If you want an edge in investing, you need to look at money flows from the smart money and the momo crowd

Investors who want an edge in the stock market know from experience that segmented money flows are one of the tools that work. During the rip-roaring bull market, many investors did not care about an edge. They simply believed in “buy, buy and buy.” Some of those investors are now realizing that they want tools to give them better foresight.

Is foresight better than hindsight? Let us explore segmented money flows with the help of a chart.

Chart

Please click here for a chart showing segmented money flows in 11 popular tech stocks. Since tech stocks have been the leaders of this market, it makes sense to look at tech stocks in addition to the Dow Jones Industrial Average DJIA, +0.14% and popular, broad ETFs such as S&P 500 ETF SPY, +0.19% Nasdaq 100 QQQ, +1.05% and small-cap ETF IWM, -0.29% Please note the following:

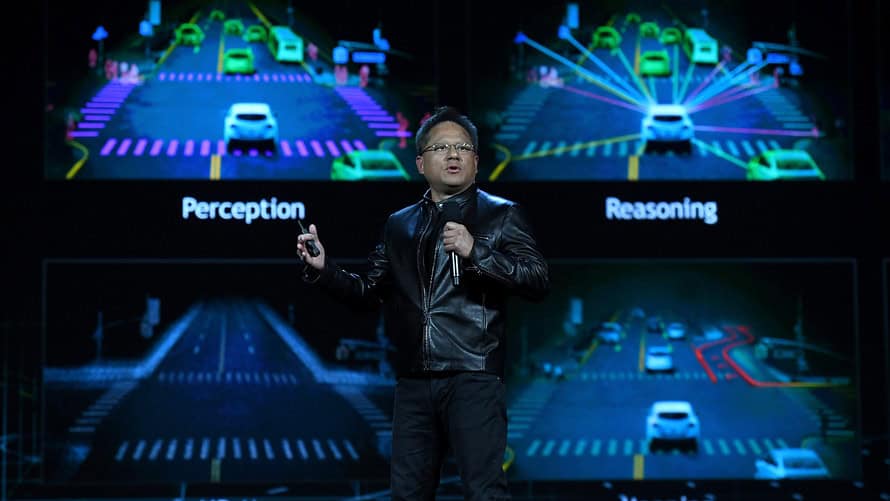

• Nvidia NVDA, +2.88% has been the poster child of this bull market. When Nvidia was trading at $292, smart money flows in Nvidia were negative but momo (momentum) crowd money flows were positive and at times extremely positive. Since then, smart money flows consistently stayed negative on Nvidia while momo crowd money flows stayed positive until the stock gapped down. Nvidia has recently traded as low as $133.31.

Interestingly, after staying negative for a long time, smart money flows have turned neutral in Nvidia while momo crowd money flows are extremely negative.

During the decline and at the top in Nvidia, The Arora Report rating has been a “sell.” However, now the ZYX Change Method is coming close to giving a “buy” signal if there is a major down spike in Nvidia below the recent low. We will provide a specific buy zone along with a stop zone and a target zone, and the appropriate position size when the signal is given.

• When Apple AAPL, +0.66% was reaching its high at $233.47, smart money flows were neutral but momo crowd money flows were positive and at times extremely positive. After about a $68 drop in Apple’s stock, momo crowd money flows in Apple are negative.

The Arora Report’s “buy now” rating during Apple’s drop and at the top has been a “no.”

• Smart money flows are positive in Intel INTC, +2.10% but neutral in AMD AMD, +2.72% Momo crowd money flows are negative in both.

• Smart money flows are mildly positive in Facebook FB, +3.22% and Google GOOG, +0.29% GOOGL, +0.63%

• Smart money flows are neutral in Alibaba BABA, -1.06% but momo crowd money flows are extremely negative.

• Smart money flows are neutral in Amazon AMZN, +0.73% Netflix NFLX, +1.72% Microsoft MSFT, +2.64% and Tesla TSLA, +2.01%

Rankings

The chart also shows relative rankings of the 11 popular tech stocks. Those rankings are based on the six screens of the ZYX Change Method. Please click here to learn about the six screens.

Risk-adjusted rankings are more useful for medium-term and long-term positions. Non-risk-adjusted rankings are more useful for short-term positions and trade-around positions.

What to do now

Investors need to accept that the character of the market is changing. What has worked over the past nine years may not work in the future. Investors ought to shift their mindset from the “buy, buy and buy” mode. Consider following a comprehensive adaptive model that has a proven track record in both bull and bear markets. It is important to not rely on static models because market conditions have changed.