Layoffs appear to rise around Thanksgiving, but could recede soon

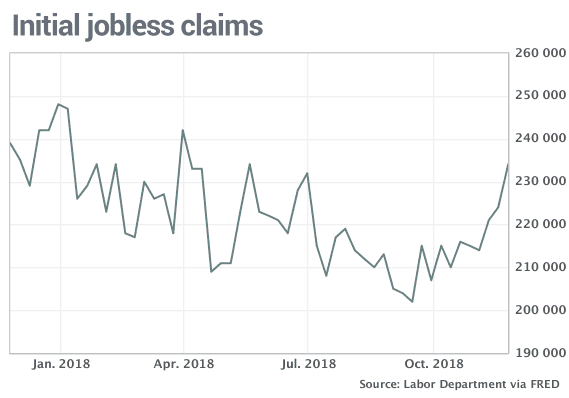

The numbers: The number of Americans who applied for unemployment benefits in the week of Thanksgiving rose to the highest level in six months. But the recent upturn might stem from holiday-season hiccups or other temporary factors and it could be reversed soon.

Initial jobless claims, a rough way to measure layoffs, rose by 10,000 to 234,000 in the seven days ended Nov. 24, based on seasonally adjusted government figures.

It was the third straight increase and easily topped the 220,000 forecast of economists polled by MarketWatch.

The monthly average of new claims also rose, up 4,750 to 223,250.

The number of people already collecting unemployment benefits, meanwhile, rose by 50,000 to 1.7 million. These so-called continuing claims are still near the lowest level since the early 1970s, however.

What happened: The sudden increase in claims seems rather unusual.

Despite some high-profile announcements of layoffs at storied companies such as General Motors GM, -1.11% the U.S. unemployment rate sits at a 48-year low. Job openings are also near a record high.

Claims could be higher due to the lingering effects of recent hurricanes or even the California brush fires, but there’s little evidence on offer.

The holiday season is also a time when claims can gyrate due to government closures and delays in when people apply for benefits. Workers don’t always file claims right away and companies hire and let go many seasonal employees.

New jobless claims actually fell last week if the government’s seasonal adjustments are stripped out. Raw claims declined by 8,651 to 217,834.

While claims are likely to fall soon, these numbers bear watching.

Big picture: The U.S. economy is not growing as fast as it did in the spring and summer, but it’s still going strong more than nine years after the end of the last recession. Consumers remain upbeat, the holiday season is shaping up to be a strong one and a stock market rebound has also calmed frayed nerves.

Market reaction: The Dow Jones Industrial Average DJIA, -0.15% and the S&P 500 SPX, -0.28% were set to open lower on Thursday after a big rally the day before. Investors have turned bullish after the Federal Reserve chairman seemed to suggest U.S. interest rates won’t rise much further.

The 10-year Treasury yield TMUBMUSD10Y, -1.11% slipped a tick to 3.02%. Yields have tumbled after recently hitting a seven-year high.