Investing can be a daunting prospect, whether you’re first starting out or have been doing it for years. The truth is that there’s a lot of misinformation out there about investing, but if you manage to steer clear of it, you’ll have an easier time putting your money to work for you. With that in mind, here are three myths about investing you can’t afford to buy into.

1. You need lots of money to make investing worthwhile

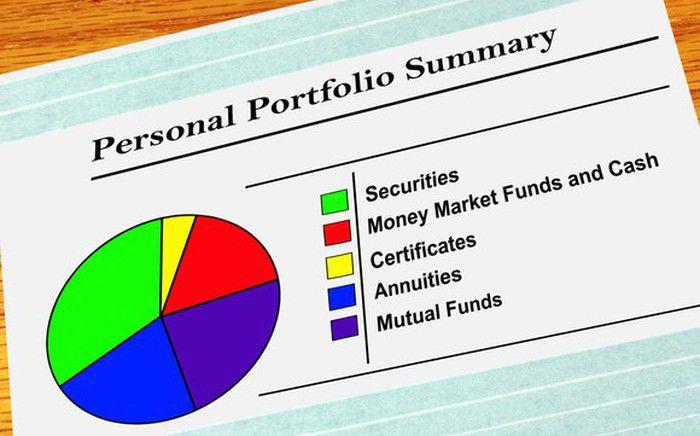

The more money you’re able to invest, the more growth potential you have. But that doesn’t mean you can’t invest with a smaller sum of cash. While certain investments, like mutual funds and municipal bonds, typically impose a minimum investment requirement, there’s a world of stocks that can be purchased for well under $100 a share.

In other words, don’t assume that it’s not worth investing a mere $200 here or $500 there. Over time, that money has the potential to grow into something really big. In fact, if you were to invest $100 over a 40-year time frame at an average annual 7% return (which is actually a few percentage points below the stock market’s average), you’d grow it into $1,500. Invest $1,000 under the same circumstances, and you’d be looking at $15,000.

2. You should dump all of your stocks in retirement

Seniors are often told that holding stocks in retirement is a risky prospect. The logic is that because seniors tend to take regular withdrawals from their portfolios to pay their living expenses, they can’t afford to keep their money in volatile investments with the potential to lose value overnight. But while it’s a dangerous idea to go heavy on stocks in retirement, they still have a place in your portfolio when you’re older.

In fact, the famous 4% rule for retirement plan withdrawals hinges on seniors holding onto some stocks. The rule states that if you start by withdrawing 4% of your nest egg’s value during your first year of retirement, and then adjust subsequent withdrawals for inflation, your savings should last 30 years. But that rule assumes a relatively healthy mix of stocks and bonds, and if you don’t have much in the way of stocks, your portfolio might not achieve the growth it needs to sustain a 4% annual withdrawal rate. Therefore, while it pays to scale back on your stock investments in retirement, there’s no need to unload them completely.

3. Bonds are always a safe bet

Generally speaking, bonds are far less volatile than stocks, which means they’re considered a lower-risk investment. But that doesn’t mean they’re risk-free. A bond’s value hinges on its issuer’s ability to keep up with its financial obligations, so if you buy bonds whose issuer’s credit rating gets downgraded, the value of your bonds could plummet. Furthermore, if you buy bonds from an issuer that encounters financial trouble, you could end up out of luck if that issuer fails to make interest payments as scheduled.

That’s why you must research each investment you make, bonds included, rather than operate under the assumption that all bonds are safe to buy. Furthermore, once you add bonds to your portfolio, it’s important that you monitor them regularly and be on the lookout for signs of a potential default.

The more you educate yourself about investing, the more successful you’re likely to be at it. You can invest with a minimal amount of cash, hold stocks when you’d older, and lose money on bonds, so the next time someone tries to convince you to believe one of these myths, you’ll know to ignore that very bad advice.