Flat Returns Test The Impatient, And It Is Happening Right Now

First, for those who think of me as one of those perma-bears, I am nothing of the sort. I can’t wait to invest in the next U.S. stock bull market. But first, we must muddle through a period of negative, or at best weak positive returns. So, in that sense, I guess I am a realist. And there is something going on right now regarding the very popular approach of investors looking at trailing returns on their investments. If the current cycle is like many that preceded it, there will be confusion, frustration and ultimately some very bad moves made by investors attempting to get a “quick-fix” in their portfolio. The two charts below will show you what I mean.

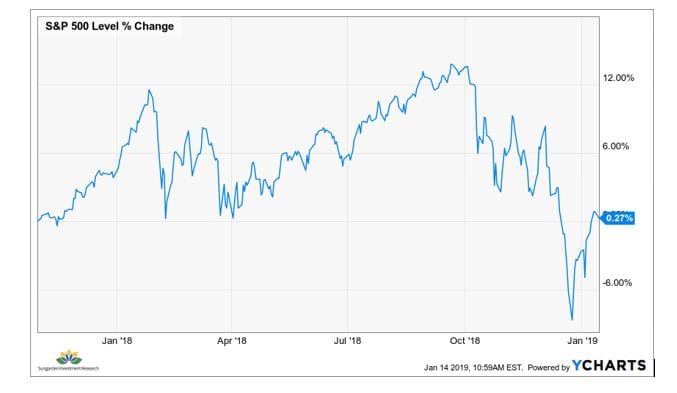

This first one shows that the S&P 500 Index has been about flat since the start of November 2017. That is over 14 months during which perhaps the most popular investment in many portfolios has produced about zero return. That is par for the course with long-term investing, and it also reinforces the impact that bear market cycles have on long-term returns for those who just sit there and take it. That’s why I am such a fan of tactical investing. You don’t have to sit there and take it. You can defend and potentially even exploit down markets in stocks, bonds or both.