$300M shortfall has some people wondering if homeowners should pay more

A $300-million drop in non-residential property values, mostly in downtown Calgary, has some in the business community suggesting homeowners should pay more to cover the shortfall.

It may not be a popular position to take, but even the city’s top bureaucrat suggests it may be the only option for city council as it struggles to fill that massive decline in the value of downtown office buildings.

The so-called business property tax shift was essentially triggered by falling oil prices, which led to layoffs, a drop in demand for office space and a steep plunge in the value of office towers.

Big drops in assessments mean lower tax bills. The city, though, still has to collect about the same amount of money, so that means someone else has to pick up the difference.

It means increases in tax bills for business properties outside of the downtown core.

For each of the past two years, city council has reached into savings for more than $80 million to limit tax increases to no more than five per cent.

At Alberta Fire and Flood, a disaster restoration company, the firm is dealing with its own tax problems: a doubling of its tax bill in five years.

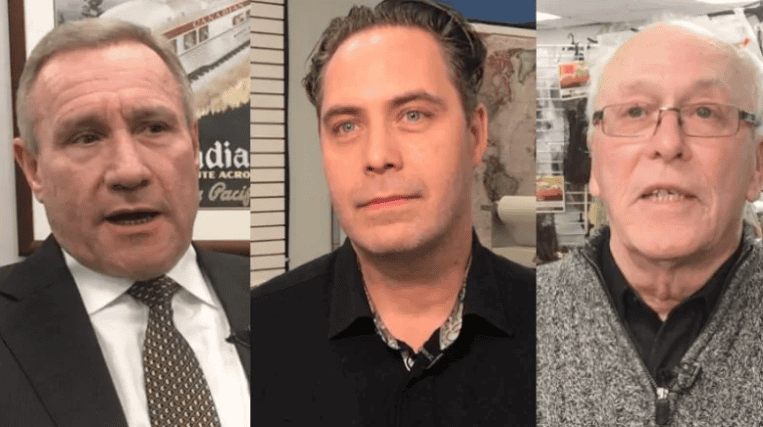

“I don’t think that administrations are getting the pain and suffering that small- and medium-sized businesses are incurring and the load that’s being transferred,” said David Smith, one of the company’s owners.

“I think that there’s a lot of companies that are really struggling to keep themselves afloat, and having your property taxes double in five years, for a lot of businesses that is going to be a real difficult problem.”

Smith hasn’t seen the company’s property assessment for 2019 yet, but he expects his tax bill to reach $80,000 this year.

Not fair, no empathy

At Fairplay Stores, a pet supply store in northwest Calgary, owner Don Lee says the city, well, isn’t playing fair.

“You’re not putting words in my mouth at all, this isn’t fair,” said Lee.

“I mean, eventually this is going to cripple small businesses. We hear stories all the time of restaurants and small businesses going out of business,” he said.

The city has provided tax relief the past two years by limiting non-residential property tax increases.

So far, no decision has been made on whether the so-called “phased tax program” will be renewed again this year. Council is looking at different scenarios that could include another five per cent cap — or possibly 10 per cent.

A five per cent cap for 2019 would cost $89 million.

“I know that the city has dipped into its rainy day fund to try and help, but listen, that’s not a long-term solution,” he said.

Lee says city spending needs to be trimmed, including wages and salaries.

“It’s hard sometimes as a small business owner. We’re not millionaires and we see some of the salaries that are being paid to city employees. Our fellows come in here and they’re making $18, $19, $20 dollars an hour and they see somebody out there on the end of the shovel making $30. Well, maybe we need to take a hard look at that,” he said.

Homeowners should pay more

Terry Steinke owns Map Town in downtown Calgary. He knows what suburban business owners are going through after he experienced rising property tax bills when downtown commercial property values spiked several years ago.

While he’s seeing a break on his tax bill now, he feels the city also needs to restrain spending to ease the tax burden for all businesses.

“What I would like to challenge the mayor and city council is try to control your expenses,” said Steinke.

“Do we have to have property tax increases every single year?” he asked.

He says one possible solution is to shift more of the burden onto homeowners, not businesses.

“If your property taxes went up, say, by $25 a month, or $250 a year, is that going to make or break your household?”

Smith, at Alberta Fire and Flood, says it won’t be popular but it should be looked at.

“Residential property taxes are still undervalued, I think, in Calgary, compared to other cities,” he said.

“But I mean it’s a pretty tough thing when people, especially seniors and people on fixed incomes, to suddenly find out that you’re going to have another $2,000 on your residential tax bill in the next year,” he said.

‘Most vexing problem’

City manager Jeff Fielding says Calgary is facing quite the conundrum.

“This is the most vexing problem I’ve ever faced, and it was such a dramatic change over such a short period of time on a specific segment of our assessment base, said Fielding.

While council has yet to decide how to tackle the issue this year, Fielding says the residential tax base must be considered.

“Really, the only way that you’re going to get at it specifically is start moving the ratio of non-residential to residential. And you know we do enjoy the lowest residential taxes in the country,” he said.

“That’s only the immediate solution that you have and it would have to have take place over a gradual period of time,” he said.

City council is expected to make a decision on a possible relief program before tax rates are finalized in April.