Supplying New England remains company’s ‘goal and commitment’

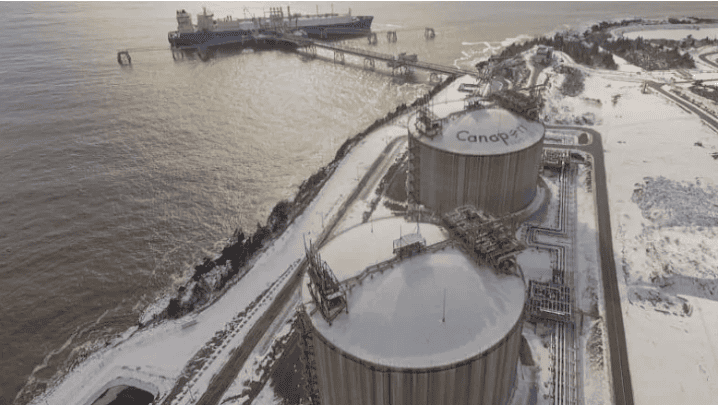

The general manager of Canaport LNG says the end of natural gas production off Nova Scotia has done little to boost production at his Saint John import facility.

“We were hoping to see more business, to tell you the truth,” said Javiar Azagra. “We thought it was going to be more opportunities for us to bring more gas but actually it didn’t happen.”

After almost two decades, gas supplies have run out at the Nova Scotia gas fields at Cape Sable Island and Deep Panuke.

Production was stopped completely Jan. 1.

Corridor only producer left

That left Corridor Resources the only natural gas producer in the Maritimes, but according to consultant Todd MacDonald of Energy Atlantica, Corridor can supply less than one half of one per cent of the total natural gas demand in the region.

The remainder is being met largely through suppliers in the U.S. and even Alberta, said MacDonald, with gas arriving here through the Maritimes and Northeast pipeline via Maine.

He expects prices in the region to remain relatively stable thanks to long-term contracts for transportation costs.

“If you think about your natural gas, it has two components, the actual cost of the molecule and then the cost to transport that molecule,” said MacDonald.

“And now the cost to transport that molecule has been fixed at a fixed price for the next 15 or 20 years. And that represents upwards of 75 percent of your total cost.”

Existing long-term contracts made by natural gas customers may be part of the reason Canaport LNG could pick up little new business when offshore Nova Scotia gas vanished from the marketplace.

The company imports gas in liquid form to reduce volume. It is then returned to gas form and marketed via pipeline through Repsol S.A. which, said Azagra, is willing to buy the product from other sources according to price.

Repsol is also a parent company to Canaport LNG.

Azagra said 2019 turned out to be an average winter, with the company pushing gas into the U.S. “spot” market to meet peak demand during cold snaps.

“It’s always very depending on how hard is the winter,” he said. “At Canaport we fulfil the demand of the market of New England. That’s our goal and commitment.”

Competition increases

And there was some stiff competition for that peak winter business over the past several months.

After a two-year break, a ship-based LNG regasification plant was back in operation this winter 20 kilometres off the Boston coast.

Its absence in 2018 helped give Canaport LNG a boost from bringing in just four ships in 2016 to seven ships last year.

Each vessel, said Azagra, carries about 150,000 cubic metres of LNG, which converts to about 87 million cubic metres of natural gas.

Azagra expects little improvement in the volume of business over the next year or two.

He said carbon pricing and the tightening of environmental regulations surrounding marine fuels could send customers in search of cleaner fuels such as natural gas further down the road.