Index gave back 1.0%. Despite positive corporate earnings, rising inflation and increased U.S.-Sino tensions caused investor sentiment to weigh heavily on the market. Conversely, the fixed income market was buoyed as the yield on China’s 10-year bond rose marginally to close at 3.21% in light of the optimistic prospect of continued economic recovery.

The Week Ahead

The important economic data scheduled for release in the coming week include manufacturing production, retail sales growth, and an inflation update.

Key Topics to Watch

- Federal budget

- NFIB small-business index

- Consumer price index

- Core CPI

- Import price index

- Beige Book

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Retail sales

- Retail sales ex-autos

- Philadelphia Fed manufacturing index

- Empire state manufacturing index

- Industrial production

- Capacity utilization

- Business inventories

- National Association of Home Builders index

- Building permits

- Housing starts

- Consumer sentiment index (preliminary)

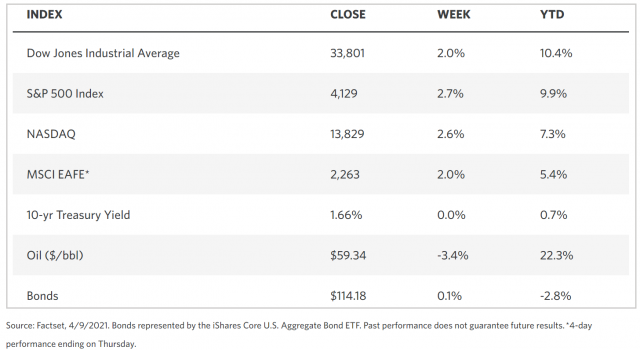

Markets Index Wrap Up