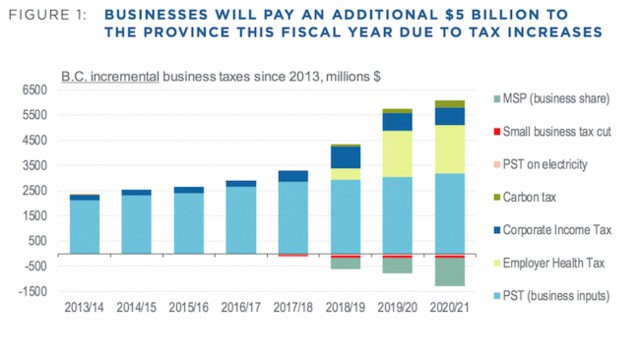

A new report from the Business Council of BC estimates B.C. businesses are paying nearly $5 billion more in annual taxes than they were in 2013.

BCBC says the cumulative tax increase, coupled with regulatory changes, is weighing on investment and business sentiment in B.C.

Provincial sales tax (PST), the new Employer Health Tax (EHT) and higher corporate taxes have cost B.C. businesses additional billions over the past six years.

The sky isn’t falling, explains BCBC chief economist Ken Peacock. But he says the layering on of various tax policies is a burden for business, and the real cost goes beyond additional billions.

“Not investing, not choosing to update or upgrade facilities, not expanding operations, not opening a new branch or a new facility or a new site, and just adopting a bit more of a wait-and-see-what’s-happening-in-other-jurisdictions approach,” Peacock says of the tax burden implications that are difficult to quantify.

The report examines six years of policy changes and their financial impact on businesses – a period that includes policies enacted by BC Liberal and NDP governments.

During that time, it pins the single largest tax increase on a return to a PST system in 2013 after a failed attempt to shift the province to a Harmonized Sales Tax (HST) regime. BCBC calculates that under a PST system, businesses are paying an additional $3 billion in sales tax on inputs – costs that would have been eliminated under the HST.

The second biggest tax increase is B.C.’s new EHT, which took effect at the start of this year and replaces Medical Services Plan (MSP) premiums, which will be eliminated in 2020. BCBC estimates the net tax impact on B.C. businesses to total $800 million per year.

A two-percentage-point increase in the province’s corporate income tax rate since 2013 is the third most significant tax hit for businesses. A one-point increase came under the BC Liberals, and the BC NDP matched it in 2017.

A rising carbon tax was also highlighted as a contributor to businesses’ tax burden. After thawing a $30-per-tonne freeze in 2018, B.C. implemented two $5-per-tonne increases, bringing the tax’s total to $40 per tonne. BCBC estimates that $10 increase will cost companies an additional $170 million to $175 million in aggregate costs.