Stock Markets

Volatile trading in several sectors of the market triggered the largest weekly loss in the stock market. Fears of speculative excesses were coupled with reduced optimism that fourth-quarter GDP growth would slow down after a spectacular third-quarter growth figure. The heightened political and economic uncertainties ahead under an untested Biden administration have prompted increased caution in consumer spending. Some sectors of the economy fared well, such as housing and business investment. Growth may slow down for the first quarter although activity and employment may be expected to make a comeback, in light of the $900 billion fiscal stimulus package that passed in December. Even considering the negative equity-market returns for January and the extreme volatility in some of the heavily shorted stocks the basic outlook for the stock market remains steady. Prospects for economic momentum remain unchanged with continued support expected from the central bank and government stimulus later in the year.

U.S. Economy

This week saw a slew of unusual market behaviors, most remarkable of which is the GameStop speculative play fueled by small day traders squeezing out the short position from large hedge funds. Despite the narrative surrounding the small video-game retailer and the attention-grabbing headlines suggesting a David-versus-Goliath face-off, the unusual market gains realized are not indicative of a sustained breakout in any particular sector. The event does, however, suggest that market conditions might be vulnerable to further speculative excursions capable of yielding short bursts of abnormal returns. While it is unlikely that the recent activity suggests that a stock-market bubble exists or that a new and persistent trend is developing in equities trading, it does however underscore a greater risk-taking spirit, causing ripples in the smooth market advance of the previous years. Notwithstanding recent events, the future outlook remains stable.

- A large amount of liquidity has been introduced into the markets and the economy in general as a result of the recent federal stimulus. The stimulus package is a significant driver in lowering the costs of borrowing to consumers and businesses alike, thus maintaining the stability of the credit system and the overall economic recovery. The extra liquidity is also fueling investment in riskier assets as investors shy away from low-risk, low return interest-bearing instruments to seek greener pastures.

- Vaccine distribution continues to fuel optimism despite timeline issues, and it is widely expected to gain momentum later in the year. The pandemic’s impact on recent corporate earnings have currently evaluated market valuations; by year’s end, a more fully-opened economy is expected to enhance earnings and bring valuations to normal levels. Moving forward, the Fed has committed to maintaining interest rates at current levels and monetary stimulus consistent at levels favorable to enhanced market performance.

The recent market volatility does not have any long-term implications on the economy. Bouts of speculation keep the market players interested, while investors continue to search for value plays and encouraging corporate earnings reports. The underlying fundamentals of business activity remain sound and safe for long-term investing.

Metals and Mining

The recent volatility in the stock market has pushed gold prices up as flight to safety continued. Gold recovered some of its mid-month attrition and ending at 4.4% off its year-to-date high. It opened Monday and traded at $1.864 per ounce before correcting to $1,836 on Wednesday in light of the growing strength of the US dollar. On Thursday the metal began covering from its descent, remaining below its resistance level at $1,860 as initial optimism about hope for an economic stimulus appears to be discounted. Silver traded at $28 an ounce, attracting the interest of retail investors who targeted GameStop over the week. The market volatility weighed as well on the metals sector, causing it to give back earlier gains by midweek. By 9:42 am on Friday, silver was trading at $27.17 per ounce.

During the closing week of January, platinum showed volatility and broke down to $1,043 per ounce, levels which it had not seen since early in the month. The metal recovered somewhat later in Friday trading, buoyed by the recovery in gold and silver. It rebounded from an intraday high of $1,100 to settle at $1,082 at 9:48 a.m. Palladium, on the other hand, continued on its downward trend since early in January after its year-to-date peak of $2,364 per ounce. It has since then dropped by 5.7% off its high, trading at $2.221 at 9:51 am Friday. The rest of the base metals appear to continue on their downtrend as they are weighed down by the improving dollar, except for tin which continues to remain strong. Copper fell from $7.984.50 per tonne earlier in the week to $7,778.50, improving slightly to $7,814 by Friday. Nickel closed the week at $17,580, zinc at $2,546, and lead at $2,009.50 per tonne.

Energy and Oil

Oil prices traded flat for most of the week, although it ended Friday slightly up from one day earlier, on positive news of more vaccine supply with the possible release of Johnson & Johnson and Novavax into the market. Oil companies are expected to post earnings results; Chevron was the first to announce its earnings loss during the past week, although other companies may be more optimistic in light of help provided by the OPEC and Big Pharma. There was some initial reaction concerning Biden’s order that the U.S. government switch over its 645,000-vehicle fleet to electric (EVs) made with union labor and at least 50% of their parts made in America. This was found to be non-executable in the near future, however, as no such EV currently exists. EVs are built with a high percentage of imported components, and Tesla, the most successful EV manufacturer, is not unionized. GM announced that by 2035 it aims to produce zero-emission cars and trucks, and be fully carbon-neutral by 2040, although critics feel that these goals are largely aspirational and unrealistic.

In the meantime, oil lobbyists are attempting to build an alliance with ethanol producers to mount a front against the new administration’s push towards EVs; so far, the effort has not been successful. At the same time, Standard and Poor’s (S&P) Global Ratings announced that it may cut the credit ratings of several oil majors based on climate and “energy transition” risk. The credit-rating agency believed that the transition to other forms of energy, price volatility, and weaker profitability increase the risk for oil and gas companies. In another order, Biden ended the financing of fossil fuel projects abroad. In the past five years, the U.S. has invested billions of dollars in oil and gas projects, such as LNG in Mozambique, the Vaca Muerta shale in Argentina, and financial support for Pernex, all of which are to be terminated.

Natural Gas

Spot prices for natural gas increased in the past week at most locations. The Henry Hub spot price ascended to $2.71 from $2.42 per million British thermal units (MMBtu) during the period January 20 to 27. At the New York Mercantile Exchange (Nymex), the February 2021 contract price expired on Wednesday at $2.702/MMBtu, higher by $0.16/MMBtu. The March 2021 contract price went up to $2.720, an increase of $0.19/MMBtu. The 12-month strip average from March 2021 through February 2022 futures contract price increased by $0.14/MMBtu to $2.915/MMBtu. Working natural gas stocks totaled 2,881billion cubic feet (Bcf) for the same week, amounting to 3% above last year’s corresponding level and 9% more than the preceding five-year average for the same week. Net withdrawals from working glass for the week totaled 128 Bcf.

At Mont Belvieu, Texas, the natural gas plant liquids composite price dropped by $25/MMBtu to average $7.10/MMBtu for the week. Propane, butane, and isobutane prices slid by 6%, 5%, and 4% respectively. The natural gasoline price rose by 1%, while the ethane price remained unchanged over the week. For the week ending January 19, the number of oil-directed rigs rose from 287 to 289 and the natural gas rig count increased from 85 to 88. This brings the total rig count to 378.

World Markets

European shares continue to descend due to continued pandemic concerns and fear in the delay of coronavirus vaccine distribution. The pan-European STOXX Europe 600 Index closed the week 3.11% down, while Germany’s Xetra DAX Index, France’s CAD 40, and Italy’s FTSE MIB slumped 3.18%, 2.88%, and 2.34% respectively. The UK’s FTSE 100 Index also declined by 4.30%. The European Commission committed to allowing European Union (EU) members to block the exports of vaccine doses if their purchase orders had not yet been completed. Production shortfalls in Pfizer and Astra Zeneca prompted a scale-back in inoculation programs in Spain, Germany, and France, a situation that may prevail until the second quarter when vaccine availability is expected to improve.

Fourth-quarter GDP reports in the European economies showed overall resilience, creating optimism that the region may avoid a deeper recession. Germany’s GDP expanded by 0.1% resulting from strong exports and construction activity. Spain’s economy expanded unexpectedly by 0.4% partly due to increased household consumption. France’s GDP by 1.3% in the fourth-quarter, which was still better than the expected 4.1% fourth-quarter contraction. Improvements were attributed to robust fourth quarter exports, strong investment in business, and rising consumer spending. Germany, on the other hand, downgraded its 2021 GDP growth forecast to 3% from a previously estimated 4.4% in light of continuing lockdowns. In Italy, political uncertainties prevail as Prime Minister Giuseppe Conte steps down after losing a parliamentary.

Japan’s stock market fell during the week. The Nikkei 225 Stock Average dropped 3.4% to close the week at 27, 663.39, although the blue-chip index remained over its year-to-date level by 0.8%. The Japanese government approved a third supplementary budget amounting to JPY 19 trillion (equivalent to US$ 185 billion) to strengthen measures to head off the third coronavirus wave. Chinese stocks fell for the week due to monetary concerns. The country’s central bank drained US$12.1 billion in liquidity from the financial system to stem a possible financial asset bubble. The Shanghai Composite Index dropped by 3.4% and the large-cap CSI 300 fell 3.9%. Economic news was more optimistic with industrial profits rising 20% in December from its corresponding level last year, increasing 4% for the year after a decline in 2019. The country celebrates its Lunar New Year next month, with tighter restrictions on traveling and social gatherings due to Covid.

The Week Ahead

About 22% of the S&P 500 companies are scheduled to release their earnings reports in the coming week, bringing the earnings season to full swing. Important economic data is also scheduled to be released, including the ISM Purchasing Managers Index and the January jobs report.

Key Topics to Watch

- Markit manufacturing PMI (Final)

- ISM manufacturing index

- Motor vehicle sales (SAAR)

- Housing vacancies

- ADP employment report

- Markit services PMI (final)

- ISM services index

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Productivity

- Unit labor costs

- Factory orders

- Nonfarm payrolls

- Unemployment rate

- Average hourly earnings

- Trade deficit

- Consumer credit

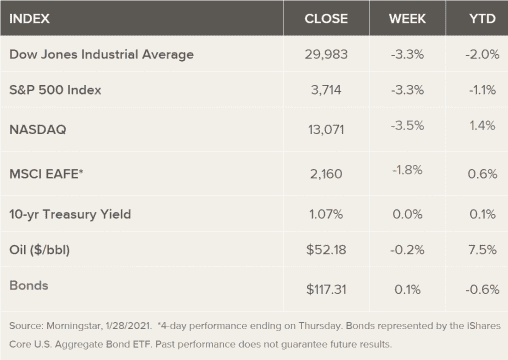

Markets Index Wrap Up