Watsco Inc (NYSE:WSO) – Stock analysts at Seaport Global Securities issued their Q1 2020 EPS estimates for shares of Watsco in a research report issued on Wednesday, February 19th. Seaport Global Securities analyst W. Liptak expects that the construction company will post earnings per share of $0.85 for the quarter. Seaport Global Securities also issued estimates for Watsco’s Q2 2020 earnings at $2.50 EPS, Q3 2020 earnings at $2.45 EPS, Q4 2020 earnings at $1.06 EPS and FY2020 earnings at $6.85 EPS.

Several other equities research analysts also recently commented on the company. William Blair reaffirmed an “outperform” rating on shares of Watsco in a report on Thursday, January 16th. Stephens reduced their target price on Watsco from $192.00 to $190.00 and set an “overweight” rating for the company in a report on Tuesday, February 18th. Buckingham Research reduced their target price on Watsco from $164.00 to $160.00 and set a “neutral” rating for the company in a report on Friday, February 14th. Finally, Zacks Investment Research raised Watsco from a “hold” rating to a “buy” rating and set a $186.00 target price for the company in a report on Wednesday, January 22nd. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating and three have assigned a buy rating to the stock. Watsco has an average rating of “Hold” and an average target price of $167.83.Shares of NYSE WSO opened at $168.47 on Monday. Watsco has a 12 month low of $136.45 and a 12 month high of $183.00. The company has a market cap of $6.50 billion, a price-to-earnings ratio of 26.32 and a beta of 0.85. The company has a quick ratio of 1.36, a current ratio of 3.35 and a debt-to-equity ratio of 0.18. The business has a fifty day simple moving average of $175.20 and a 200-day simple moving average of $172.06.

Watsco (NYSE:WSO) last announced its earnings results on Thursday, February 13th. The construction company reported $0.92 EPS for the quarter, missing the consensus estimate of $1.00 by ($0.08). Watsco had a net margin of 5.16% and a return on equity of 14.68%. The company had revenue of $1.07 billion for the quarter, compared to analysts’ expectations of $1.08 billion. During the same period in the prior year, the company earned $1.02 earnings per share. The company’s revenue for the quarter was up 8.2% on a year-over-year basis.

A number of large investors have recently bought and sold shares of WSO. Captrust Financial Advisors raised its position in Watsco by 12,907.6% during the fourth quarter. Captrust Financial Advisors now owns 106,402 shares of the construction company’s stock valued at $19,079,000 after buying an additional 105,584 shares during the period. Baillie Gifford & Co. raised its position in Watsco by 6.3% during the fourth quarter. Baillie Gifford & Co. now owns 1,602,471 shares of the construction company’s stock valued at $288,684,000 after buying an additional 95,549 shares during the period. Millennium Management LLC raised its position in Watsco by 262.9% during the third quarter. Millennium Management LLC now owns 109,721 shares of the construction company’s stock valued at $18,562,000 after buying an additional 79,488 shares during the period. Man Group plc raised its position in Watsco by 2,803.5% during the fourth quarter. Man Group plc now owns 68,928 shares of the construction company’s stock valued at $12,417,000 after buying an additional 66,554 shares during the period. Finally, Welch & Forbes LLC raised its position in Watsco by 66.2% during the fourth quarter. Welch & Forbes LLC now owns 118,738 shares of the construction company’s stock valued at $21,391,000 after buying an additional 47,277 shares during the period. 80.52% of the stock is currently owned by hedge funds and other institutional investors.

The firm also recently declared a quarterly dividend, which was paid on Friday, January 31st. Investors of record on Thursday, January 16th were given a dividend of $1.60 per share. This represents a $6.40 annualized dividend and a yield of 3.80%. The ex-dividend date was Wednesday, January 15th. Watsco’s payout ratio is 98.46%.

About Watsco

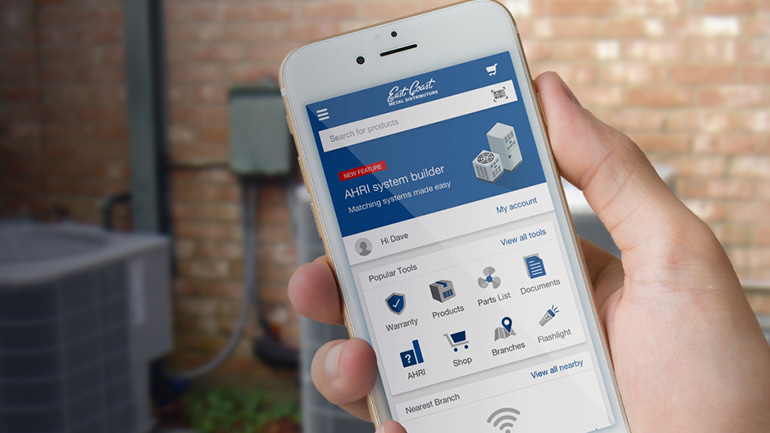

Watsco, Inc, together with its subsidiaries, distributes air conditioning, heating, and refrigeration equipment; and related parts and supplies in the United States, Canada, Mexico, and Puerto Rico. It offers residential ducted and ductless air conditioners; gas, electric, and oil furnaces; commercial air conditioning and heating equipment systems; and other specialized equipment.