The maximum amount you can contribute to your 401(k) retirement savings plan is climbing by $500 in 2019. If you’re younger than 50, the maximum is now $19,000 rather than last year’s $18,500. If you’re 50 or older, it’s now $25,000 versus last year’s $24,500.

What does that mean to you? Frankly, the hike in the amounts themselves aren’t too significant. The 401(k) contribution limits have always been generous enough so even assiduous savers don’t come within throwing distance of meeting the maximum. If you do max your account out, though, you can save $500 more this year. If you don’t come close, it’s still good to be reminded of how dynamic retirement vehicles 401(k)s can be. Here are the benefits of 401(k)s as we head into 2019.

1. Saving in a 401(k) helps you prepare for a comfortable retirement

Many people planning for retirement think first of Social Security, even though the average yearly Social Security benefit is just $17,532, or $1,461 every month — and that includes a recent cost-of-living adjustment. This isn’t enough for most people to live on, meaning it’s likely you will need to draw on your retirement savings or work at least part time during your retirement, or a mix of both. By utilizing a 401(k), you’re doing yourself a big favor for the future by bulking up your nest egg.

2. Saving in a 401(k) lowers your tax bill

A chief benefit of 401(k) accounts is that contributions are made pre-tax, meaning you don’t pay tax on the amount you store in your account when you do it. If you make $75,000 annually and contribute $5,000, come tax season, you’ll only be taxed on $70,000 for that year. Your 401(k) funds continues to grow free of tax until you withdraw the money in retirement, at which point it’s finally taxed.

3. Many employers match 401(k) contributions with free money

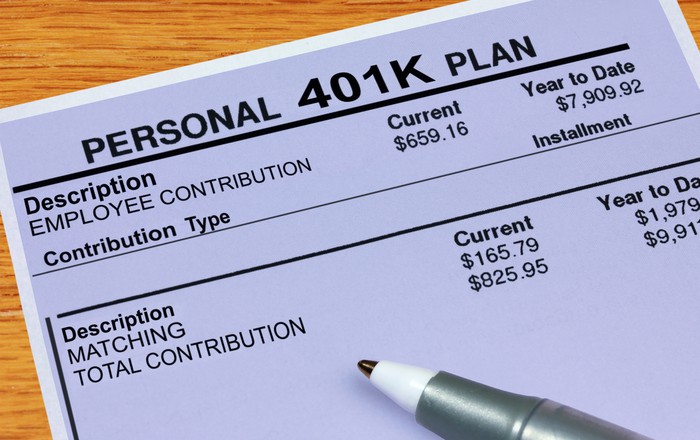

What’s the best kind of money? Free money. More than three-quarters of U.S. employers who provide a 401(k) plan also offer matching contributions, according to the Investment Company Institute (ICI). A 401(k) match can power your ability to save for retirement. What it means is this: For every amount you contribute to the 401(k) plan, your employer puts that same amount (or a percentage of it) in your account too! The most common employee contributions are between 4% to 6% of their total income, and the most common employer matches are 50% and 100% of that contribution amount, according to BrightScope/ICI.

Say you earned $60,000 and contributed 4% pre-tax to your 401(k). In a year, you’ve saved $2,400. If your employer matches 50% of your contribution, that’s an additional $1,200, for a total of $3,600.

4. You can save via payroll deduction

Automating your savings is the best way to save, because it happens without you having to think about it. Contributions to employer-sponsored 401(k) plans are taken out by payroll deduction and your propensity to save is 15 times greater if you use payroll deductions.

Make sure your 401(k) is up to speed

Do some research to find out if your 401(k) plan is the best option available to you. Generally speaking, your company should offer investment options that give you real choices of where to put your money, by choosing from the primary asset classes, such as stocks, bonds, and money market funds. The choices should allow you to build a balanced portfolio, with varying degrees of risk.

On average, 401(k) plans in the U.S. provide roughly 13 stock funds (about 10 U.S. funds and three international funds), according to the Investment Company Institute. If your plan offers significantly fewer, or only offers your company’s stock as an option, reconsider whether it’s a good plan. Investing in your company’s stock as a retirement vehicle doesn’t provide sufficient diversity. If your company goes through a bad patch or even goes under, it’s not prudent to have your salary, job prospects, and retirement tied up in its financial fate.

Scope out what you’re paying in fees as well. The fees on 401(k) plans in the U.S. are an average of 1%, according to the Center for American Progress. Check the fine print; if yours charges significantly more, it can erode the value of your account.

What happens if you can’t come close to the 401(k) maximum contribution, or your investment choices aren’t optimal, or the fees look high, or a combination of the three?

…and consider a traditional IRA if it’s not

Then it’s time for traditional Individual Retirement Accounts (IRAs) to come to the rescue! A traditional IRA also offers pre-tax savings. Your savings accrue pre-tax as well; traditional IRA funds are taxed upon withdrawal. You must start required minimum distributions (RMDs) at age 70 1/2.

Nicely enough, maximum contributions for IRAs are also rising for 2019, to $6,000 per year if you’re under 50 and $7,000 if you’re 50 and over. IRAs can be opened at a bank, brokerage, or other financial institution. All offer self-directed accounts, where you decide whether you want to place your funds in stocks, bonds, or money markets.

The traditional IRA is one type. There is also a Roth IRA, which does not offer pre-tax contributions. You contribute after-tax money, but the Roth IRA grows tax-free and is not taxed when you withdraw the funds later in retirement, like the traditional IRA is.

You can also save pre-tax for retirement in both a 401(k) and a traditional IRA. If your employer does offer a 401(k) match, consider contributing enough to your 401(k) to receive your employer’s match, then fund your IRA for the year.

When it comes to retirement savings, the more you sock away using a retirement vehicle, the more you’ll ultimately have in your golden years. If you save $10,000 every year, for example, the money will compound to $156,455 in 10 years if you receive an 8% annual compound rate of return. And in 30 years? The same yearly investment total and return rate could result in a robust $1.2 million for your retirement. Sweet!