Chip maker reports computing and graphics sales of $938 million while Street expected $1.05 billion

Advanced Micro Devices Inc. shares plummeted in the extended session Wednesday after the chip maker’s outlook and revenue fell short of Wall Street estimates owing to weaker-than-expected graphics sales as blockchain-related became a negligible part of the company’s business.

AMD AMD, -17.42% which had been down as much as 25% after hours, were last down 22% in the extended session following the company’s conference call, Shares closed down 9.2% at $22.79 in regular trading.

AMD’s third-quarter revenue rose to $1.65 billion from $1.58 billion in the year-ago period. Wall Street expected revenue of $1.7 billion from AMD, which had forecast revenue of $1.65 billion to $1.75 billion for the third quarter. Estimize, a software platform that uses crowdsourcing from hedge-fund executives, brokerages, buy-side analysts and others, expected revenue of $1.75 billion.

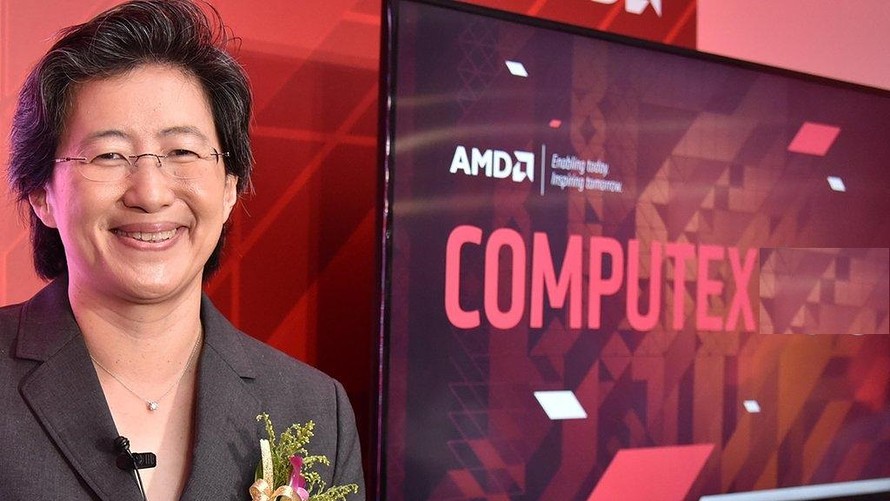

“Client and server processor sales increased significantly although graphics channel sales were lower in the quarter,” said Lisa Su, AMD chief executive, in a statement.

On the conference call, Su said weak graphics processing unit, or GPU, sales resulted from a dropoff in blockchain-related sales, which includes those to cryptocurrency miners. In the previous year’s quarter, blockchain sales accounted for a “high single digit percentage” of AMD’s revenue, whereas in this quarter they were “negligible,” said Chief Financial Officer Devinder Kumar on the call.

Less than a year ago, the price of Bitcoin BTCUSD, -0.47% topped out at more than $19,000 in December, while the price of Ether, the cryptocurrency that runs of the Etherium blockchain, had surged to more than $1,300 in January. That was when AMD was saying about 10% of GPU revenue was tied to blockchain sales. On Wednesday, Bitcoin traded at $6,463.01, while Ether was at $201.22.

AMD reported computing and graphics sales of $938 million for the third quarter, while analysts had expected $1.05 billion. The company reported enterprise embedded and semi-custom sales of $715 million, while analysts had forecast $653 million.

Su said she expects data center GPU sales to be a “meaningful contribution” to fourth-quarter sales, but it won’t be a quick fix.

“We are expecting that it might take a couple quarters to completely get back to a normal channel, however it is factored into our Q4 guidance,” Su told analysts. For the fourth quarter, AMD estimates revenue of $1.4 billion to $1.5 billion, while analysts had forecast revenue of $1.6 billion.

The company reported third-quarter net income of $102 million, or 9 cents a share, compared with $61 million, or 6 cents a share, in the year-ago period. Adjusted earnings were 13 cents a share.

AMD was expected to post adjusted earnings of 12 cents a share, according to analysts surveyed by FactSet. Estimize had called for earnings of 15 cents a share.

Of the 34 analysts who cover AMD, 13 have buy or overweight ratings, 16 have hold ratings and five have sell or underweight ratings, with an average price target of $25.62, according to FactSet.

AMD shares have been on a volatile roller-coaster ride after the company reported its best earnings in seven years in its previous report, rallying to peak at a 12-year high of $34.14 in mid-September, capping an impressive five-month, 200% surge, and were 33% off from that peak by the close Wednesday.

Adding to fears of a China trade war and a supply glut, chip maker stocks have led the broader market selloff of late as other chip makers have also forecast weaker-than-expected outlooks.

As of Wednesday’s close, AMD’s stock remains the best year-to-date performer on the S&P 500 with a 122% gain and has been the second-most actively traded stock on the index over the past 52 weeks. In comparison, the S&P 500 SPX, -3.09% is down 0.7% for the year, the tech-heavy Nasdaq Composite Index COMP, -4.43% is up 3%, and the PHLX Semiconductor Index SOX, -6.61% is down 8.5%.