Medtronic PLC (NYSE:MDT) was the recipient of some unusual options trading activity on Tuesday. Stock traders bought 43,944 call options on the stock. This is an increase of approximately 786% compared to the typical daily volume of 4,960 call options.

Several equities analysts recently weighed in on the stock. Morgan Stanley raised their price objective on shares of Medtronic from $116.00 to $123.00 and gave the company an “equal weight” rating in a research report on Tuesday, December 17th. Citigroup lowered shares of Medtronic from a “buy” rating to a “neutral” rating in a research report on Thursday, January 2nd. Guggenheim upgraded shares of Medtronic from a “neutral” rating to a “buy” rating and set a $135.00 price objective on the stock in a research note on Thursday, January 2nd. They noted that the move was a valuation call. Argus raised their price objective on shares of Medtronic to $135.00 and gave the stock a “buy” rating in a research note on Monday, November 25th. Finally, Oppenheimer lifted their price target on shares of Medtronic from $118.00 to $123.00 and gave the stock an “outperform” rating in a research note on Wednesday, November 20th. Six analysts have rated the stock with a hold rating and seventeen have issued a buy rating to the stock. The stock has a consensus rating of “Buy” and an average price target of $119.90.

NYSE:MDT traded up $0.17 during trading hours on Friday, hitting $119.03. The company’s stock had a trading volume of 4,893,167 shares, compared to its average volume of 4,158,431. The stock has a fifty day simple moving average of $113.96 and a 200-day simple moving average of $107.77. The company has a market capitalization of $156.88 billion, a P/E ratio of 22.80, a PEG ratio of 2.84 and a beta of 0.60. The company has a debt-to-equity ratio of 0.49, a current ratio of 2.77 and a quick ratio of 2.28. Medtronic has a twelve month low of $82.77 and a twelve month high of $119.84.

Medtronic (NYSE:MDT) last posted its earnings results on Tuesday, November 19th. The medical technology company reported $1.31 EPS for the quarter, beating the consensus estimate of $1.28 by $0.03. The firm had revenue of $7.71 billion during the quarter, compared to the consensus estimate of $7.66 billion. Medtronic had a return on equity of 14.52% and a net margin of 15.11%. The business’s quarterly revenue was up 3.0% on a year-over-year basis. During the same period last year, the company earned $1.22 earnings per share. On average, equities analysts predict that Medtronic will post 5.6 EPS for the current fiscal year.

The company also recently announced a quarterly dividend, which will be paid on Friday, January 17th. Shareholders of record on Friday, December 27th will be paid a $0.54 dividend. The ex-dividend date is Thursday, December 26th. This represents a $2.16 annualized dividend and a dividend yield of 1.81%. Medtronic’s payout ratio is presently 41.38%.

In other Medtronic news, EVP Robert John White sold 52,165 shares of the firm’s stock in a transaction dated Friday, November 1st. The shares were sold at an average price of $109.33, for a total value of $5,703,199.45. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Richard H. Anderson bought 5,000 shares of the firm’s stock in a transaction on Friday, December 6th. The stock was purchased at an average price of $111.13 per share, with a total value of $555,650.00. The disclosure for this purchase can be found here. In the last three months, insiders have sold 106,433 shares of company stock worth $11,704,539. 0.28% of the stock is owned by corporate insiders.

Institutional investors and hedge funds have recently modified their holdings of the business. Aviance Capital Partners LLC raised its stake in shares of Medtronic by 5.1% during the 2nd quarter. Aviance Capital Partners LLC now owns 5,098 shares of the medical technology company’s stock valued at $496,000 after purchasing an additional 247 shares during the period. LaFleur & Godfrey LLC grew its position in Medtronic by 10.5% during the second quarter. LaFleur & Godfrey LLC now owns 6,341 shares of the medical technology company’s stock worth $618,000 after buying an additional 600 shares in the last quarter. Massmutual Trust Co. FSB ADV grew its position in Medtronic by 3.6% during the second quarter. Massmutual Trust Co. FSB ADV now owns 71,462 shares of the medical technology company’s stock worth $6,960,000 after buying an additional 2,505 shares in the last quarter. Equitable Trust Co. grew its position in Medtronic by 10.8% during the second quarter. Equitable Trust Co. now owns 239,657 shares of the medical technology company’s stock worth $23,340,000 after buying an additional 23,345 shares in the last quarter. Finally, Colonial Trust Advisors grew its position in Medtronic by 2.2% during the second quarter. Colonial Trust Advisors now owns 35,473 shares of the medical technology company’s stock worth $3,455,000 after buying an additional 764 shares in the last quarter. Hedge funds and other institutional investors own 80.65% of the company’s stock.

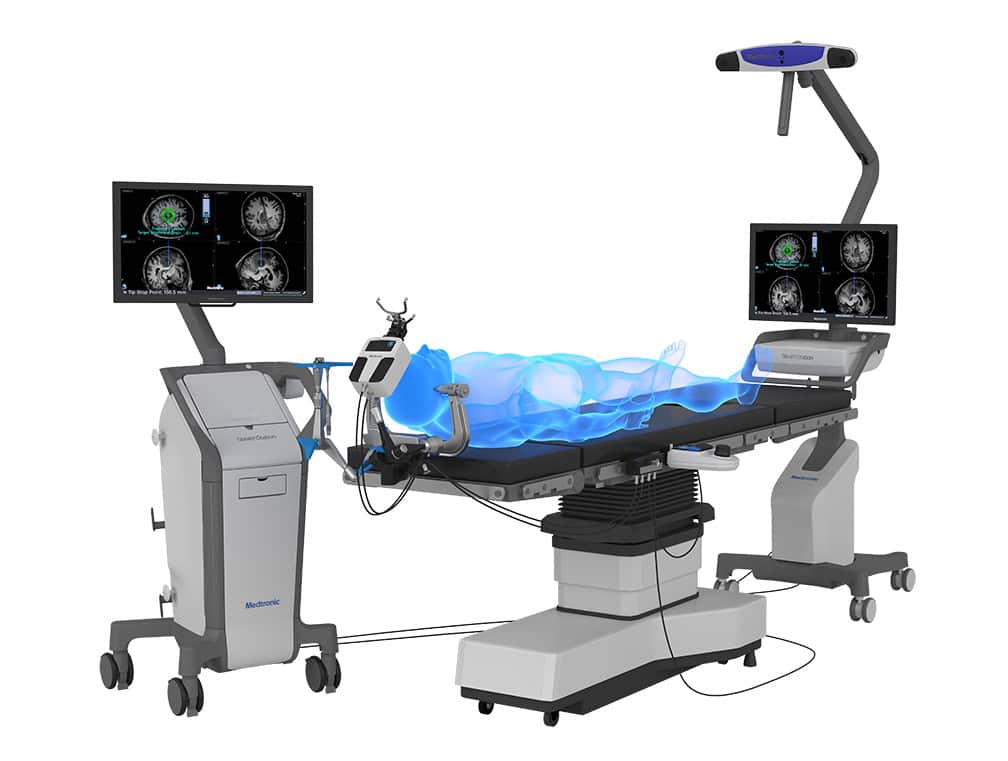

Medtronic Company Profile

Medtronic plc develops, manufactures, distributes, and sells device-based medical therapies to hospitals, physicians, clinicians, and patients worldwide. It operates through four segments: Cardiac and Vascular Group, Minimally Invasive Therapies Group, Restorative Therapies Group, and Diabetes Group.