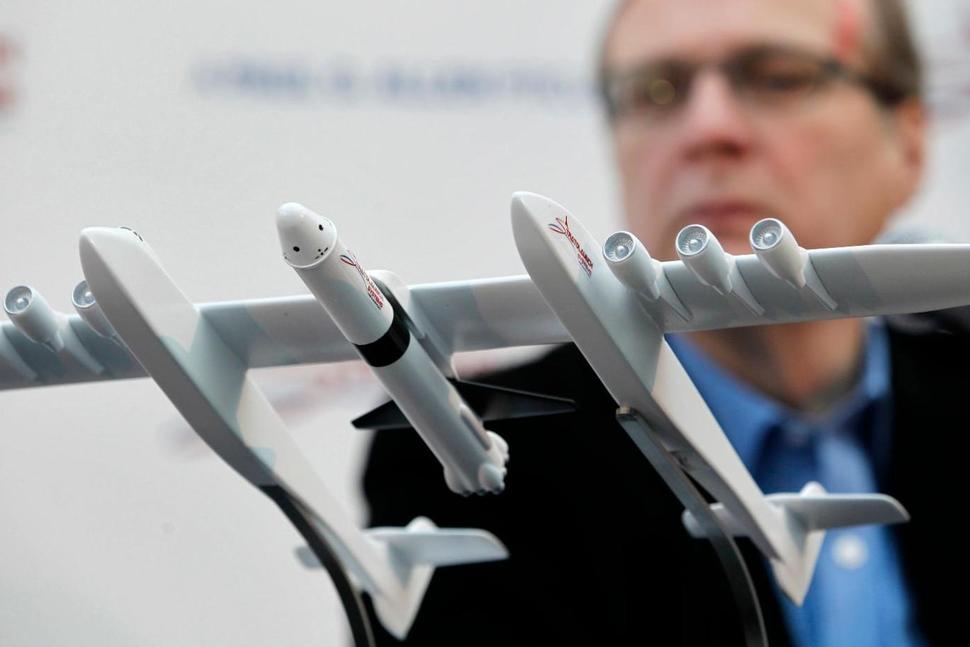

What’s Next for Paul Allen’s Big Investments? It’s Not Clear

What’s next for Paul Allen’s technology, research and philanthropy commitments? It’s not clear. SEATTLE — Prior to his death on Monday, billionaire Microsoft co-founder Paul Allen invested large sums in technology ventures, research projects and philanthropy, some of it eclectic and highly speculative. What happens to those commitments now? Outside of bland assurances from his […]

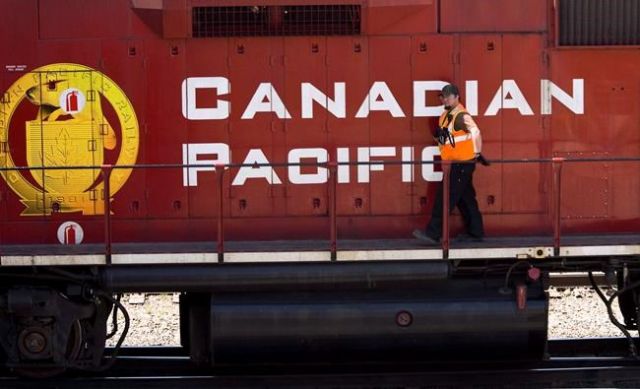

CPR record revenues

Canadian Pacific Railway Ltd. says it earned the highest adjusted per-share profits and revenues of its 137-year history last quarter, helping the country’s second largest railroad to overcome the impact earlier this year from service interruptions tied to labour action. The Calgary-based railway earned $4.35 per diluted share for the quarter ended Sept. 30, compared […]

Do You Really Need a Financial Planner?

You may think hiring a financial planner is necessary only if you’re Scrooge McDuck. After all, professional money advice comes at a cost — and not exactly a small one. It varies depending on your net worth, but the average fee for holistic financial planning services is about 1% of assets under management. That may […]

7 Factors to Consider When Shopping for Health Insurance

OPEN ENROLLMENT SEASON is here. Whether you select your health insurance through an employer, Medicare or a government exchange, October and November are when most Americans have the opportunity to switch plans. While shopping for health insurance can seem overwhelming, breaking down the process can help make it easier. “If people take a step back […]

4 Ways to Be a Better Co-Worker

Most workers spend a lot of time thinking about themselves. That makes sense given that in most companies, whether you are promoted, get a raise, or otherwise get ahead, it requires taking an active interest in promoting yourself. Just worrying about you, however, ignores a vital part of the work experience: your co-workers. In many […]

Tax-Savvy Ways to Manage an Inheritance

WHEN IT COMES TO inheritance, it’s typically more gratifying to think about how to spend the newfound money than what the tax consequences might be. But earning a payout from a deceased relative comes with its own complicated tax repercussions. And spending the gifted money too quickly or thoughtlessly could result in an unexpectedly high […]