Sentiment didn’t fall this sharply from one month to another even during the worst of the housing crisis

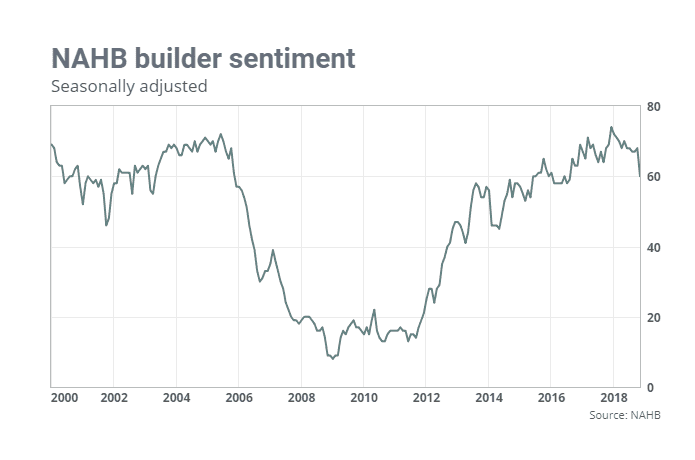

The numbers: The National Association of Home Builders’ monthly confidence index plunged eight points to 60 in November.

What happened: The many headwinds that have been dogging the industry finally showed up in this report. Labor is still expensive, lots are still scarce, lumber is at the mercy of tariff politics, and now, mortgage rates are rising and customers are holding back.

NAHB, the building industry’s Washington lobby, noted in a press release that the reading of 60 is still “positive,” but that “customers are taking a pause.” The eight-point plunge is only reminiscent of the nine-point drop just after the 9/11 attacks and one other instance, a 10-point drop, in early 2014. The overall reading is the lowest since mid-2016. November’s results badly missed the Econoday consensus of a flat reading.

In November, the sub-gauge of current conditions fell seven points to 67, the tracker of expected future conditions plunged 10 points to 65, and the gauge of buyer traffic was down eight points, to 45.

Any reading over 50 signals improvement.

Big picture: The gauge of builder sentiment has long been considered an early read on the pace of construction, an important economic indicator considering how desperately more new homes have been needed.

But such a sharp drop may presage something more sinister than a slower pace of building. Home builders were one of the first groups to feel the top of the market cycle just before the Great Recession. In June 2005, NAHB’s index hit 72, its cycle high. It started to tumble the next month, and by mid-2006 stood in contraction territory.

To be sure, builders may not be the canary in the coal mine now as they were a decade ago. And many economists have called the top of the housing cycle already. Still, such a sharp drop can only seem ominous.

What they’re saying: “Housing is performing at a moderately high level, but it also appears to be settling into a plateau,” Jefferies economists wrote after the NAHB release. “Moderation in housing activity is a blessing that delays what has previously been an inevitable development of excesses. While the pace of housing market activity has decelerated, there are no signs of threatening excesses such as inventory overhangs and a surge in delinquencies.”

The Jefferies economics team also noted that November’s NAHB survey had far fewer respondents than October’s: 315 versus 360. “Some of the volatility in this data can be traced to the month-to-month changes in the sample,” they observed.

Moody’s Investors Service on Monday downgraded its outlook on the U.S. building materials industry, saying that “private residential construction growth is decelerating.”

Market reaction: All the headwinds that builders have been complaining about may already be baked into big-company stocks. Shares of D.R.Horton, Inc. DHI, +0.52% are down 32% in the year to date, while KB Home KBH, +2.53% shares have lost 41% in that time.