Equities researchers at Deutsche Bank initiated coverage on shares of Medtronic (NYSE:MDT) in a research note issued on Friday, January 3rd, Benzinga reports. The brokerage set a “buy” rating and a $99.00 price target on the medical technology company’s stock. Deutsche Bank’s target price would suggest a potential downside of 16.99% from the company’s previous close.

Other analysts also recently issued reports about the company. Argus lifted their target price on Medtronic to $135.00 and gave the stock a “buy” rating in a research report on Monday, November 25th. Royal Bank of Canada upped their price target on Medtronic from $118.00 to $122.00 and gave the stock an “outperform” rating in a research report on Wednesday, November 20th. Guggenheim upgraded Medtronic from a “neutral” rating to a “buy” rating and set a $135.00 target price on the stock in a research note on Thursday, January 2nd. They noted that the move was a valuation call. JPMorgan Chase & Co. upped their price objective on shares of Medtronic from $122.00 to $128.00 and gave the company an “overweight” rating in a report on Friday, December 20th. Finally, Oppenheimer upped their price target on shares of Medtronic from $118.00 to $123.00 and gave the company an “outperform” rating in a research note on Wednesday, November 20th. Six equities research analysts have rated the stock with a hold rating and eighteen have given a buy rating to the company. Medtronic presently has an average rating of “Buy” and a consensus target price of $120.59.

Shares of NYSE:MDT traded down $1.71 on Friday, reaching $119.26. The company’s stock had a trading volume of 3,382,523 shares, compared to its average volume of 3,559,251. The company has a market cap of $162.15 billion, a P/E ratio of 34.47, a PEG ratio of 2.94 and a beta of 0.60. The company has a debt-to-equity ratio of 0.49, a quick ratio of 2.28 and a current ratio of 2.77. The company has a 50-day simple moving average of $115.26 and a 200 day simple moving average of $108.64. Medtronic has a 52-week low of $82.77 and a 52-week high of $122.15.

Medtronic (NYSE:MDT) last posted its quarterly earnings data on Tuesday, November 19th. The medical technology company reported $1.31 EPS for the quarter, topping the consensus estimate of $1.28 by $0.03. The company had revenue of $7.71 billion during the quarter, compared to analyst estimates of $7.66 billion. Medtronic had a net margin of 15.11% and a return on equity of 14.52%. Medtronic’s quarterly revenue was up 3.0% compared to the same quarter last year. During the same period in the previous year, the firm earned $1.22 earnings per share. On average, equities research analysts forecast that Medtronic will post 5.6 EPS for the current fiscal year.

In related news, EVP Michael J. Coyle sold 2,102 shares of the stock in a transaction on Thursday, November 14th. The stock was sold at an average price of $109.77, for a total value of $230,736.54. Following the completion of the transaction, the executive vice president now directly owns 189,162 shares of the company’s stock, valued at approximately $20,764,312.74. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, EVP Robert John White sold 52,165 shares of Medtronic stock in a transaction on Friday, November 1st. The stock was sold at an average price of $109.33, for a total transaction of $5,703,199.45. The disclosure for this sale can be found here. In the last three months, insiders sold 106,433 shares of company stock valued at $11,704,539. 0.28% of the stock is owned by insiders.

Hedge funds have recently added to or reduced their stakes in the business. Aviance Capital Partners LLC lifted its stake in Medtronic by 5.1% during the second quarter. Aviance Capital Partners LLC now owns 5,098 shares of the medical technology company’s stock worth $496,000 after purchasing an additional 247 shares in the last quarter. LaFleur & Godfrey LLC lifted its stake in Medtronic by 10.5% during the 2nd quarter. LaFleur & Godfrey LLC now owns 6,341 shares of the medical technology company’s stock worth $618,000 after acquiring an additional 600 shares in the last quarter. Massmutual Trust Co. FSB ADV lifted its stake in Medtronic by 3.6% during the 2nd quarter. Massmutual Trust Co. FSB ADV now owns 71,462 shares of the medical technology company’s stock worth $6,960,000 after acquiring an additional 2,505 shares in the last quarter. Colonial Trust Advisors boosted its holdings in Medtronic by 2.2% during the 2nd quarter. Colonial Trust Advisors now owns 35,473 shares of the medical technology company’s stock valued at $3,455,000 after acquiring an additional 764 shares during the period. Finally, Coldstream Capital Management Inc. boosted its holdings in Medtronic by 6.7% during the 3rd quarter. Coldstream Capital Management Inc. now owns 2,693 shares of the medical technology company’s stock valued at $292,000 after acquiring an additional 170 shares during the period. Institutional investors own 80.61% of the company’s stock.

Medtronic Company Profile

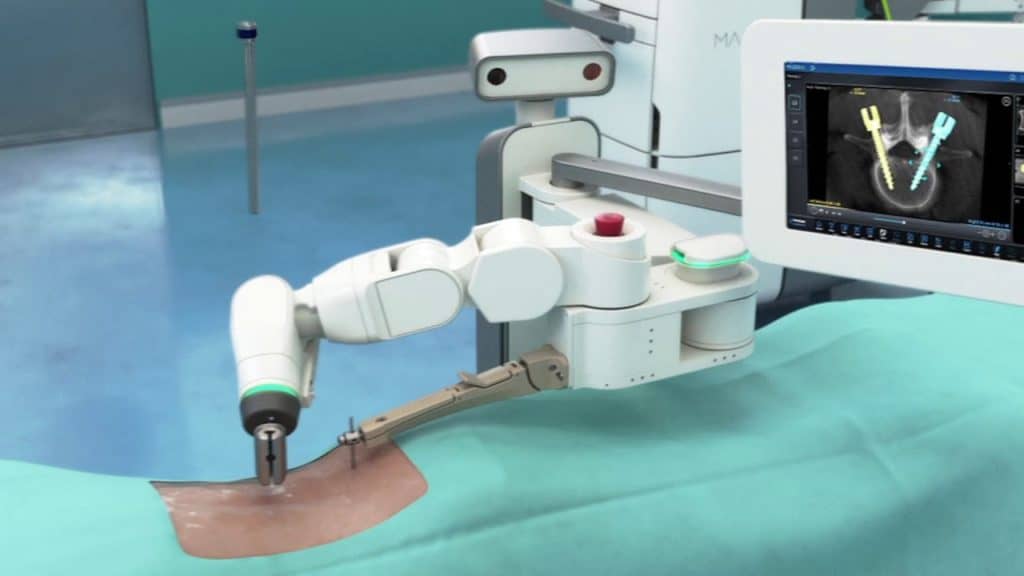

Medtronic plc develops, manufactures, distributes, and sells device-based medical therapies to hospitals, physicians, clinicians, and patients worldwide. It operates through four segments: Cardiac and Vascular Group, Minimally Invasive Therapies Group, Restorative Therapies Group, and Diabetes Group.