Are you in the “retirement bubble”? The retirement bubble are the few years leading up to retirement and the first few years in retirement when your retirement nest egg is most vulnerable to market shocks. Why? It is because of sequence of investment returns risk. Sequence of investment returns is most dangerous when you are withdrawing money from your portfolio, which is exactly what most retirees need to do in retirement.

But, I hear you thinking, doesn’t the 4% retirement rule protect me? The short answer is yes, it does provide some protection. Based on the research used to develop the 4% rule, it was found that an initial withdrawal of 4% from a portfolio was the highest withdrawal rate over the time period analyzed that didn’t leave the retiree broke after 30 years of withdrawals. Does this mean you are guaranteed to never run out of money in retirement if you rely on the 4% rule? Unfortunately, no. I recently recorded a podcast titled The Problem With The 4% Rule and the following graphics below illustrate the damaging consequences of sequence of investment return risk.

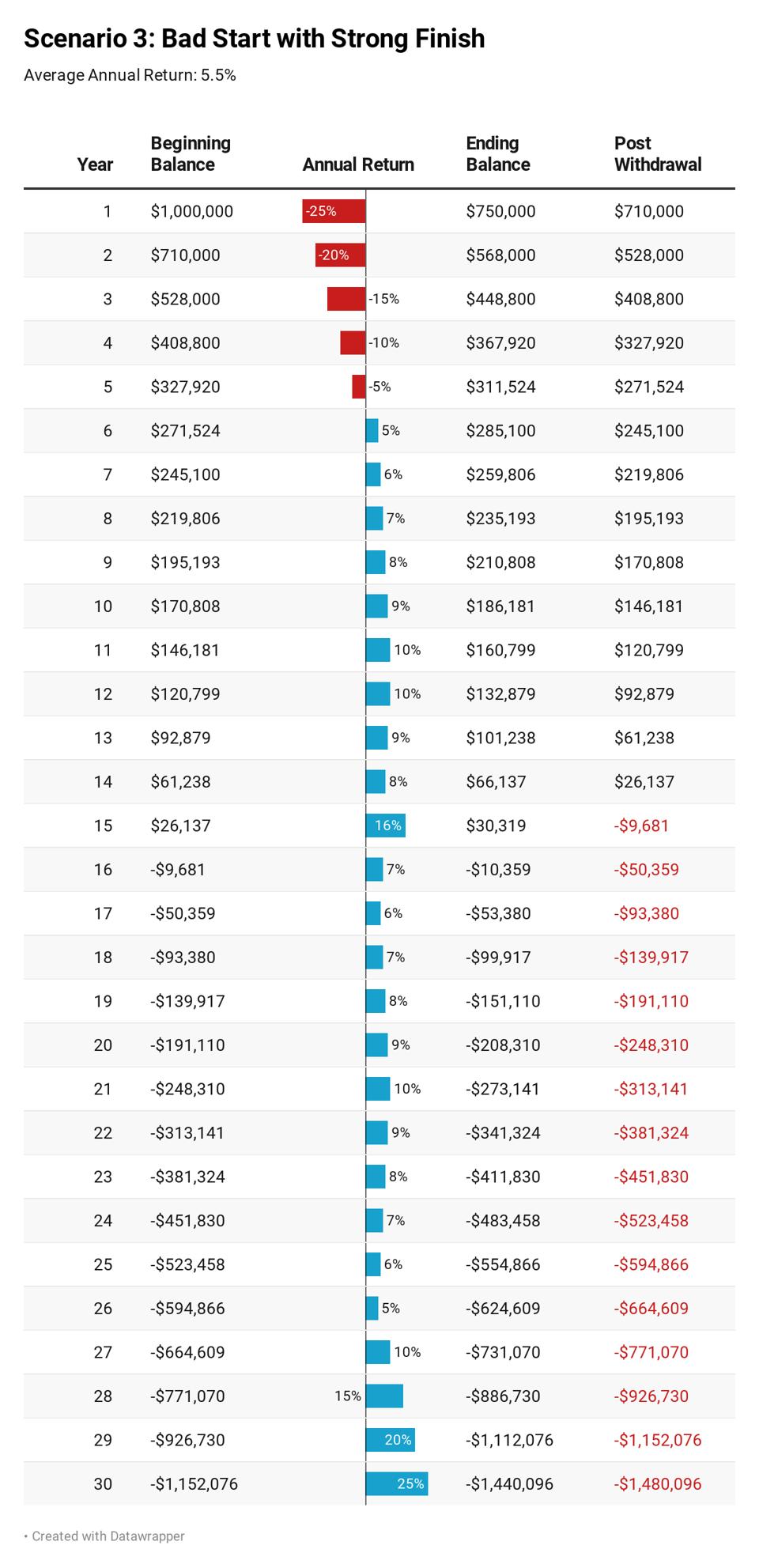

Let’s look at three examples that use the following same assumptions:

· Average annual portfolio return: 5.50%

· Time frame: 30-year period

· Starting portfolio value: $1 million

· Annual withdrawal: $40,000 (this is 4% of the portfolio starting value)

You may be thinking, if in all three examples we are starting with the same portfolio value, we are withdrawing the same amount per year, and the average annual return is the same each year, what’s the point of having three scenarios since everything is the same? Won’t the result the be identical? Well, this is where things get interesting. Everything isthe same except that the sequence of investment returns are different across each of our three scenarios. In other words, the investment performance each year will vary. Will this make a difference? Let’s have a look at the ending balance of the portfolio for each scenario.

In this first scenario we have several years of strong investment performance, but near the end of the 30 years the markets and our investment return turn negative…

What do you notice? In this first scenario with a strong start and bad finish, you end up with nearly $2.8 million in your portfolio at the end of 30 years even after withdrawing $40,000 per year. This is an excellent outcome! For this retiree, it may have been possible to withdraw even more than the $40,000 per year as their portfolio value increased.

Let’s look at what happens when we get a flat 5.5% return each and every year for 30 years…

In this second scenario, you had a portfolio that had 30 years of positive investment performance and the ending portfolio value was about $2 million. Although this investment scenario is highly unlikely — what are the chances of getting a flat 5.5% return each year for 30 years — it is interesting that even though there was never a negative year and even though you earned the same average annual return as the first scenario (5.5%), you end up with less terminal wealth at the end of 30 years.

What do you notice in this third scenario? A lot more red. Again, the average annual return is the same across all three scenarios (5.50%), but look at what happens. You run out of money in year 15. How is that possible?

The reason is that when your portfolio experienced negative returns early on, it was never able to recover even with the high returns later on. Basically, your portfolio got stuck in a hole, and with the $40,000 withdrawals each year, it was too little and too late. This is obviously not the outcome you want in retirement.

Are there strategies to help mitigate this risk? Yes, but the lesson here is to recognize that the order of investment returns matters a great deal in retirement. Creating a safe retirement income distribution plan is not as simple as following the 4% rule. This is why Nobel Prize winner, William Sharpe, said retirement income planning is “The hardest and nastiest problem in finance.” While it may not be simple or easy, it is imperative if you want a lifetime stream of income.

In upcoming Forbes articles, I will discuss several strategies to reduce the sequence of returns risk.