Genesco Inc. (NYSE:GCO) – Equities researchers at Jefferies Financial Group increased their FY2020 earnings estimates for Genesco in a research report issued on Monday, December 9th, according to Zacks Investment Research. Jefferies Financial Group analyst J. Stichter now expects that the company will earn $4.25 per share for the year, up from their previous estimate of $4.06.

Genesco (NYSE:GCO) last announced its earnings results on Friday, December 6th. The company reported $1.33 earnings per share (EPS) for the quarter, beating the Thomson Reuters’ consensus estimate of $1.10 by $0.23. Genesco had a positive return on equity of 10.98% and a negative net margin of 1.74%. The business had revenue of $537.30 million during the quarter, compared to analyst estimates of $540.64 million. During the same quarter in the previous year, the business earned $0.95 earnings per share. The company’s revenue for the quarter was down .5% compared to the same quarter last year.

Other research analysts have also issued reports about the stock. Pivotal Research lifted their price objective on shares of Genesco from $51.00 to $57.00 in a research note on Monday, December 9th. Zacks Investment Research upgraded shares of Genesco from a “hold” rating to a “buy” rating and set a $57.00 price objective on the stock in a research note on Tuesday, December 10th. Robert W. Baird boosted their price target on shares of Genesco from $40.00 to $52.00 and gave the stock a “neutral” rating in a research note on Monday, December 9th. TheStreet upgraded shares of Genesco from a “c+” rating to a “b-” rating in a research note on Friday, December 27th. Finally, Susquehanna Bancshares reiterated a “buy” rating and set a $56.00 price target on shares of Genesco in a research note on Friday, December 6th. One investment analyst has rated the stock with a sell rating, one has given a hold rating and three have assigned a buy rating to the company’s stock. The company presently has an average rating of “Hold” and a consensus price target of $55.50.

NYSE:GCO traded down $0.41 during midday trading on Tuesday, hitting $47.51. 395,506 shares of the company were exchanged, compared to its average volume of 467,719. The company has a fifty day simple moving average of $44.02 and a 200 day simple moving average of $40.44. Genesco has a fifty-two week low of $31.65 and a fifty-two week high of $53.20. The company has a current ratio of 1.34, a quick ratio of 0.28 and a debt-to-equity ratio of 1.27. The company has a market capitalization of $710.75 million, a PE ratio of 14.48, a price-to-earnings-growth ratio of 2.28 and a beta of 0.49.

In other news, VP Daniel E. Ewoldsen sold 3,016 shares of the firm’s stock in a transaction dated Wednesday, December 11th. The shares were sold at an average price of $51.00, for a total value of $153,816.00. Following the transaction, the vice president now directly owns 14,073 shares in the company, valued at approximately $717,723. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, VP Daniel E. Ewoldsen sold 3,270 shares of the business’s stock in a transaction on Tuesday, December 17th. The stock was sold at an average price of $49.39, for a total transaction of $161,505.30. Following the transaction, the vice president now directly owns 10,803 shares in the company, valued at approximately $533,560.17. The disclosure for this sale can be found here. In the last three months, insiders have sold 8,786 shares of company stock worth $435,571. 4.40% of the stock is owned by insiders.

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the company. Eagle Asset Management Inc. increased its position in shares of Genesco by 0.3% in the third quarter. Eagle Asset Management Inc. now owns 626,332 shares of the company’s stock worth $25,065,000 after purchasing an additional 1,667 shares during the period. Millennium Management LLC increased its holdings in shares of Genesco by 504.3% during the third quarter. Millennium Management LLC now owns 387,627 shares of the company’s stock valued at $15,512,000 after acquiring an additional 323,481 shares in the last quarter. LSV Asset Management boosted its position in shares of Genesco by 19.2% during the second quarter. LSV Asset Management now owns 260,900 shares of the company’s stock valued at $11,033,000 after buying an additional 42,100 shares during the last quarter. Smith Graham & Co. Investment Advisors LP boosted its position in Genesco by 0.6% in the third quarter. Smith Graham & Co. Investment Advisors LP now owns 198,955 shares of the company’s stock worth $7,962,000 after purchasing an additional 1,100 shares during the last quarter. Finally, D. E. Shaw & Co. Inc. boosted its position in Genesco by 185.4% in the second quarter. D. E. Shaw & Co. Inc. now owns 189,654 shares of the company’s stock worth $8,020,000 after purchasing an additional 123,191 shares during the last quarter.

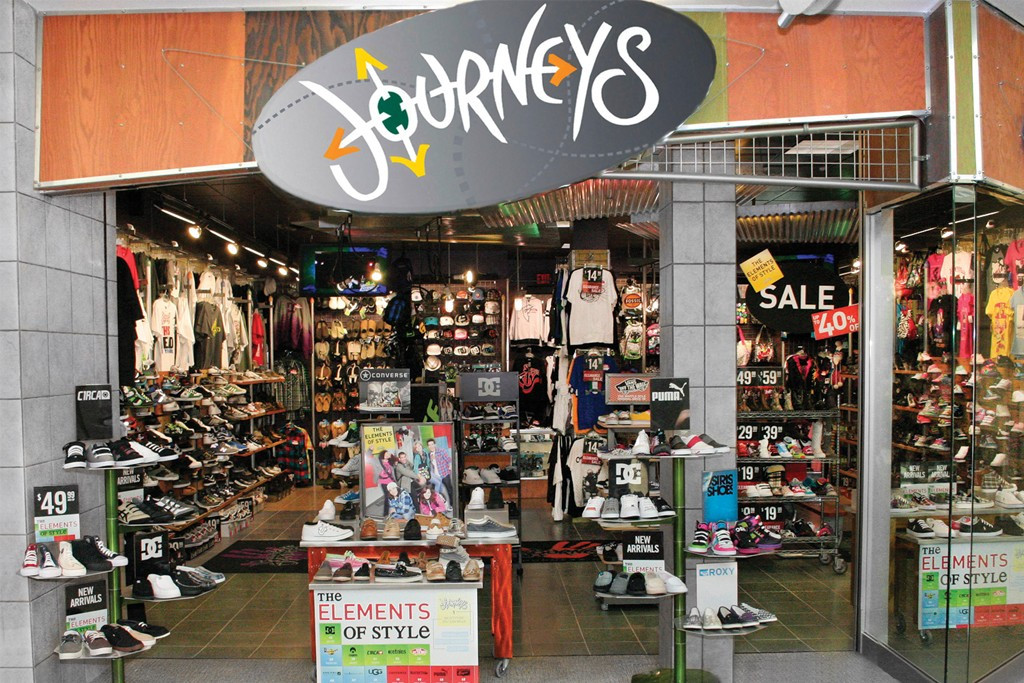

About Genesco

Genesco Inc operates as a retailer and wholesaler of footwear, apparel, and accessories. The company operates through four segments: Journeys Group, Schuh Group, Johnston & Murphy Group, and Licensed Brands. The Journeys Group segment offers footwear and accessories through the Journeys, Journeys Kidz, and Little Burgundy retail chains, as well as through e-commerce and catalogs for young men, women, and children.