Growth stock Align Technology (ALGN) has been a mainstay in IBD growth screens for months, mostly due to top fundamentals and strong price performance. Not only is Align a classic example of how strong stocks can indeed get stronger, but it also proves why the N in CAN SLIM — which stands for new — carries so much importance.

The medical device company is mostly known for its Invisalign orthodontic products, which are basically invisible braces. Align also sells iTero intraoral digital scanners, which scan the mouths of patients and capture three-dimensional images. The scans help dental professionals create accurate models for restorative work, including crowns, veneers and implants.

When the company reported second-quarter earnings in July, Invisalign case shipments jumped 30.5% to 302,700. Americas shipments rose 22% and international shipments jumped 45%.

Growth Stock Align: Top Fundamentals

Strong demand for Invisalign fueled a 53% jump in quarterly profit. Sales rose 38% to $490.3 million. With growth like that, it’s no surprise to see the leading growing stock selling at a premium valuation. Its trailing price-to-earnings ratio is 81. Its forward P-E is 76. But a high P-E multiple is justified because strong growth is expected to continue. Annual earnings this year are seen rising 37%, with growth of 25% expected in 2019. Estimates have been heading higher.

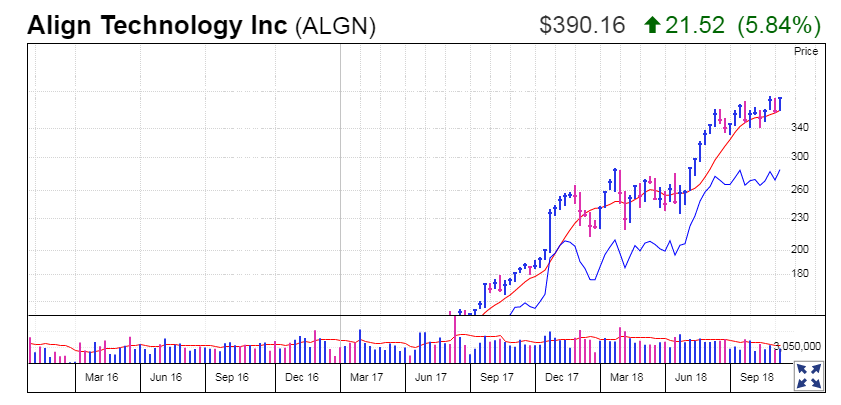

After a lengthy uptrend, some might argue that Align’s latest base breakout was from a late-stage base. Others will say that a 24% pullback that started in late January was enough to shake out enough sellers to reset the base count. That’s a valid argument, too, although the February low of 229.37 didn’t quite undercut the low of the prior base (212.86). When the low of a prior base gets undercut, it officially resets the base count to 1.

Align’s most recent breakout from a flat base didn’t get very far, but the growth stock is still showing resilience and trading near highs. Align tried to clear the 285.10 entry on Aug. 28, but an early gain faded. Align is still respecting its 50-day moving average, though, as it trades just below the 400 level.