It will also roll out in Puerto Rico later this year.

T-Mobile’s entry into the mobile banking game is now available nationwide, a bit over four months after it first rolled out as a pilot program. The mobile-first checking account is called T-Mobile Money, and it comes with some sweet perks for the carrier’s subscribers. It has no fees and offers a four percent Annual Percentage Yield (APY) for users’ money up to $3,000 — everything above that will have a one percent APY — so long as they sign up with their T-Mobile ID and deposit at least $200 each month.

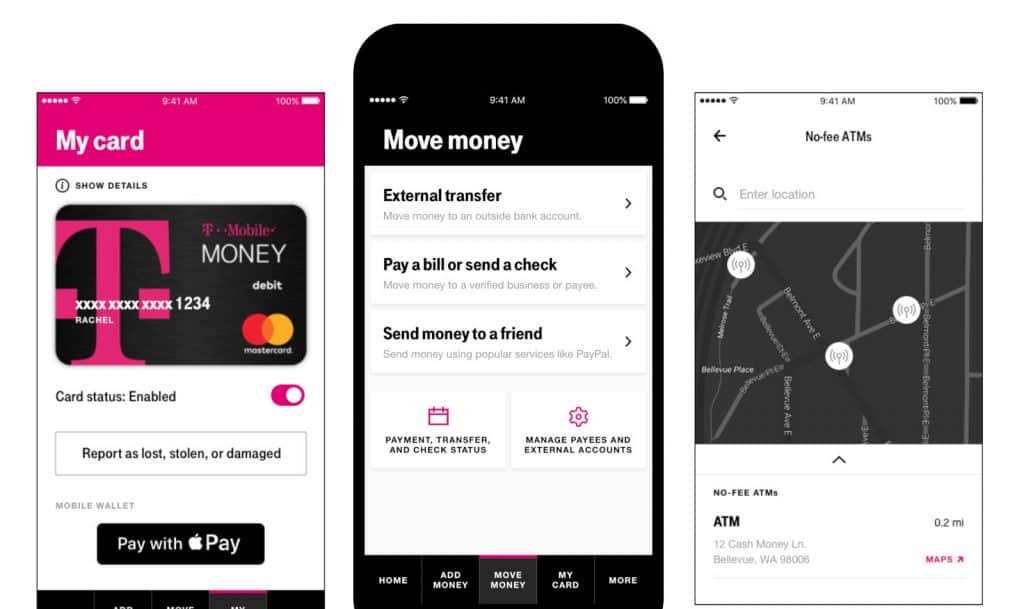

If users can stick to the required minimum deposit, they can also opt in for the Got Your Back overdraft. That gives them a $50 overdraft protection, so they can withdraw a few more bucks without incurring penalties for when times are especially tough. The app also gives them a way to transfer money, make mobile check deposits, pay bills, send checks and even pay with mobile wallets, including Apple Pay, Google Pay and Samsung Pay.

T-Mobile created the service in partnership with BankMobile, a division of Customers Bank. An account comes with a Mastercard debit card subscribers can use to pay for purchases or for withdrawals at 55,000 Allpoint ATMs worldwide. Anyone interested can use the service either via its official website or its Android and iOS app, which are now available for download from Google Play and Apple App Store, respectively. Residents from any of the 50 US states 18 and older with a social security number can sign up for an account. Later this year, the service will become available to more potential users when it makes its way to Puerto Rico.