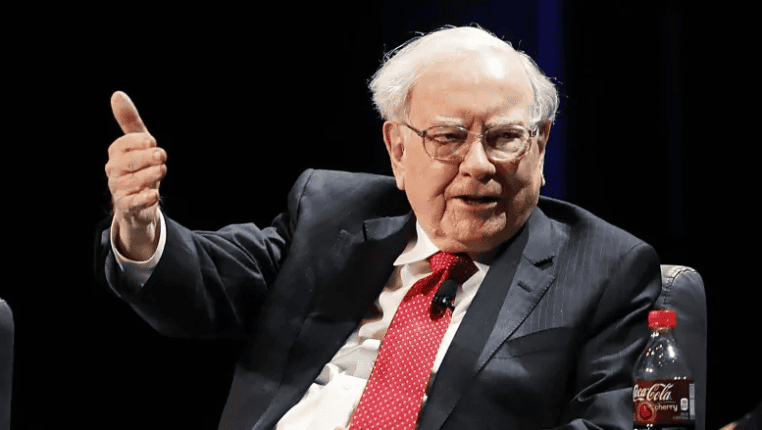

Falling stocks, Kraft Heinz trigger huge Berkshire Hathaway 4th quarter net loss

Billionaire Warren Buffett says the company he built through decades of acquisitions continues to perform well even though he hasn’t found any major deals at attractive prices recently.

Buffett released his annual letter to Berkshire Hathaway Inc. shareholders on Saturday. He wrote that investors should continue betting on the American economy because Berkshire has prospered by doing so, but that they shouldn’t forget about the rest of the world.

“There are also many other countries around the world that have bright futures. About that, we should rejoice: Americans will be both more prosperous and safer if all nations thrive,” Buffett wrote. “At Berkshire, we hope to invest significant sums across borders.”

Buffett wrote that the two potential successors he promoted last year to oversee most day-to-day operations are doing well, but the 88-year-old tycoon made no mention of retiring.

Praise for firm’s new managers

Longtime Berkshire executives Greg Abel and Ajit Jain joined the company’s board last January and took on additional responsibilities. Jain now oversees all of the conglomerate’s insurance businesses while Abel oversees all of the conglomerate’s non-insurance business operations.

“These moves were overdue,” Buffett said. “Berkshire is now far better managed than when I alone was supervising operations. Ajit and Greg have rare talents, and Berkshire blood flows through their veins.”

Buffett wrote that Berkshire continues to hold roughly $130 billion US in cash and short-term investments because he hasn’t found any reasonably priced acquisitions in recent years, so he’ll likely continue investing more in stocks.

Long-term prospects costly

“Prices are sky-high for businesses possessing decent long-term prospects,” he wrote.

Edward Jones analyst Jim Shanahan said he was disappointed that Berkshire didn’t use more of its cash to repurchase its own shares or invest in other stocks, especially when the market declined near the end of the year.

Buffett’s letter is always well-read in the business world because of his remarkable track record and his talent for explaining complicated subjects in plain language.

Berkshire reported a $4-billion profit for last year as most of its eclectic mix of businesses — including BNSF railroad, Geico insurance and several large utilities — performed well. But that was significantly lower than the previous year’s $45 billion, because Berkshire had to write down the paper value of many of its stock holdings.

Still, Andy Kilpatrick said the results were better than he expected.

“Berkshire’s operating businesses are doing great,” said Kilpatrick, a retired stockbroker and author who wrote Of Permanent Value: The Story of Warren Buffett. “I’m glad to see there’s no talk of retirement.”

Berkshire Hathaway Inc. owns more than 90 companies, including the railroad and clothing, furniture and jewelry businesses. Its insurance and utility businesses typically account for more than half of the company’s net income. The company also has major investments in such companies as Apple, American Express, Coca-Cola and Wells Fargo & Co.

4th quarter net loss

On the same day of the letter’s release, the company reported a huge quarterly net loss, even as operating profit soared.

Sinking stocks and deteriorating prospects from an investment in Kraft Heinz pummelled the company’s bottom line.

The fourth quarter net loss was $25.39 billion, or $15,467 per Class A share, reflecting more than $27.6 billion of investment losses, including from stocks Berkshire still owns.

That compared with a year-earlier profit of $32.55 billion, or $19,790 per Class A share, most of which resulted from a lowering of the U.S. corporate tax rate.

Results included a $3.02-billion writedown for intangible assets that Buffett said was “almost entirely” attributable to Kraft Heinz, in which Berkshire owns a 26.7 per cent stake.