Viewray (NASDAQ:VRAY) was downgraded by equities research analysts at BTIG Research from a “buy” rating to a “neutral” rating in a research report issued to clients and investors on Friday, MarketBeat Ratings reports.

A number of other analysts have also issued reports on VRAY. Mizuho reiterated a “buy” rating and issued a $7.00 price target on shares of Viewray in a report on Friday. ValuEngine upgraded Viewray from a “hold” rating to a “buy” rating in a report on Tuesday, December 3rd. Zacks Investment Research lowered Viewray from a “buy” rating to a “hold” rating in a report on Thursday. B. Riley lowered their price target on Viewray from $5.00 to $2.50 and set a “neutral” rating for the company in a report on Friday. Finally, Guggenheim reiterated a “buy” rating and issued a $8.00 price target on shares of Viewray in a report on Tuesday, December 3rd. Five investment analysts have rated the stock with a hold rating and eight have issued a buy rating to the company. The stock has a consensus rating of “Buy” and an average price target of $5.65.

Shares of NASDAQ:VRAY opened at $1.35 on Friday. The company has a debt-to-equity ratio of 0.62, a current ratio of 3.70 and a quick ratio of 2.58. The firm has a market capitalization of $134.20 million, a PE ratio of -1.30 and a beta of 1.20. The business has a 50 day simple moving average of $2.93 and a two-hundred day simple moving average of $3.26. Viewray has a 1 year low of $1.16 and a 1 year high of $9.76.

Viewray (NASDAQ:VRAY) last announced its quarterly earnings results on Thursday, March 12th. The company reported ($0.31) earnings per share (EPS) for the quarter, missing analysts’ consensus estimates of ($0.25) by ($0.06). The firm had revenue of $16.47 million during the quarter, compared to analysts’ expectations of $17.05 million. Viewray had a negative net margin of 110.61% and a negative return on equity of 75.41%. Equities research analysts expect that Viewray will post -1.11 EPS for the current fiscal year.

Several hedge funds have recently modified their holdings of the company. Needham Investment Management LLC acquired a new position in shares of Viewray during the fourth quarter worth $907,000. Geode Capital Management LLC increased its position in shares of Viewray by 59.2% during the fourth quarter. Geode Capital Management LLC now owns 1,346,216 shares of the company’s stock worth $5,681,000 after purchasing an additional 500,864 shares in the last quarter. Bamco Inc. NY increased its position in shares of Viewray by 112.3% during the fourth quarter. Bamco Inc. NY now owns 1,985,000 shares of the company’s stock worth $8,377,000 after purchasing an additional 1,050,000 shares in the last quarter. Fosun International Ltd increased its position in shares of Viewray by 44.6% during the fourth quarter. Fosun International Ltd now owns 23,819,500 shares of the company’s stock worth $100,518,000 after purchasing an additional 7,348,242 shares in the last quarter. Finally, Marshall Wace LLP acquired a new position in shares of Viewray during the fourth quarter worth $50,000.

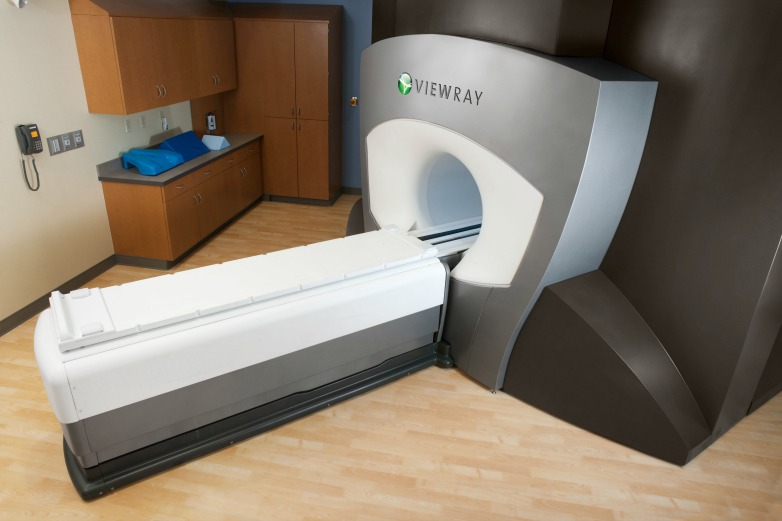

Viewray Company Profile

ViewRay, Inc designs, manufactures and markets MRIdian, the magnetic resonance imaging (MRI)-guided radiation therapy system to image and treat cancer patients simultaneously. The Company offers radiation therapy technology combined with magnetic resonance imaging. MRIdian integrates MRI technology, radiation delivery and the Company’s software to locate, target and track the position and shape of soft-tissue tumors while radiation is delivered.